Berkshire Hathaway: Buy, Sell, or Hold?

There's a reason why nearly everyone who follows the stock market is familiar with Warren Buffett. Not only is he one of the greatest investors of all time, but a long-term stake in his holding company, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), has proven to be one of the best investments of all time. Over the nearly 60 years he's been at the helm, Berkshire's shares have grown at an annualized rate of roughly 20%.

For decades, all an investor needed to do in order to generate massive wealth was to invest with Buffett. But is that still true today?

2 facts to know about Berkshire Hathaway today

The first thing for investors to understand is that Berkshire Hathaway is not immune to the law of large numbers. What does that mean? Simply put, a business with $1 million in sales has more opportunities to double its sales than a business with $1 billion in sales. Similarly, companies that are valued at $100 million will find it easier to double in size than those valued at $100 billion.

With a market cap that recently topped $1 trillion, Berkshire is one of the largest companies in the world. The value of the entire U.S. economy, for reference, is almost $29 trillion. Berkshire's cash stockpile alone comes to $277 billion. Berkshire made its name through decades' worth of smart acquisitions and shrewd investments, but even Buffett acknowledges that Berkshire's opportunities are dwindling as the company is growing. "There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others," Buffett recently explained, adding that this size allowed for "no possibility of eye-popping performance."

Simply due to scale, Berkshire will find it more difficult to beat the market as handily as it has in the past. But that doesn't mean that Berkshire still can't beat the market by a slimmer margin.

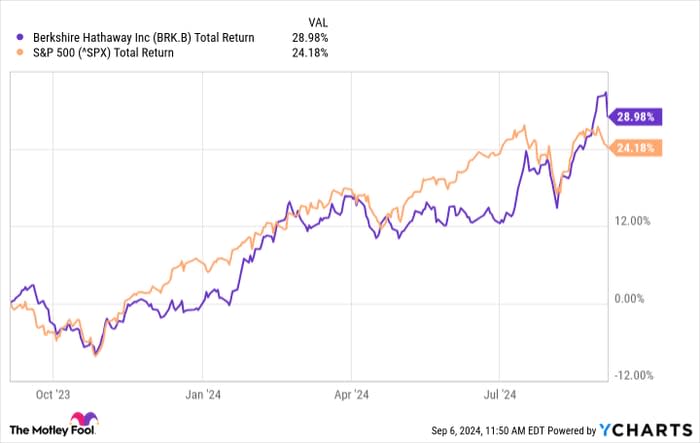

This is the second thing every investor must understand: Berkshire is far from a dead investment. It has outperformed the S&P 500 over the last one-year, three-year, five-year, and 10-year time periods. There's a good reason for this continued outperformance: Berkshire's business structure is designed for it.

At the core of Berkshire's empire sits a portfolio of insurance companies. These insurance businesses generate high levels of float, which is the excess cash insurers have after they collect policy premiums but before claims force them to pay that capital out. This float provides Berkshire with investable funds that it can deploy regardless of what markets are doing. It's a huge plus to have what Buffett calls "permanent capital" -- that is, a pool of money that is always available to put into new investments, especially when valuations crash and outside capital dries up.

This structural capital advantage isn't going away anytime soon, nor is the proven investing acumen of Buffett and his lieutenants -- some of whom have spent years learning from Buffett. The only challenge has been size, but recent results show that Berkshire's run is far from over.

BRK.B Total Return Level data by YCharts

Should you still buy Berkshire stock today?

The simple answer is that there has never been a bad time to buy Berkshire stock in the past, and that remains true today. Of course, even the valuation of a high-quality business can get too high. But Berkshire's valuation is more than reasonable. Shares are trading at just under 1.7 times book value, which at first appears expensive compared to Berkshire's history. Never in the past decade have shares traded at such a high price-to-book basis. However, Berkshire has spent nearly $80 billion buying back its own stock since 2018, an act that has increased shareholder wealth while it artificially depressed accounting book value. A slight adjustment for this suggests Berkshire stock is simply valued on the high end of its historical range.

Is Berkshire stock a steal at today's prices? For patient investors, yes. Paying a bit of a premium for one of the stock market's best companies will likely prove savvy for long-term shareholders. But like any stock, Berkshire's short-term valuation could sharply decline at any moment, especially if stocks in general decline. Berkshire shares are still a buy, but it's more important than ever to maintain a long-term investment horizon.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.