1 Headline Number from This Artificial Intelligence (AI) Giant's Latest Report Could Mislead Investors

When dissecting the state of a public company, you can't often rely on the headline figures alone. Frequently, there's more to the story than just revenue growth or profit margins -- there's a story behind each metric.

Case in point, consider Broadcom's (NASDAQ: AVGO) latest report. The company certainly wasn't trying to be misleading, but the headline number that it trumpets -- that its revenue rose 47% year over year to $13.1 billion -- doesn't tell the full story of what's going on.

Broadcom's former core business isn't doing great

Broadcom has become a gigantic tech player by doing a lot of things. It's best known for designing chips, but it also offers software for computing infrastructure, virtual desktops, and cybersecurity. In addition, it makes connectivity switches that are critical for data center functionality.

In that light, one might look at last quarter's 47% revenue growth figure and assume that Broadcom's core operations were excelling. They weren't. In November, Broadcom completed its $69 billion acquisition of VMware, which focused on cloud computing and virtual desktops. As a result, Broadcom's financials now include sales from a huge business that it didn't own last year, skewing its growth figures.

If you factor out VMware's contribution to the top line, Broadcom's revenue rose a mere 4% year over year. That's a poor performance, especially considering the tailwinds that are blowing for its semiconductor business.

Given the massive demand for its connectivity switches and custom chip designs (Broadcom has helped cloud computing giants such as Alphabet design custom chips for artificial intelligence training), investors were disappointed by its fiscal third-quarter results. After the company delivered the report on Sept. 5, the stock plummeted 10%. Clearly, the market wasn't distracted by the headline figure and responded accordingly.

Clearly, this AI-connected company's recent performance wasn't what investors were hoping for. But is there hope for a rebound on the horizon?

Next year should be better for Broadcom

During the earnings conference call, analysts asked management what they were expecting in terms of growth from the AI segment, especially since it was flat year over year in fiscal Q3. For that period, which ended Aug. 4, AI revenue was about $3.1 billion, but management expects it to rise to $3.5 billion in Q4. Furthermore, Broadcom expects strong AI growth in fiscal 2025, although it didn't offer specific guidance for that period.

In its fiscal 2025, Broadcom's numbers will once again be comparable to prior-year numbers on an apples-to-apples basis -- both years' figures will include the inorganic growth the company accrued from the VMWare purchase. The consensus forecast from analysts covering Broadcom is that its revenue will grow by 17% in fiscal 2025, so they agree with management that it should be a better year.

But is that enough to make the stock a buy?

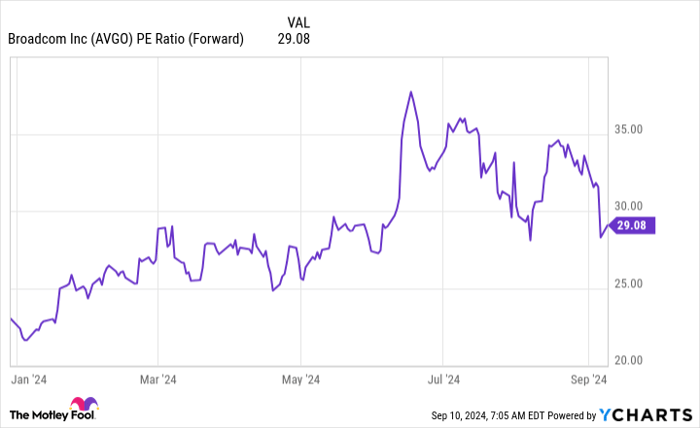

AVGO PE Ratio (Forward) data by YCharts.

Recently Broadcom was trading at 29 times forward earnings. That's a higher valuation than some of its chipmaking peers -- Taiwan Semiconductor Manufacturing, for example, was trading at 25 times forward earnings.

Despite the recent share price drop and Broadcom's pedigree, its stock doesn't quite look like a strong value proposition, nor like a great growth story. Its thesis lands somewhere in the middle of those two, making it a difficult stock to buy. I think there are better options out there than Broadcom if you're looking to increase your exposure to the artificial intelligence trend.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.