Down 3.7% So Far, Is C3.ai on Track for a Better Performance in the Second Half of 2024?

Simply being involved with artificial intelligence (AI) doesn't mean a stock is due for a big year on the markets. Even though C3.ai (NYSE: AI) has "AI" as its ticker symbol, the stock has been anything but a hot AI stock to own this year. Not only is it lagging the S&P 500's impressive 15% gains in 2024, but C3.ai is down around 3.7% since the start of the year.

The good news for investors is that this enterprise AI software provider has shown significant improvement in recent months, largely tied to improved performance in its most recently reported quarter. Could C3.ai stock be due for a much better performance in the second half of 2024, and is now a good time to invest in it?

C3.ai's sales growth hasn't been all that impressive

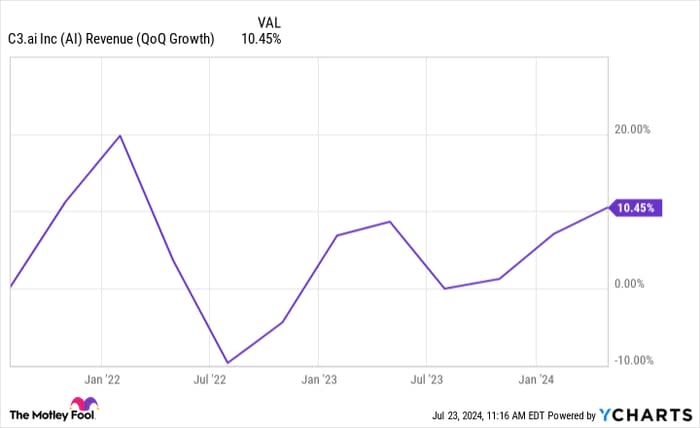

A key reason C3.ai has struggled this year is that up until recently, it didn't show much of a boost due to its AI offerings. Although company CEO Thoms Siebel often talks up the company's opportunities and its easy turnkey solutions, the numbers simply haven't supported that optimism. On a quarter-over-quarter basis, the company has often generated minimal revenue growth, and in some cases, it has even been negative.

AI Revenue (QoQ Growth) data by YCharts

To its credit, C3.ai reported improvement in its recent quarter, but there isn't a persistently strong trend to suggest business has been taking off due to AI. Despite the company supposedly being well positioned to meet the growing demand for AI solutions, investors may be having doubts about just how well C3.ai's products and services meet the needs of customers.

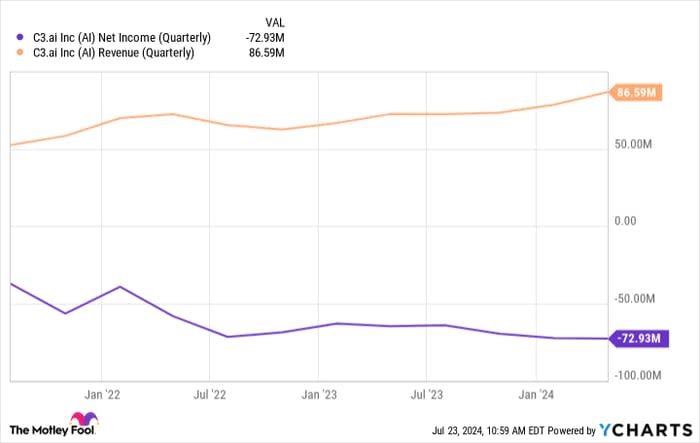

The company's bottom line is an even greater concern

If a business needs to spend heavily to grow its operations, that can be a red flag for investors. While marketing and advertising spend is necessary to grow sales, investors should see an improvement in the bottom line as well as the top line. But as C3.ai's revenue has been growing, its losses have been getting deeper.

AI Net Income (Quarterly) data by YCharts

If a business is growing but not showing a corresponding improvement on its bottom line, that can be a sign its growth may be due to the business spending aggressively to acquire customers via discounts and promotional offers. Without an improvement in earnings, it's hard to show investors that the company is scaling in a way where there is a path to profitability and that its operations are sustainable.

C3.ai isn't a good AI stock to own

Although C3.ai delivered an improved quarter in its most recent results, there are still question marks about the viability of its business and how much value its turnkey solutions truly offer to customers. The company needs to offer more to investors than just a slightly higher growth rate to make it a tenable investment. There needs to be an improvement in terms of profitability for this to be a better buy, not just in the second half, but beyond that as well.

While the AI hype did help propel C3.ai's stock last year, investors don't appear to be as easily convinced of the company's potential this time around. Until C3.ai can calm concerns relating to its inconsistent growth rate and lack of profitability, investors are likely going to be better off pursuing other AI stocks.

Should you invest $1,000 in C3.ai right now?

Before you buy stock in C3.ai, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and C3.ai wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $688,005!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool recommends C3.ai. The Motley Fool has a disclosure policy.