Duolingo Helps Users Learn Languages. But It Just Made Its 2nd Acquisition in 2 Years for Businesses Which Do Something Else

Language-learning app Duolingo (NASDAQ: DUOL) had nearly 100 million monthly active users as of the first quarter of 2024. And as a person with a background in linguistics, I believe this statistic is more impressive than most people realize.

Anecdotally, I've found it incredibly difficult to keep language learners motivated. Think about it: Almost everyone can express themselves well in their primary language and somehow "just know" all of the grammatical rules. Suddenly, they're exposed to something entirely different where the sounds are foreign, the words are unknown, and the rules don't make sense. They try hard but keep making mistakes, leading to embarrassment. Eventually, it's just easier to settle for good enough instead of pushing through toward greater proficiency.

Duolingo hangs on to users despite the intrinsic pressures that demotivate language learners. And it does this with "gamification." Duolingo's platform uses game elements to make the difficult process of language learning fun. In other words, users keep logging back in because it feels like a game.

It clearly works. On top of growth with monthly active users, Duolingo has more than 31 million daily active users as of Q1, which was up a whopping 54% year over year.

Without this context, Duolingo investors might struggle to understand why the company acquired Gunner in 2022 and bought Hobbes earlier this month. These two small companies have nothing to do with language learning; they're both animation studios. But animation studios can help to better gamify the platform.

As co-founder and Chief Executive Officer Luis von Ahn said when Duolingo acquired Gunner:

We know that the hardest thing about learning a language, or any new subject, is staying motivated and that's why we make Duolingo fun. Art and animation are foundational to the Duolingo brand, and we use them to help make Duolingo a beloved daily habit in millions of learners' lives.

Why investors can't overlook Duolingo stock

I fully understand that Duolingo stock isn't for everyone. Assuredly, some believe it's overvalued. Valuing a stock is admittedly a complex art. But by virtually every metric, Duolingo is expensive. It trades at nearly 15 times sales and at more than 44 times its free cash flow. Throwing a dart at a list of random stocks would almost certainly hit something valued cheaper.

DUOL Price to Free Cash Flow data by YCharts.

However, investors should keep an eye on Duolingo even if they find it overvalued because this is a business that keeps offering pleasant surprise after pleasant surprise.

One of the most pleasant of surprises is the percentage of Duolingo's users that are willing to pay for a subscription. There are only 7.4 million paying subscribers. But these accounted for nearly 80% of the company's Q1 revenue, which is why this is a big deal.

For Duolingo, the percentage of users paying for a subscription has consistently increased with time, which is why revenue is skyrocketing.

Quarter | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 |

|---|---|---|---|---|---|---|---|---|

Paying subscribers | 3.3 million | 3.7 million | 4.2 million | 4.8 million | 5.2 million | 5.8 million | 6.6 million | 7.4 million |

Penetration percentage | 7.2% | 7.4% | 7.8% | 8% | 7.9% | 8% | 8.3% | 8.6% |

Source: Filings from Duolingo. Table by author.

Keep in mind that when Duolingo sells a subscription to a user, the user gets a better experience because they don't have to deal with potentially disruptive advertising. But for the company, there's little, if any, incremental cost. Therefore, this growth in paying subscribers helps profitability.

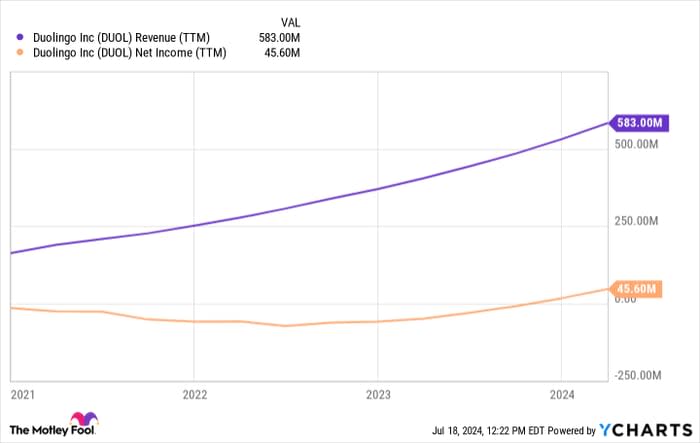

This is why Duolingo is one of the very few stocks that is achieving profitability and increasing revenue at rates exceeding 40% -- a truly elite combination.

DUOL Revenue (TTM) data by YCharts.

Duolingo can keep this kind of thing up if it can get non-paying users to upgrade to a subscription. Its gamification helps in this regard. And, the company hopes, its budding animation efforts will help improve gamification.

Beyond the core language app, Duolingo wants to branch out further into multiple education verticals, which could allow it to repeat this process multiple times.

Duolingo may look overvalued today, but the business is doing some pretty impressive things. And if management finds ways to keep it going or even further improve operations, then this is a company that can grow into its price tag and create value for shareholders.

Should you invest $1,000 in Duolingo right now?

Before you buy stock in Duolingo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Duolingo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $722,626!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Duolingo. The Motley Fool has a disclosure policy.