Buying a Tech ETF Could Be a Great Idea. But Stay Away From This One.

I'm not a fan of technology investing because I'm a bit of a luddite, preferring to avoid fancy tech as much as possible. I'll take a mechanical watch over a digital one every day of the week, even though I know the digital one is technically better. But when it comes to investing you just can't ignore technology stocks, so you have to figure out a way to own them that is comfortable for you.

A technology-focused exchange-traded fund (ETF) is one very good option, but don't make it the iShares Expanded Tech Sector ETF (NYSEMKT: IGM). Here's why.

The iShares Expanded Tech Sector ETF sounds interesting

When I came across the iShares Expanded Tech Sector ETF, my first thought was, "What does expanded mean?" And because I'm an investing geek I went right down a rabbit hole trying to figure out why this exchange-traded fund was "expanded." The top-level logic is interesting.

Image source: Getty Images.

According to the ETF's marketing website, it provides "Broad exposure to the technology sector, and technology-related companies in the communication services and consumer discretionary sectors." That's reasonable, given that technology pervades just about every sector today. And the communications and consumer discretionary sectors are two sectors where technology plays a huge role. But how are the stocks actually selected from those sectors?

To find that out, I had to track down the index methodology for the index the ETF tracks. But that index isn't directly disclosed on the marking website. It is listed as the benchmark index. Being a benchmark index isn't the same thing, since a lot of ETFs benchmark to the S&P 500 index but don't specifically track the index stock-for-stock. I had to read the prospectus to get confirmation that the S&P North American Expanded Technology Sector Index was the index I needed to understand.

Given that I couldn't easily find a link to the methodology document (not unusual, but still frustrating), I had to search for information about the S&P North American Expanded Technology Sector Index. On the website describing the index, I found the explanation, "The S&P North American Expanded Technology Sector Index is designed to measure securities from the S&P North American Technology Sector Index and the supplementary stock Netflix, Inc." That's pretty unhelpful, other than telling me the index specifically includes Netflix, so I had to go into the actual methodology document to find out more.

That document says: "Underlying Index. S&P North American Technology Sector Index. For information on the underlying index, please refer to the S&P North American Sector Indices Methodology." There's a link there, but it doesn't actually go to the specific document; I had to search again. That puts me three layers deep in order to understand the iShares Expanded Tech Sector ETF. I suspect most investors would have given up by this point.

But, once I found the next methodology description, I learned that the index tracks the information technology sector, interactive home entertainment sub-industry, and the interactive media and services sub-industry (these are specific sectors within the GICS classification system). That was a lot of work for a fairly simple answer (plus Netflix!). Honestly, it should raise a red flag when an ETF makes it this hard to find out what it does.

What about performance?

That said, there are times when complicated investments are worth the extra effort because they have strong performance histories. For example, Berkshire Hathaway is a super complex business, but it has been a huge long-term winner. That's not exactly the case with the iShares Expanded Tech Sector ETF.

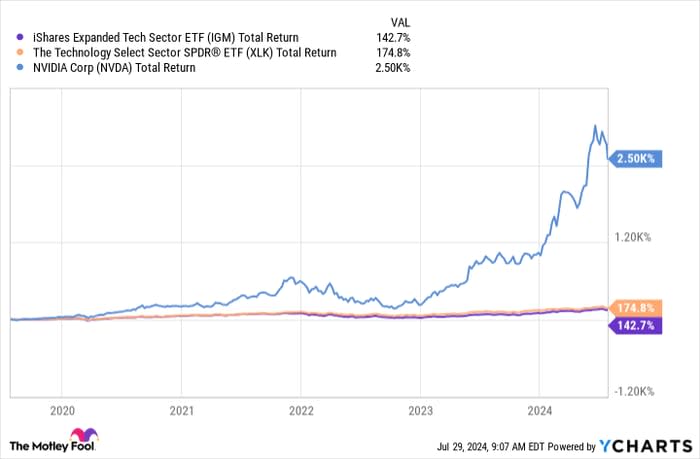

In fact, compared to a technology ETF that isn't expanded, like the Technology Sector Select SPDR ETF, it's been a laggard of late. In fairness, that's largely because a small number of very large technology stocks have been on a shocking tear, with Nvidia leading the charge. Adding more stocks increased diversification, but it also ended up watering down the gains from the handful of big winners.

IGM Total Return Level data by YCharts

And that brings up the real problem here. If you want to own a technology ETF, buy a technology ETF. Buying a technology ETF that is pitching itself as more than just a technology ETF kind of waters down the whole idea of buying a sector-specific ETF in the first place. Taking a line from a classic science fiction film's more famous characters, "Do or do not, there is no try."

I get it, but I wouldn't recommend it

Having spent an inordinate amount of time trying to figure out what the iShares Expanded Tech Sector ETF actually does (so you don't have to), I can now say I understand. What I can't say is that I'm convinced this is a good option for investors who are looking for technology exposure. And the recent performance shows why, given that the "expanded" feature has ended up watering down the ETF's performance. Buying a technology ETF is a great idea for luddites like me, but the iShares Expanded Tech Sector ETF isn't the way I'd recommend most people get their technology exposure.

Should you invest $1,000 in iShares Trust - iShares Expanded Tech Sector ETF right now?

Before you buy stock in iShares Trust - iShares Expanded Tech Sector ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and iShares Trust - iShares Expanded Tech Sector ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $683,777!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway, Netflix, and Nvidia. The Motley Fool has a disclosure policy.