Broadcom's 10-for-1 Stock Split Is Imminent: 10 Things You Need to Know

Although all eyes seem to be focused on anything and everything having to do with artificial intelligence (AI), one of Wall Street's hottest trends right now is companies enacting stock splits.

A stock split is an event that allows a publicly traded company to change its outstanding share count and share price by the same magnitude. Since 2024 began, nearly a dozen high-profile, time-tested businesses have announced and/or completed a stock split.

Image source: Getty Images.

Stock splits have two variations: forward and reverse. With a forward-stock split, a company desires to lower its nominal share price in order to make it more affordable for retail investors. Meanwhile, the goal of a reverse-stock split is to increase a company's share price, often with the purpose of ensuring it meets the continued listing standards required of a major stock exchange. Between these two "flavors," investors overwhelmingly gravitate to companies conducting forward splits.

Following the recent completion of Nvidia's 10-for-1 forward split and Chipotle Mexican Grill's historic 50-for-1 stock split, the time has come for AI networking solutions provider Broadcom (NASDAQ: AVGO) to enter this exclusive club.

Here are 10 things you need to know about Broadcom's imminent stock split.

1. Broadcom is (sort of) making history

On June 12, when Broadcom released its fiscal second-quarter operating results (the company's second quarter ended May 5), it announced a 10-for-1 forward-stock split. This is, technically, Broadcom's first-ever split.

However, prior to being acquired by Avago Technologies in early 2016 -- Avago chose to keep the Broadcom name following the purchase -- the old Broadcom had split its stock on three occasions, the last of which occurred in February 2006.

2. Its split becomes effective after the close of trading

"Imminent" isn't an exaggeration of when Broadcom's stock split is taking place. According to company filings, this 10-for-1 forward split becomes effective after the close of trading on Friday, July 12. When trading begins on Monday, July 15, Broadcom's stock will be trading at 1/10th of its prior closing value, with an outstanding share count that's increased by a factor of 10.

As I pointed out when Chipotle conducted its stock split a few weeks ago, it's not uncommon for brokers to fail to recognize that a stock split has taken place for up to a period of 24 hours. If you're a Broadcom shareholder and notice a large unrealized loss in the morning of July 15, there's no need to panic.

3. Stock splits are purely superficial

Though companies enacting forward-stock splits have historically performed well in the 12 months that follow their stock-split announcement, stock splits themselves are purely cosmetic. Altering a company's share price and outstanding share count by the same factor has no impact on its market cap or operating performance.

4. The company's split is all about investor and employee accessibility

Similar to Walmart and Chipotle, which have already become Wall Street's newest stock-split stocks of 2024, Broadcom's split is all about accessibility. "[W]e are announcing a 10-for-1 forward stock split of Broadcom's common stock, to make ownership of Broadcom stock more accessible to investors and employees," said the company's Chief Financial Officer Kirsten Spears.

It's usually a lot easier for companies to encourage participation in employee stock purchase plans (ESPPs) when the price of said stock is not north of $1,700 per share.

Image source: Getty Images.

5. Artificial intelligence has fueled its mega-rally over the last year and change

The primary catalyst powering Broadcom's stock higher by 205% since the start of 2023 is its AI networking ties. The Jericho3-AI chip, which was unveiled in April 2023, is capable of connecting up to 32,000 graphics processing units (GPUs). The company's chips are designed to reduce tail latency and maximize the compute capacity of AI-GPUs in enterprise data centers.

Just as Nvidia has become something of a mass-production GPU kingpin, Broadcom has quickly evolved into the go-to provider of specialized networking solutions in AI data centers.

6. There's more to Broadcom than just AI

However, Broadcom is more than just AI networking solutions. It's also a leading provider of wireless chips and accessories used in next-generation smartphones. Wireless carriers upgrading their networks to support 5G speeds has led to a steady device replacement cycle that's fueled demand for Broadcom's products.

Further, the company provides networking solutions for next-gen vehicles, cybersecurity solutions via subsidiary Symantec, and optical products used in industrial settings and automated equipment.

7. Consistency is key

Another reason Broadcom finds itself in desperate need of a sizable forward-stock split is its leadership. Hock Tan has been CEO of Broadcom since March 2006. Having consistency in key leadership positions helps to ensure that growth initiatives and acquisitions are seen through from start to finish. With Broadcom now worth nearly $800 billion as a company, the value of strong leadership couldn't be more apparent.

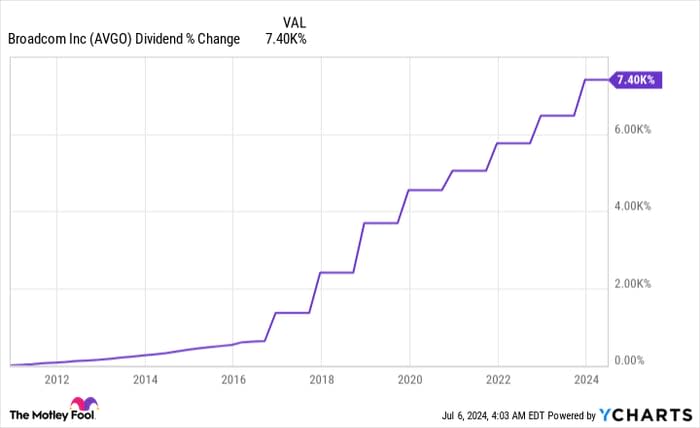

AVGO Dividend data by YCharts.

8. Broadcom's dividend growth is even more impressive than its stock split

Not to slight the euphoria surrounding Broadcom's imminent stock split, but the growth in the company's quarterly dividend is considerably more impressive and worth lauding.

In December 2010, the company doled out a $0.07-per-share quarterly payout to its investors. But on June 28, 2024, it dished out $5.25 for the quarter to its shareholders. That's a cool 7,400% increase in the company's quarterly payout in less than 14 years, which signals just how impressive its operating cash flow growth has been over that span.

9. Billionaire money managers have been active buyers of Broadcom stock

Even before Broadcom announced its first-ever stock split, billionaire money managers were piling in. Based on data provided by Form 13F filings with the Securities and Exchange Commission, six prominent billionaire investors opened a new position in Broadcom or added to their existing stake in the first quarter (total shares purchased in parenthesis):

Steven Cohen of Point72 Asset Management (470,365 shares)

Philippe Laffont of Coatue Management (416,460 shares)

Israel Englander of Millennium Management (275,053 shares)

Ken Griffin of Citadel Advisors (251,571 shares)

Ken Fisher of Fisher Asset Management (38,940 shares)

Ray Dalio of Bridgewater Associates (10,556 shares)

A stock split is highly unlikely to alter the optimism these half-dozen billionaires have for Broadcom.

10. Broadcom remains an intriguing value for growth-seeking investors

The final thing worth noting about Broadcom's imminent stock split is that it'll still be an intriguing value come Monday, July 15 -- and likely well beyond.

While it's perfectly within reason to expect a modest pullback in the company's shares following a near-parabolic move higher in recent weeks, a forward price-to-earnings ratio of 30 for a company with sustained double-digit earnings growth and increasing importance in enterprise data centers suggests that long-term investors will be rewarded for their patience.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $780,654!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill, Nvidia, and Walmart. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.