1 Unstoppable Artificial Intelligence (AI) Stock Down 29% You'll Regret Not Buying on the Dip

Artificial intelligence (AI) is a red-hot theme in the stock market right now, and while there is a ton of hype, many companies are finding tangible and highly valuable use cases for the technology.

Duolingo (NASDAQ: DUOL) is the world's largest digital language education platform, and its business was an incredible success before AI came along. However, the company is using it to create exciting new features for its users, and it's leading to new revenue streams.

The stock is down 29% from the all-time high it set earlier this year. Here's why that presents a great opportunity for investors to buy in.

Image source: Getty Images.

Using AI to enhance language learning

Duolingo is a mobile-first platform, so it places language lessons at the fingertips of practically anybody with a smartphone. Its lessons are gamified and interactive, which is a departure from traditional classroom-based learning.

During the second quarter of 2024, the platform had 103.6 million monthly active users, which was up 40% from the year-ago period. That growth rate represents an acceleration from the first quarter when its user base grew 35%, which really highlights Duolingo's positive momentum.

The number of users paying a monthly subscription to unlock additional features rose 52% year over year to 8.0 million. That already impressive growth pace could rise going forward thanks to Duolingo Max, the company's newest (and most expensive) subscription tier.

Max offers two AI-powered features: Explain My Answer, which provides each user with personalized feedback based on their mistakes, and Roleplay, which allows users to practice their conversational skills with a chatbot in the language of their choice. Duolingo has been working on AI for several years, but these new features run on OpenAI's powerful GPT-4 models, which allowed the company to release them more quickly.

Duolingo Max launched last year, and it's only available to around 15% of active users in 27 countries so far. However, it's an important step in the company's mission to deliver a learning experience capable of rivaling a human tutor. Duolingo will steadily roll out Max to more users over time, and the company says it will reveal new information about the product at its Duocon conference next month.

Duolingo's revenue and profit continue to grow rapidly

Second-quarter revenue climbed 41% to $178.3 million last quarter, exceeding the high end of management's forecast ($177.5 million). The strong result prompted management to increase its full-year revenue guidance by $2.8 million at the high end of the range, to $738.3 million.

Duolingo also reported significant progress on the bottom line. The company continues to carefully manage its costs, growing total operating expenses just 14.7% year over year. That contributed to net income's surge from $3.7 million to $24.4 million.

Simply put, Duolingo is proving to investors it doesn't have to burn significant amounts of cash to maintain strong growth across its business. In fact, unlike many tech companies in the consumer space, Duolingo spends very little money on marketing. It was the company's smallest operating expense during Q2 at $20.2 million, which represented just 18% of its total operating costs.

In the past, Duolingo told investors that up to 90% of its user acquisition is organic, which means it comes via avenues like word of mouth and free social media posts. During Q2, the company said its organic (unpaid) social media impressions soared 190% from the year-ago period.

Why Duolingo stock is a buy on the dip

An estimated 2 billion people are learning a foreign language worldwide, so Duolingo has a long runway for growth based on its current monthly active user base. Plus, if the company achieves its mission to deliver a digital learning experience that rivals human tutors, it will offer an unprecedented value proposition to students, which might even prompt them to substitute their physical lessons for the Duolingo app.

AI will be the secret to delivering that experience. Duolingo's users complete over 1 billion exercises every single day, which provides the company with mountains of valuable data it can use to improve its AI features, making them more responsive and more accurate over time.

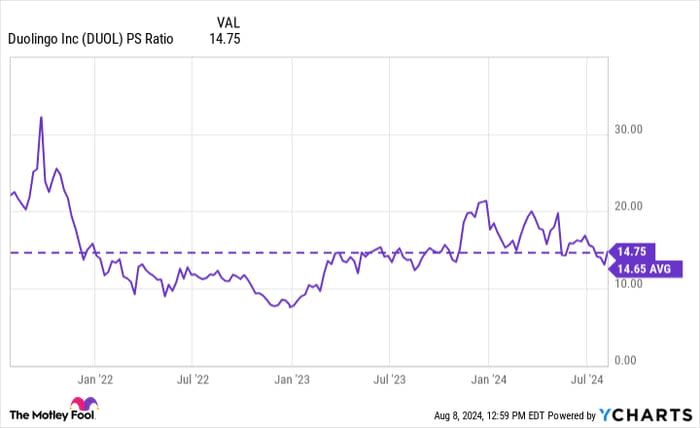

Duolingo stock is currently trading at a price-to-sales (P/S) ratio of 14.7, which is almost exactly in line with its average since it went public in 2021. In other words, Duolingo stock is neither cheap nor expensive right now, at least relative to its historical valuation levels.

Data by YCharts.

However, if the company delivers $738.3 million in revenue during 2024 as expected, that gives its stock a forward P/S ratio of 11.0 (based on the company's current market capitalization of around $8.2 billion). That implies Duolingo stock will have to rise over 30% between now and the end of this year just to maintain its average P/S ratio of 14.6.

But investors who buy the stock today should be focusing on the long term. The company is delivering blistering growth, despite the very limited availability of its AI-powered Max subscription. As it rolls out further, Duolingo could deliver more record results on the top and bottom lines.

Should you invest $1,000 in Duolingo right now?

Before you buy stock in Duolingo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Duolingo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Duolingo. The Motley Fool has a disclosure policy.