e.l.f. Beauty Stock Sell-Off: My Prediction for What Comes Next

Earlier in 2024, e.l.f. Beauty (NYSE: ELF) hit a 1,000% return over the last five years and an all-time high. It has since fallen 29%. After it reported its latest quarterly earnings, investors decided to sell off the stock due to disappointing forward revenue guidance. There has been no help from the broad market either, with growth stocks in a downtrend this summer.

Taking a longer view, e.l.f. Beauty has grown its sales like gangbusters in the last few years and is one of the only large brands in the beauty sector to gain spending share, stealing customers from legacy players. With the stock down from all-time highs, is e.l.f. Beauty a buy or sell today? Here's my prediction for what comes next.

Strong revenue growth, international expansion

Fiscal 2025's first quarter (ended June 30) showed more of the same for e.l.f. Beauty: fantastic revenue growth across the board. Overall revenue grew 50% year over year to $324.5 million, with international markets growing 91%. The brand has gained a ton of market share in North America and is now repeating its same low-price high-quality marketing in Europe and other countries. E.l.f. Beauty is the No. 4 brand in the U.K., for reference.

Undercutting the legacy competitors, e.l.f. Beauty took share again from the likes of Covergirl and Maybelline last quarter. It has consistently put up strong revenue growth, with sales up a cumulative 316% in the last five years. This makes e.l.f. Beauty one of the fastest growing public companies in the world.

Fast growth means high future expectations from Wall Street. Even though the company raised its full-year sales guidance to a range of $1.28 billion to $1.3 billion, this came in below investor expectations. Missing guidance expectations is a big reason why the stock is falling.

Concerns around decreasing margins

Another reason for concern with e.l.f. Beauty is decreasing profit margins. Its operating margin has fallen to 12% over the last 12 months compared to a peak of over 16%, with net income actually declining last quarter even while sales grew 50% over 2023.

Margins are going down because e.l.f. Beauty wants to increase its spending on marketing. In the first quarter of fiscal 2025, marketing was 23% of revenue compared to 16% in the same quarter last year. So, what does this mean? In order to sustain revenue growth, e.l.f. Beauty is pouring more and more money into advertising, which takes away from its bottom-line profits.

Management claims it is increasing marketing to grow awareness of the e.l.f. Beauty brand, which will drive further long-term revenue growth and eventually profits. But right now, the increased marketing spending is leading to compressing profit margins, which Wall Street does not like. This is another reason why the stock is down so much this summer.

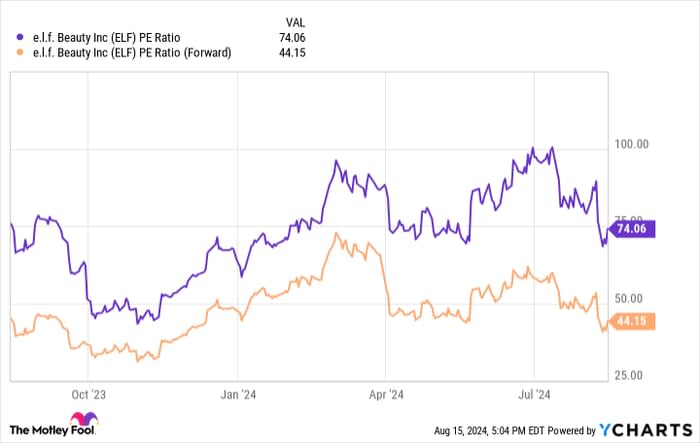

ELF PE Ratio data by YCharts

Is the stock cheap?

After its drawdown, e.l.f. Beauty stock now trades at a market capitalization of $8.77 billion. That gives the stock a trailing price-to-earnings ratio (P/E) of 74. On a forward basis that factors in future earnings growth, analysts are estimating that the stock trades at a P/E of 44 at today's prices. Even taking this forward P/E at face value, e.l.f. Beauty stock looks expensive. The S&P 500 trades at a trailing P/E of 28, for reference.

Now, some may argue that a company growing this quickly deserves a premium valuation. Let's do some math to illustrate how high the expectations for earnings growth are for e.l.f. Beauty. This fiscal year ending in March 2025, management expects around $1.3 billion in revenue. In the three years after fiscal 2025, let's assume that e.l.f. Beauty can double its sales to $2.6 billion. On its current 12% operating margin, that equates to $312 million in operating earnings in three to four years.

So, in four years e.l.f. Beauty will be trading at a P/E of 28 if the market cap doesn't change. In other words, it will take four years of above-average revenue growth in order for e.l.f. Beauty to just trade at the same P/E ratio as the S&P 500 today. These are extremely high expectations that will be difficult for e.l.f. Beauty to surpass (which is how the stock will go up).

My prediction is that -- due to its high P/E and the expectations embedded in the stock price -- e.l.f. Beauty stock will continue to disappoint shareholders who buy today. The stock may not fall further from here, but I think investors will be underwhelmed at the stock's returns over the next five years. The price you pay for a company matters, and e.l.f. Beauty still doesn't look cheap after its 2024 summer price drop.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,146!*

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,850!*

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $376,717!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of August 12, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends e.l.f. Beauty. The Motley Fool has a disclosure policy.