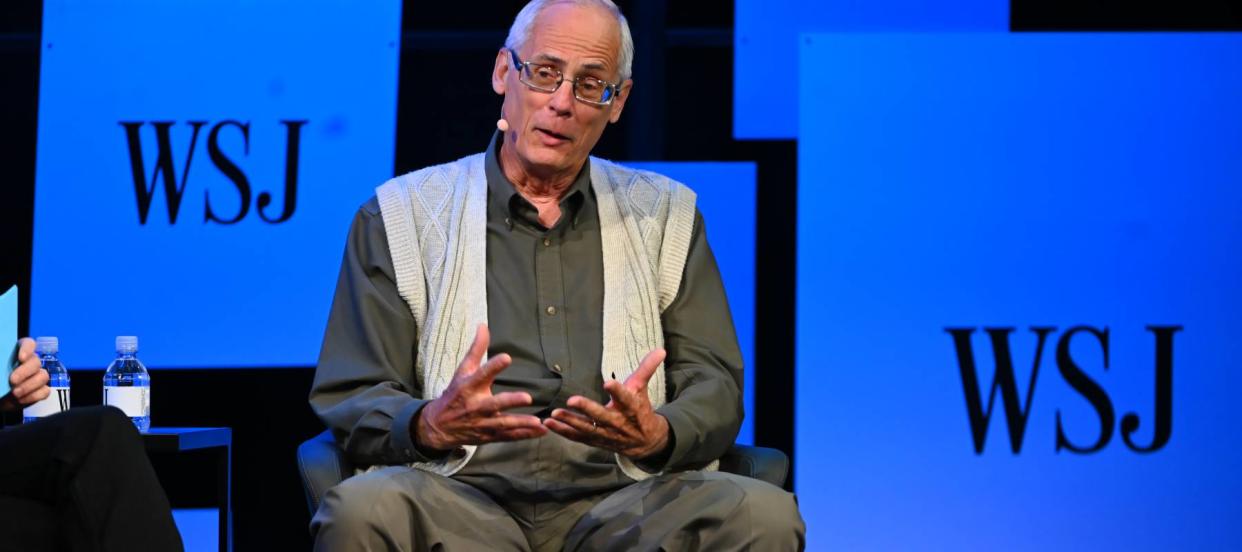

‘Father of the 401(K)’ is ‘very disturbed’ by the corporate greed in workplace retirement plans — here’s why

Ted Benna is considered the “father of the 401(k),” thanks to his redesign of the popular investment vehicle back in 1978 — a design that’s still used today.

Nowadays, 34.6% of working-age Americans have a 401(k)-style account, with an overall $7.4 trillion in assets.

Don't miss

Beating the market is no myth: These expert stock-pickers' recent success could help you build generational wealth

'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling rising costs — take advantage today

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

Despite the widespread adoption and popularity of the employer-sponsored retirement savings plan, Benna recently told the Daily Mail that he has misgivings about some of the developments in 401(k)s.

‘Greedy’ employers are charging higher fees

In 1978, Benna was working as a benefits consultant when he designed an employee retirement savings plan for a client using an innovative interpretation of the 401(k) section of the Internal Revenue Service (IRS) code. This section of the code allows employees to contribute a portion of their pay on a pre-tax basis and employers to match those contributions with tax-deductible company contributions.

The client didn’t use the plan, but Benna’s own company chose to start one, and soon after the Treasury and IRS sanctioned it.

Fast forward to today: one of Benna’s greatest misgivings is how plan fees have evolved.

“I am very disturbed by what's happening with the investment expenses,” Benna told the Daily Mail.

Originally, he said, the employer was supposed to cover all of the administrative fees. But that isn’t what’s happening now, he says, as “greedy” employers charge high administrative fees.

Benna has seen fees as high as 2.75% — which would have a material impact on investment returns. For example, after 20 years, the value of a $100,000 portfolio earning 4% with a 1% annual fee would be reduced by $30,000 versus the same portfolio with a 0.25% annual fee.

To make matters worse, even though the U.S. Department of Labor (DOL) requires plans to disclose their fees, the U.S. Government Accountability Office found that four in 10 participants in 401(k) plans don’t understand the fee information in plan disclosures.

Read more: ‘You didn’t want to risk it’: 80-year-old woman from South Carolina is looking for the safest place for her family’s $250,000 savings. Dave Ramsey responds

So how can you reduce the fees on your 401(k)?

First, you need to understand what fees you’re being charged. The DOL publication A Look at 401(k) Plan Fees is a good place to start. It explains what fees are charged and how to interpret fee disclosure statements.

Basically, there are three types of fees charged by 401(k) plans: administrative, service and investment fees.

Administrative fees help to cover the cost of operating the plan — and typically there’s not much you can do about those.

Service fees are similar to administration fees, but relate to taking an action, such as making an early withdrawal or rolling over your investment to an IRA. You can keep these fees to a minimum by taking as few actions as possible.

Investment fees are charged by the funds in your portfolio. You may be able to reduce these by moving to funds that typically have lower fees, such as passive index funds. If these funds aren’t among the choices your plan offers, you may want to see if your employer offers the option for a self-directed 401(k) plan, which will give you more investment choice.

If you’re paying a high administrative fee on your 401(k) — and can’t do anything about it — one way to potentially reduce the fee burden on your investments is to contribute to your 401(k) plan only to the amount needed to maximize employer contributions, then direct the rest of your annual savings to another plan, such as an individual retirement account (IRA), where it may be possible to pay less in fees. Before doing this, you may want to consult a financial planner.

You can withdraw your whole plan — but you probably shouldn’t

A second misgiving that Benna has about 401(k) plans is that you can withdraw the total amount when you switch employers. This can be tempting, but can greatly reduce the size of your future nest egg.

Depending on the size of your portfolio, you have several other options: leaving it where it is, rolling it into the 401(k) plan at your new employer or rolling it into a traditional or Roth IRA. If you’re leaving your current job, it’s worth speaking to a financial adviser about your best move.

Although Benna has misgivings, 401(k)s remain a powerful tool for achieving financial security in retirement. By understanding and managing your fees—and resisting the temptation to withdraw the funds before you retire—you can get the most out of your plan.

What to read next

Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here's how you can save yourself as much as $820 annually in minutes (it's 100% free)

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.