Will Broadcom Reach a Trillion-Dollar Market Cap by Next Year?

The next $1 trillion company is likely to be one of the artificial intelligence winners, given the outsize growth possibilities of that sector relative to everything else in the economy.

While much of the recent attention has gone to the "Magnificent Seven," semiconductor and software conglomerate Broadcom (NASDAQ: AVGO) has emerged as a key player in the AI races. With a lethal combination of AI-fueled hypergrowth, diversification, and a growing 1.4% dividend, the immediate future looks bright for Broadcom.

While the stock is already up 40% this year, reaching roughly a $700 billion market cap, there's a case to be made for its valuation increasing another 40% to reach a $1 trillion market cap by next year.

Broadcom's valuation

Although Broadcom may look expensive on a trailing price-to-earnings basis of 63, that's a bit misleading. First, Broadcom completed the acquisition of software giant VMware last November, so it doesn't even have a full year of results for that segment yet (more on VMware later). Second, Broadcom's acquisition strategy means the company deducts high amortization of intangible assets and other acquisition-related costs, which lower generally accepted accounting principles (GAAP) net income but aren't really indicative of the overall business.

On a forward-looking basis, however, for the fiscal year ending in October 2025, Broadcom trades at just 25 times forward adjusted earnings. That's a much more reasonable valuation, and why there still could be upside for this surprising outperformer.

AI-powered growth

Like its name indicates, Broadcom is a diversified business, from infrastructure chips to software, but its AI portfolio is fast becoming a juggernaut. Broadcom's AI portfolio consists really of two divisions; one is in networking switching and routing chips, network interface connectors, and optical transceivers that shoot data around and between AI data centers. Demand for these networking solutions has been skyrocketing of late due to the massive data transport needs of AI.

Second, Broadcom has custom ASIC (application-specific integrated chip) intellectual property that several cloud giants use for their in-house accelerators. Obviously, that segment has been taking off as well.

Broadcom noted its AI-related revenue across networking and ASICs amounted to about 15% of its semiconductor revenue in fiscal 2023, ending October of last year, good for around $4.2 billion. But this year, management has had to raise its forecast for AI revenue in each of the last two earnings reports, and now forecasts over $11 billion in AI-related revenue for this fiscal year -- nearly tripling over the prior year.

As of now, AI revenue seems to only be accelerating beyond management's usual conservative guidance. As AI-related chip revenue makes up a greater proportion of Broadcom's semiconductor revenue -- probably around 30% this year -- Broadcom's chip segment should continue to grow faster and attract a higher multiple.

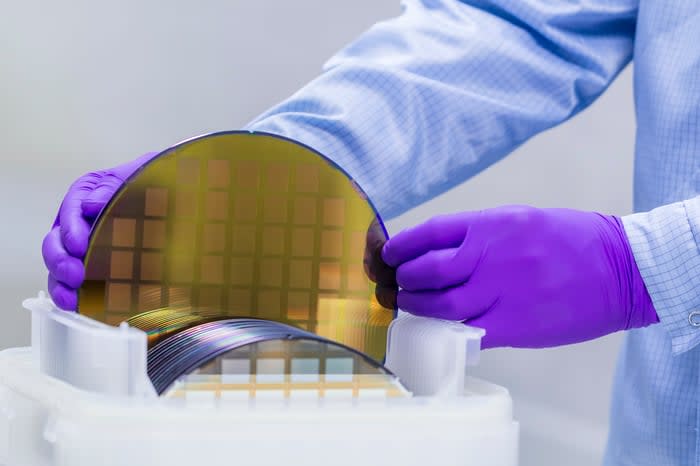

Image source: Getty Images.

And the VMware acquisition could be a game changer

Meanwhile, last November's acquisition of VMware appears to be a hit. The $69 billion acquisition closed last November, and Broadcom has already been successful at cutting out excess overhead costs, while consolidating products and accelerating revenue.

VMware's recent introduction of vSphere, which virtualizes not only compute but all aspects of modern data centers, is proving very popular. The product helps large enterprises unify all elements of their on-premise data centers to mimic the ease of use of public cloud, which enterprises are loving as artificial intelligence applications further complicate their IT infrastructure.

Transitioning to a subscription model from a one-off licensing model, VMware's revenue grew from $2.1 billion in the February-ended quarter to $2.7 billion in the May-ended quarter, good for 29% quarter-over-quarter growth, with CEO Hock Tan saying he expects VMware to reach $4 billion in quarterly revenue in short order. When combined with cost cuts, Tan expects VMware, which made relatively low margins as a stand-alone entity, to achieve an operating margin in line with historical Broadcom software.

Last year, Broadcom's software segment without VMware achieved a ridiculous 74% operating margin. At a $16 billion run rate, that would mean Broadcom may generate $12 billion in operating profit from VMware by next year, after only paying $69 billion for the company -- a massive return on investment.

And a new acquisition could get Broadcom to $1 trillion

Both AI revenue and VMware have the potential to accelerate profits and raise Broadcom's multiple further. But a final push to the $1 trillion valuation may only come if the company announces another acquisition.

Tan has executed the growth-by-acquisition strategy flawlessly, identifying differentiated technology franchises within communications-related chips and infrastructure software, buying them, and slashing costs while letting each franchise focus on its strengths.

Broadcom has been bold in this strategy, too, identifying bigger and more consequential targets, while diversifying into software. With both hardware and software companies now available for Tan and his team to target, Broadcom has a lot of options.

And in contrast to most other acquiring companies, Broadcom may actually see its valuation rise when it announces its next acquisition, given its track record of success.

So despite Broadcom's strong recent run, there's good reason to think it may become the next $1 trillion company in short order.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $711,657!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Billy Duberstein and/or his clients have positions in Broadcom. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.