Biden’s Education Department trying to ‘mass cancel’ $147B in student loans: suit

President Biden is trying to sneak past Congress and “mass cancel” almost $147 billion in federally held student loans, according to a new lawsuit filed by seven Republican-led states.

Alabama, Arkansas, Florida, Georgia, Missouri, North Dakota and Ohio sued Biden, Education Secretary Miguel Cardona and the Department of Education over the latest student loan forgiveness plan that they say would “unlawfully” cancel $73 billion “overnight” and $146.9 billion overall.

“This is the third time the Secretary has unlawfully tried to mass cancel hundreds of billions of dollars in loans,” the complaint states. “Courts stopped him the first two times, when he tried to do so openly. So now he is trying to do so through cloak and dagger.”

Missouri Attorney General Andrew Bailey, who led the complaint, argued the Education Department was now “throwing spaghetti at the wall to see what sticks” with less than nine weeks to go before Election Day.

The suit claims Cardona had already “quietly sent orders to loan servicing companies to start mass canceling loans as soon as this week,” which “violates a statute prohibiting the Secretary from implementing rules like this one sooner than 60 days after publication.”

The education secretary issued a notice of proposed federal rulemaking in April for the student debt cancellation plan, which Republican plaintiffs said would “create an end-run” around federal court injunctions already halting some of the loan forgiveness.

Those “with at least one outstanding federally held student loan” were automatically included in the forgiveness push if they did not “call their servicer and opt out” by Aug. 30, a July Education Department press release noted.

The plan would “forgive interest for millions of borrowers up to $20,000” — including those with household incomes over $240,000 — and wipe the balances for undergraduate student borrowers who have been paying their loans for 20 years and graduate students who have been making payments for 25 years.

It would further forgive debt for students from institutions that once were but are now no longer part of any federal grant and loan programs — or non-degree programs and institutions that were determined by the Education Department to not provide financial value to students.

Other loan forgiveness would apply to some income-driven repayment plans — one of which, the Saving on a Valuable Education (SAVE) Plan, would cost as much as $475 billion and was already blocked by federal courts.

The US Supreme Court upheld those rulings after having struck down Biden’s attempt last year to make use of a 2003 law designed for Iraq and Afghanistan war veterans to unilaterally cancel up to $430 billion in debt for 43 million student borrowers.

While the SAVE Plan has only had preliminary injunctions placed on it halting the loan forgiveness, the cancellation attempted under the Higher Education Relief Opportunities for Students (HEROES) Act of 2003 was ruled unconstitutional.

Still, the Department of Education boasts that 4.8 million Americans have already had their debts forgiven to the tune of $169 billion.

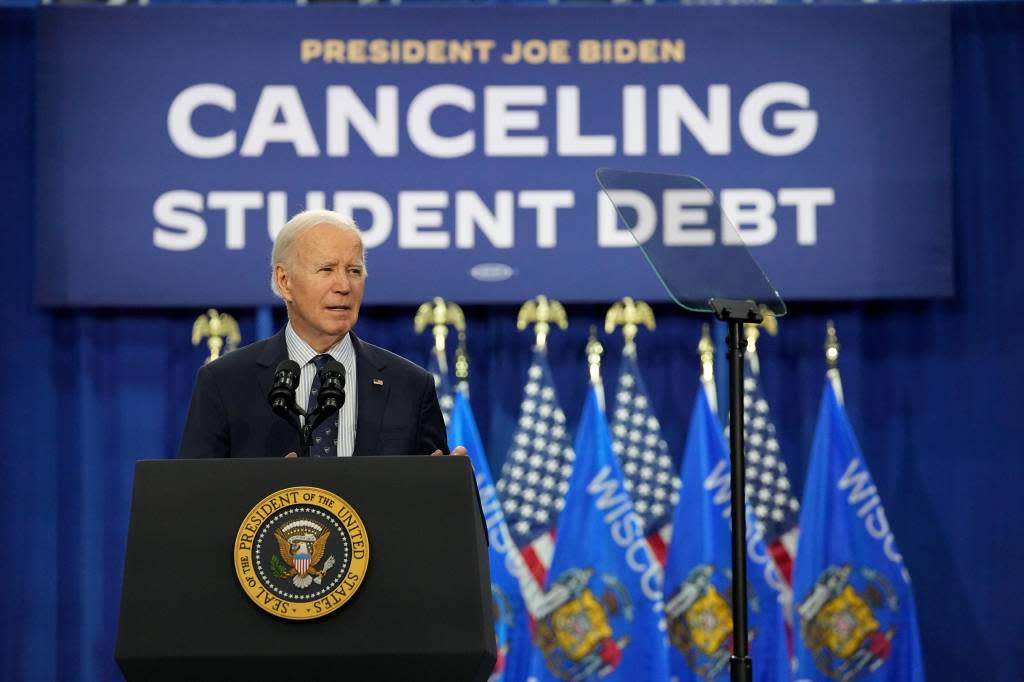

Vice President Kamala Harris and Biden, before he dropped off the 2024 ticket, have both made trips to critical swing states like Pennsylvania and Wisconsin to tout the loan forgiveness.

Congressional Republicans have accused Biden of cooking up the various schemes to “buy votes” — from the young and educated members of the Democratic constituency — ahead of the 2024 election.

“The Biden-Harris administration knows it doesn’t have the legal authority to unilaterally cancel student loans,” Sen. Bill Cassidy (R-La.) told The Post. “That is why it is subverting the rulemaking process to take student debt from those who willingly took it on and transfer it to taxpayers who chose not to go to college or already worked to pay their loans off.”

“Make no mistake, this is a clear abuse of power designed to buy votes before the November election,” added Cassidy, who is the top Republican on the Senate Health, Education, Labor and Pensions Committee.

“The US Department of Education declines to comment on pending litigation, but we will continue to fight for borrowers across the country who are struggling to repay their federal student loans,” a spokesperson said in a statement.

“We will continue to follow the law as we work to prepare for possible debt relief this fall, which would only be implemented after the proposed rules first introduced this spring are finalized.”