Costco Just Did Something It Hasn't Done in 7 Years. Here's How It Could Boost the Stock.

It's been the top question from the analyst community for some time already. But on July 10, warehouse-style retail chain Costco Wholesale (NASDAQ: COST) finally made a highly anticipated announcement: Membership fees are going up, starting on Sept. 1.

In May, Costco's new CFO Gary Millerchip pointed out that it's historically raised prices for its memberships every five years. But the last time the retail giant raised its membership prices was back in June 2017, which has now been seven years. This behind-schedule price increase is why analysts have peppered management with questions on this subject in recent earnings calls.

Of course, analysts weren't asking about this anticipated move merely because Costco was behind schedule. They were really asking about it because it's something that can boost the stock. Here's what investors need to know.

The Costco business model

To fully appreciate this news from Costco, investors need to have a firm grasp of its business model. It's tempting to think that the company just sells a bunch of stuff for a profit. But there's far more nuance to it than this.

Costco's fiscal year ends near the beginning of September, so it's already well into its fiscal 2024 right now. The company already has over $210 billion in net sales through the first 44 weeks of the fiscal year. Therefore, it's true that this is a massive retail operation.

However, retail sales aren't very lucrative for Costco. For the fiscal third quarter of 2024, management had reported year-to-date net sales of $171 billion. But the direct merchandise costs were nearly $153 billion. That's a gross margin of just 11%. Once operating expenses are figured into the equation, there's little to show for its retail sales.

In reality, this is the goal. Costco wants its members to be happy with the bargains they find in its stores. Prices are consequently lowered as much as possible to further this goal.

Costco makes up for low-margin retail sales by charging membership fees. There isn't any real cost associated with charging these fees, making it a pure-profit part of the business. As new members join the club, enticed by the bargains, profits go up for Costco.

How higher membership prices can help

Costco has two membership tiers and prices are going up for both. The entry-level membership is going from $60 to $65, an increase of 8%. And the higher-level membership is going from $120 to $130, which is also an 8% increase.

Should investors expect Costco's profits to immediately go up by 8% as a result of the increase in its membership fees? No, it's not that straightforward. Fee increases aren't designed to directly pad the bottom line. Rather, they're designed to attract more members.

Yes, higher membership prices are counterintuitively designed to attract new Costco members. On the Q3 earnings call, new CEO Ron Vachris explained it like this: "Fee increases go back to the member in lower prices. I mean, it creates -- that's one of the key parts that we use that money for is that it allows us to broaden that distance from the competition and bring greater value in improving our operation overall for the member."

Charging higher membership fees allows Costco's management to find ways to offer better value to its customers. Therefore, there isn't a direct correlation between the membership fee and the company's profits. However, there is an indirect correlation: Offering better value helps retain members and attract new ones, which does boost profits.

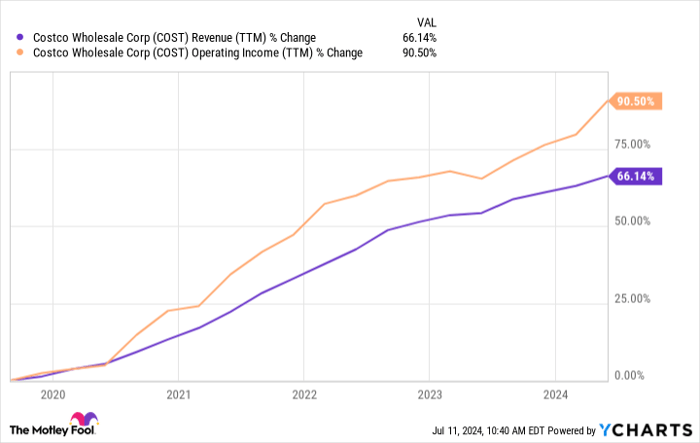

Over the last five years, operating income for Costco has gone up faster than revenue, as the chart below shows. So it seems the business model is working just fine.

COST Revenue (TTM) data by YCharts

In Q3, Costco had a membership renewal rate of 93% -- that's superb and ideally it would hold steady or increase more from here. Now, it's possible that the renewal rate could fall in coming quarters. But it's important for long-term investors to not get too caught up with near-term results. There will likely be a lag between Costco's higher membership fees and the potentially positive impact to the business.

It's important to be patient when drawing conclusions. However, if Costco attracts new members and renewal rates tick higher over the next year or so, that would be a really great sign for the long-term health of the business.

In conclusion, the positive impact to Costco's business won't be immediate. It will take time to see if the higher membership fees will allow management to offer better bargains and boost its membership numbers. But if it's successful, membership income could soar, which is where it gets most of its profit. And when profits go up, it's normally a good thing for the stock.

Should you invest $1,000 in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $826,672!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale. The Motley Fool has a disclosure policy.