'I Don't Want to See Them Homeless,' Daughter Tells Dave Ramsey About Parents With $280K Income

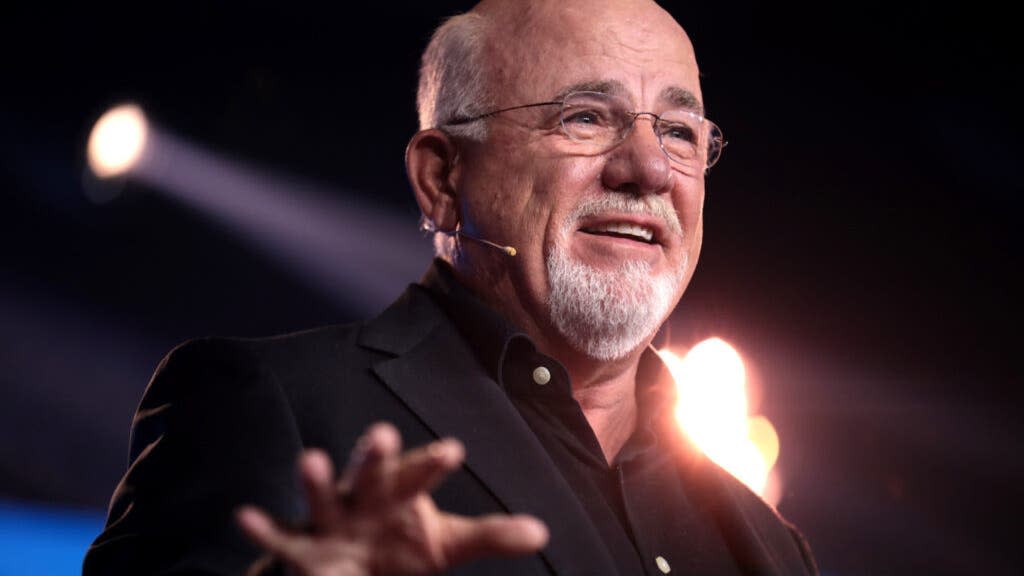

A caller on The Ramsey Show, a podcast hosted by financial expert Dave Ramsey, expressed fears that she might have to financially support her parents in their retirement.

"My parents don’t have anything saved for retirement," the caller, Marie, began. "And for various reasons that I experienced growing up, my husband and I are not OK with them living with us in the future."

Don't Miss:

Can you guess how many Americans successfully retire with $1,000,000 saved? The percentage may shock you.

How much money will a $200,000 annuity pay out each month? The numbers may shock you.

Ramsey, clearly confused, asked, "Why is it your job to take care of them? If they go on the street, why is it your job to get them out of the street?"

Like most children, Marie responded that she loves her parents and doesn't want to see them homeless. Throughout the call, it was revealed that Marie's parents have moved around frequently and hopped from job to job. They recently relocated to a new state where her dad will make $280,000 annually.

"This answers the question," Ramsey stated. "You don’t need to do anything. You need to look at your mom and dad and say ‘I love you, bye.’ People who make $280,000 a year and can’t figure out how to have housing aren’t your problem. This is asinine, Marie, that you even have the feeling that you have to prepare for the homelessness of someone making $280,000. Your family is dysfunctional. They have dumped some crap on you."

Trending: Executives and founders of Uber, Facebook and Apple are bullish on this wellness app that you can coinvest in at $1.15 per share.

Marie and her husband together make around $90,000 per year. Upon learning this, Ramsey replied, "What in the world, girl? Your dad makes $280,000 and you and your husband together don’t make $90,000? And you somehow got that this is your job to prepare for their homelessness?"

Throughout the call, Marie almost defended her question, stating that her parents won't be making $280,000 indefinitely and won't have any savings built up for their retirement.

"Well, that's their fault," Ramsey said. "If he screws up a $280,000 income and ends up homeless, that is not on you. It is not on you. You do not need to do this. I don’t know what in the world has gotten into you."

Marie's fears are not completely unfounded. People over the age of 50 now make up close to half of the homeless population in the United States. The number of homeless individuals over age 65 is expected to double by 2030. The Pew Charitable Trusts also performed an analysis that found a strong correlation between rising rent prices and an increase in homelessness. If Marie's parents don't make changes in how they handle their finances, there is a real possibility they could wind up homeless.

Trending: Planning a summer vacation? Cancel your trip up to 48 hours before departure and get a 75% refund.

Marie's dilemma highlights a broader issue that many families face: financial planning, or lack thereof, especially as individuals approach retirement age. While her parents earn a substantial income, their situation demonstrates how critical it is to start long-term planning and saving for the future.

As Ramsey points out, children should not feel obligated to provide for their parents' financial security, especially when the parents have the means to create a better future for themselves. However, many people, regardless of income, struggle with managing their finances and planning for retirement. This is where the expertise of a financial advisor can be invaluable.

If you or your loved ones are uncertain about your financial future, seeking advice from a professional can provide clarity and peace of mind. It’s never too early — or too late — to start planning for a secure and comfortable retirement. By taking proactive steps now, you can help prevent financial difficulties and ensure that you and your family are well-prepared for the future.

Ultimately, financial planning isn’t just about securing a comfortable retirement — it’s about achieving peace of mind and financial independence. Don't wait until it's too late; consult a financial advisor today and take control of your financial future.

Read Next:

The average American couple has saved this much money for retirement — How do you compare?

Boomers and Gen Z agree they need a salary of around $125,000 a year to be happy, but millennials say they need how much?

"ACTIVE INVESTORS' SECRET WEAPON" Supercharge Your Stock Market Game with the #1 "news & everything else" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article 'I Don't Want to See Them Homeless,' Daughter Tells Dave Ramsey About Parents With $280K Income originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.