These 3 Stocks Could Soar Under Their New CEOs

CEOs make a difference. And for different reasons, investors in these three companies will hope that their new leaders will make a tangible difference in improving performance.

William Brown took over as CEO of 3M (NYSE: MMM) on May 1 and has significantly influenced investors' thoughts about the company. Kelly Ortberg will take over as CEO of Boeing (NYSE: BA) on Aug. 1, and Johnson Controls (NYSE: JCI) recently announced it's searching for a new CEO. Here's how new leaders could potentially improve these companies.

Willam Brown and 3M

Brown's presentation on the second-quarter earnings call clarified that he intends to restructure the company fundamentally. He said that 3M's organic growth had been below par for several years, and that the keys to improving it are new products driven by an increased focus on research and development (R&D) and a rigorous approach to operational improvement.

It takes time for R&D investment to come to fruition, so investors should look for near-term action on improving operations and capital deployment, and Brown's willingness to abandon assets that aren't a good fit for 3M.

Among the operational improvements, he plans to reduce 3M's supply chain complexity, implement lean manufacturing practices, improve sourcing, and drive $1 billion worth of improvement in working capital by reducing the time it takes 3M to cycle its inventory into sales.

While much of this might sound simple, the reality is that 3M investors haven't heard it from their management in a long time. And Brown starts in a relatively favorable position to implement change. The recent dividend cut frees up cash to restructure the company and deploy capital.

In addition, the spinoff of healthcare specialist Solventum (and the retention of a 19.9% stake) gives 3M financial firepower to meet its legal settlement obligations.

Lastly, the restructuring actions started by the previous leadership team in 2023 are bearing fruit as 3M is improving its margin performance.

All told, Brown is in an excellent position to improve the company's growth, margins, and cash flow generation. With 3M's end markets slowly improving, the scene is set for him to enhance shareholder value.

Image source: Getty Images.

Kelly Ortberg and Boeing

3M needs a leader with a strategic direction, but Boeing needs one with a firm handle on execution. Based on his track record, Ortberg is a good choice. Formerly CEO of Rockwell Collins, he led it into its acquisition by United Technologies to create Collins Aerospace.

Ortberg then became the CEO of Collins Aerospace, after which United Technologies merged its aerospace business (including Collins Aerospace) with Raytheon Technologies to become Raytheon -- now named RTX.

Apologies for the word salad. Readers need to take away the key point that, as previously discussed, the Rockwell Collins acquisition and the Collins Aerospace merger significantly outperformed their initial expectations for synergy generation. In other words, their integration generated more cost savings than originally planned, and Ortberg was a large part of that.

Boeing will need more of the same to squeeze operational improvements out of the business because it's currently burning cash and is highly indebted and faces potentially tricky labor negotiations. And its defense business keeps reporting losses due to problematic fixed-price development projects.

Image source: Getty Images.

The aerospace company has a multiyear backlog, continues to win airplane orders, and has reported some better delivery rates recently.

Kelly Ortberg has his work cut out, but Boeing appears to be in good hands. Readers should note he will have the support of his former colleagues Dave Gitlin (ex-president of Collins Aerospace) and Akhil Johri (previously chief financial officer of United Technologies) on the Boeing board to support him.

Johnson Controls

The heating, ventilation, and air-conditioning (HVAC) and building solutions company operates in desirable end markets. Its products help building owners improve efficiency and reach their net zero emissions goals. And the development of new connected smart technologies is enhancing the value of its products.

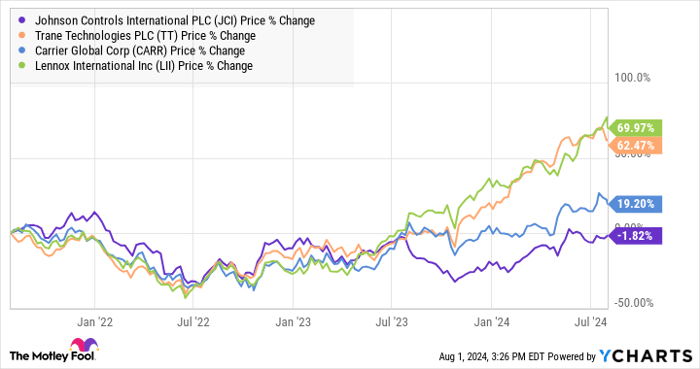

Yet there's a problem, manifested in the following chart comparing the company's stock with its peers.

Simply put, Johnson Controls does not have a good record of meeting its guidance.

It also disappointed with its sales growth in 2023 as dealers reset inventory more than planned. After starting 2024 forecasting mid-single-digit revenue growth and adjusted earnings per share (EPS) of $3.65 to $3.80, management recently told investors organic growth would be just 3%, and adjusted EPS would be $3.66 to $3.69.

Image source: Getty Images.

Johnson Controls is a strong business, operating in good end markets, and the recent announcement of a deal to sell its noncore residential and light commercial HVAC business makes sense. As such, the stock has significant upside potential provided the new CEO can restore confidence in management's guidance and ability to execute on its plans.

Should you invest $1,000 in 3M right now?

Before you buy stock in 3M, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and 3M wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $638,800!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool recommends 3M, RTX, and Solventum. The Motley Fool has a disclosure policy.