Artificial Intelligence Powers Zoom. Is Now a Golden Opportunity to Buy the Stock?

Share prices of Zoom Video Communications (NASDAQ: ZM) zoomed higher after the video conferencing company's latest quarterly results topped expectations. The stock, nonetheless, is still down modestly on the year.

Let's zoom in on the company's most recent results and see if this turnaround can last and if it is a golden opportunity to buy the stock.

AI integration and contact center leading turnaround efforts

Zoom was a huge winner during the pandemic when working from home became the norm for many workers. However, it also pushed forward a lot of demand for its offerings, which has led the company to generate relatively modest revenue growth in the years after.

That didn't exactly change in Q2, with the company growing revenue a modest 2.1% year over year to $1.16 billion. However, that topped the analyst consensus for revenue of $1.15 billion. Enterprise revenue increased 3.5% to $682.8 million, while online revenue was flattish at $479.7 million.

Adjusted EPS, meanwhile, rose from $1.34 to $1.39, surpassing the consensus by $0.18.

The number of customers paying more than $100,000 increased 7% year over year to 3,933 and now represents about 31% of its total revenue.

Trailing-12-month next-dollar retention for enterprise customers, meanwhile, was 98%. A number below 100% indicates that the company is seeing more churn and/or customers downgrading than it is seeing customers expand their business with Zoom. For small self-service customers, the company's average monthly churn was 2.9%, which it said was a record low.

One place where the company shined, though, was in the contact center market, where it more than doubled its customer count to over 1,100. Zoom also said it signed its largest-ever contract center deal in the quarter. The company credited artificial intelligence (AI) features such as the ability to wrap up notes and make suggestions as a key differentiator that helped it make inroads in the space.

Workvivo, which the company acquired last year, also had a strong quarter, with customers paying more than $100,000 roughly doubling to 69. The company said it also still has a number of large deals in the pipeline for the employee engagement platform.

Looking ahead, Zoom raised its guidance for its full fiscal year and now projects revenue of between $4.63 billion and $4.64 billion and adjusted EPS of between $5.29 and $5.32. That was above its previous forecast for $4.61 billion and $4.62 billion in revenue and adjusted EPS of between $4.99 and $5.02. Management forecasts Zoom will generate free cash flow of between $1.58 billion to $1.62 billion for the full year.

For the third quarter, management expects revenue of between $1.16 billion and $1.165 billion and adjusted EPS of between $1.29 and $1.31.

Image source: Getty Images.

Is now the time to buy Zoom stock?

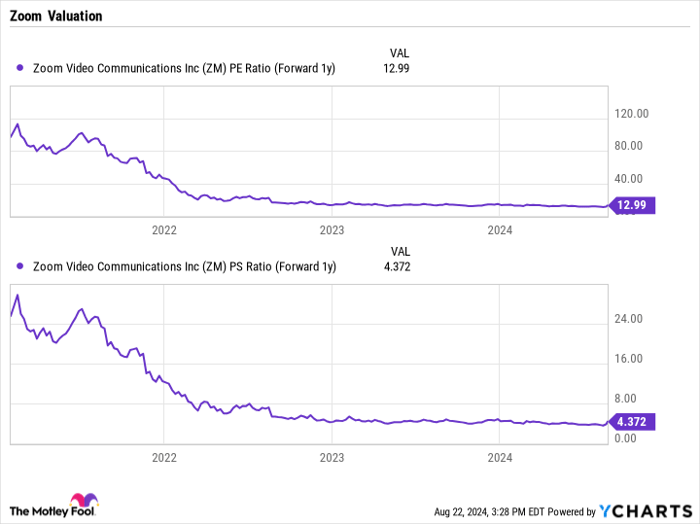

Three of the things that stand out most about Zoom are its robust free cash flow, huge pile of cash, and its valuation. The stock only trades at a forward price-to-earnings (P/E) ratio of 13 times and a forward price-to-sales (P/S) multiple, a common metric used to value software-as-service (SaaS) stocks, of just over 4 times.

ZM PE Ratio (Forward 1y) data by YCharts

When taking into consideration that about 36% of Zoom's market cap is in cash, the stock is actually considerably cheaper than those popular valuation metrics suggest.

Now, the company needs to start growing again, and there were some signs of progress with its growth in contact centers, which has been helped by its AI features. However, with $7.5 billion in cash, the company has options to try and kick-start growth, whether through investment or acquisition. It could also buy back a lot of stock as well.

At this point, Zoom remains a very cheap stock with a lot of optionality given its cash and cash flow generation. Given that, I would be a buyer of the stock at current levels even after the post-earnings jump in price.

Should you invest $1,000 in Zoom Video Communications right now?

Before you buy stock in Zoom Video Communications, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Zoom Video Communications wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Geoffrey Seiler has positions in Zoom Video Communications. The Motley Fool has positions in and recommends Zoom Video Communications. The Motley Fool has a disclosure policy.