6 Things To Know Before Retiring in These Midwestern States

You may have heard of the charm of the Midwest. Or perhaps you know people who live there and praise the opportunity to experience the change in seasons. Maybe you’ve seen rankings where the Midwest tops lists for most affordable places in the United States.

Check Out: I’m an Economist: Here’s My Prediction for Social Security If Trump Wins the 2024 Election

Learn More: 9 Easy Ways To Build Wealth That Will Last Through Retirement

If you’ve never lived in the Midwest, but are considering that part of the country for your retirement, there are some helpful things to know before making the move.

Here’s a look at some information and rankings to help you find the best spot for your retirement.

Analyzing the States

GOBankingRates analyzed each state to find the best ones to retire. The analysis included cost of living, home values, tax rates and crime rates. Two Midwestern states, North Dakota and Indiana, ranked among the top 10 states for retirement.

Other Midwestern states included in the analysis were Illinois, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, Ohio, South Dakota and Wisconsin.

Discover More: 8 States To Move to If You Don’t Want To Pay Taxes on Social Security

Explore More: 2 Changes Are Coming to Social Security in 2025

North Dakota Is Best

According to the analysis, North Dakota ranked as the seventh best state to retire. It finished the highest among Midwestern states.

In North Dakota, the average single-family home is valued around $270,000. With an annual average cost of living for retirees around $41,000, it scored well among the states. The tax rates and crime rates were also favorable for retirees.

Find Out: I’m an Economist: Here’s My Prediction for Social Security If Kamala Harris Wins the Election

Indiana Is Good

The state famous for the Indianapolis 500 may also be a good spot for your retirement. Indiana also ranked among the top 10 states for retiring.

About 17% of the population here is 65 and over. The average single-family home in Indiana is worth about $247,000. The total annual cost of living for retirees is affordable at about $39,000.

Looking at the Midwest

In terms of the rest of the Midwestern states, they did overall okay in the analysis. States like Minnesota and Ohio finished in the top 15 states for retiring. Here’s a look at how the other Midwestern states ranked:

Minnesota (#13)

Ohio (#14)

Michigan (#16)

Wisconsin (#18)

Missouri (#19)

Nebraska (#25)

Iowa (#27)

South Dakota (#28)

Kansas (#34)

Illinois (#40)

Best Cities in the Midwest

The Midwest is generally known for having some incredibly affordable places to live with good access to healthcare for retirees. Per Kiplinger “Many states in the region offer affordability, beautiful scenery, an abundance of activities and quality healthcare.”

On its list of great places to retire in the Midwest, Kiplinger listed Peoria, Illinois, Fort Wayne, Indiana, and Des Moines, Iowa.

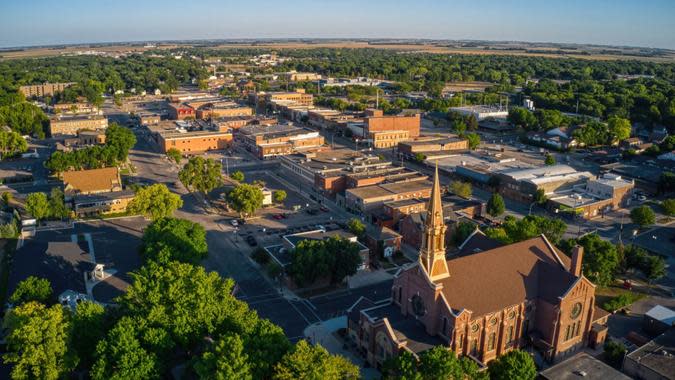

Pictured: Peoria, IL

Read Next: 7 Things You’ll Be Happy You Downgraded in Retirement

Living on Social Security

While Social Security is not meant to be the only source of income for retirees, that is the reality for many of those in retirement. This situation can present a challenging financial time for retirees who may not have enough money to live as comfortably as they’d like.

With that in mind, Insider Monkey compiled a list of the best states to live on Social Security Alone. Ohio and South Dakota were among the best states. In the list of the best cities in the Midwest for retired couples living only on Social Security, Muncie, Indiana, Youngstown, Ohio, and Keokuk, Iowa, were among the top choices.

More From GOBankingRates

5 Things You Should Stop Wasting Money on if Kamala Harris Wins in November, According to Experts

Here's How To Become a Real Estate Investor for Just $1K Using This Bezos-Backed Startup

This article originally appeared on GOBankingRates.com: 6 Things To Know Before Retiring in These Midwestern States