1 Important Growth Trend Nvidia Investors May Have Missed in the Latest Quarterly Report

Nvidia (NASDAQ: NVDA) delivered an outstanding set of results once again for the first quarter of fiscal 2025 (for the three months ended April 28) on May 22. Not surprisingly, the company's data center segment was the star of the show.

The huge demand for Nvidia's artificial intelligence (AI) chips led to a stunning 427% year-over-year jump in its data center revenue last quarter to $22.6 billion, accounting for 87% of its top line. This segment was the driving force behind the eye-popping surge in Nvidia stock in the past year and a half, and it could continue to be a big money spinner for the company thanks to the fast-growing addressable opportunity within AI chips.

However, there is another segment where Nvidia is seeing benefits related to AI adoption. Let's take a closer look at that business and why it could become a big deal for the company in the long run.

Nvidia's gaming business is getting an AI boost

Nvidia's gaming revenue increased 18% year over year in the previous quarter to $2.6 billion, accounting for 10% of the company's top line. The size of Nvidia's gaming business pales in comparison to the revenue it gets from selling data center chips, but there is a good chance that it could become a bigger contributor in the future, thanks to the emergence of AI-enabled personal computers (PCs).

Nvidia management remarked on the latest earnings conference call that its RTX class of PC graphics processing units (GPUs) are equipped with CUDA Tensor Cores, which is why they can run generative AI applications. Nvidia points out that its RTX GPUs have an installed base of more than 100 million, and the company's software framework allows these users to run large language models (LLMs).

For instance, Nvidia partnered with Microsoft to enable AI-specific performance optimizations on Windows so that RTX-powered PCs can run LLMs up to three times faster than before. These moves Nvidia made to target the AI PC market could pay off handsomely in the long run. That's because the demand for AI-enabled PCs is set to take off remarkably.

According to IDC, AI PC shipments could hit 50 million units in 2024 and more than triple to 167 million units in 2027. It won't be surprising to see this market growing at a nice clip even after that, as AI PCs are expected to account for 60% of all PC shipments in 2027. The growing shipments of AI PCs should ideally create the need for more Nvidia GPUs so that users can run AI models and applications locally on their computers.

It is worth noting that 53% of Nvidia's installed base use the company's RTX-class GPUs. We have seen that the company puts its RTX installed base at around 100 million, which means that there are almost an equivalent number of users who use older graphics cards. The adoption of AI PCs is likely to encourage those users to upgrade to newer graphics cards, and this should unlock a solid growth opportunity for Nvidia's gaming business, as it controls 80% of the PC graphics card market.

On the other hand, Nvidia also dominates the data center GPU market with an estimated share of more than 90%. What this means is that Nvidia is the dominant player in the overall market for discrete GPUs. This puts the company in a terrific position to grow at an outstanding pace in the long run, as the overall GPU market is set to grow to $773 billion in 2032 from $42 billion in 2022, according to Precedence Research.

Stronger growth is in the cards

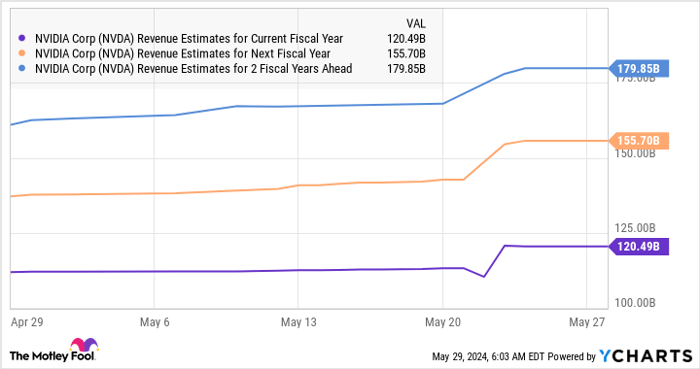

Nvidia's solid quarterly report, its impressive share of the GPU market in both servers and PCs, and the multi-billion-dollar revenue opportunity that this market presents explain why analysts have raised their growth expectations from the company.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts

The chipmaker is now expected to finish fiscal 2025 with more than $120 billion in revenue, which will be almost double the revenue it generated in fiscal 2024. Nvidia's revenue is forecasted to head higher over the next couple of fiscal years as well, though it won't be surprising to see the company deliver stronger growth than analysts expect, thanks to the gaming and data center GPU opportunity.

That's why investors looking to buy a growth stock can still consider buying Nvidia, as its red-hot rally seems sustainable.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.