Better Artificial Intelligence (AI) Stock: Palantir vs. C3.ai

Two names that have emerged alongside big tech on the artificial intelligence (AI) scene are enterprise software companies Palantir Technologies (NYSE: PLTR) and C3.ai (NYSE: AI).

Although each company has done an impressive job penetrating the AI market, I see one of them as the superior long-term investment.

Let's break down the ins and outs of Palantir and C3.ai and explore what each has to offer.

1. The case for and against Palantir

Palantir sells data analytics software to the private sector as well as the U.S. government and its Western allies.

For the 12-month period ended June 30, Palantir boasted 593 total customers -- an increase of 41% year over year. While this has helped the company accelerate its revenue, I find the unit economics of the entire business to be more important.

For the quarter ended June 30, Palantir's income from operations was $105 million. This was roughly a tenfold increase from the second quarter in 2023. The combination of rising revenue and a disciplined cost structure has fueled impressive levels of profitability for Palantir, which the company can reinvest into the business.

My one word of caution when it comes to investing in Palantir is related to valuation. Palantir's market capitalization hovers around $70 billion -- pretty high for a company that's generated $2.5 billion over the last 12 months.

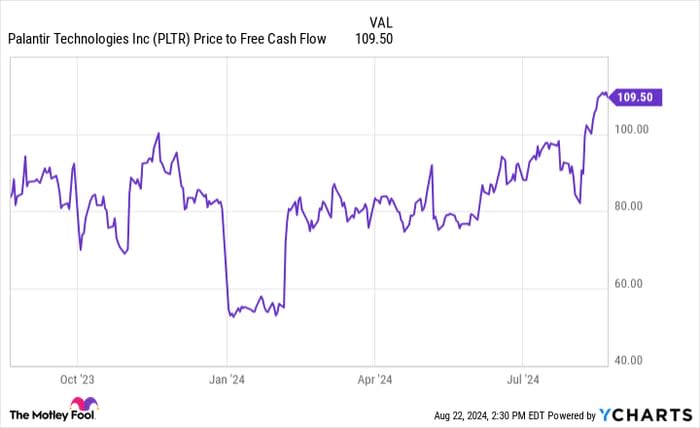

PLTR Price to Free Cash Flow data by YCharts

With a price-to-free-cash-flow (P/FCF) ratio of 109, Palantir stock is far from cheap. Moreover, the chart above clearly shows that Palantir's valuation has experienced quite a bit of expansion throughout 2024.

While this dynamic might make Palantir unattractive to some investors, let's take a look at C3.ai before making a firm decision on which company may be the better option.

Image source: Getty Images.

2. The case for and against C3.ai

C3.ai sells software to many different end markets including energy, manufacturing, defense, financial services, and healthcare. Moreover, the company has a deep partner network with major cloud providers and consulting firms such as Amazon, Alphabet, Microsoft, Accenture, and Booz Allen Hamilton.

At the end of May, C3.ai reported earnings for its fiscal year ended April 30.

For the 12 months ended April 30, C3.ai generated $310 million in revenue. While this represented a respectable 16% growth year over year, there are some blemishes with C3.ai's business.

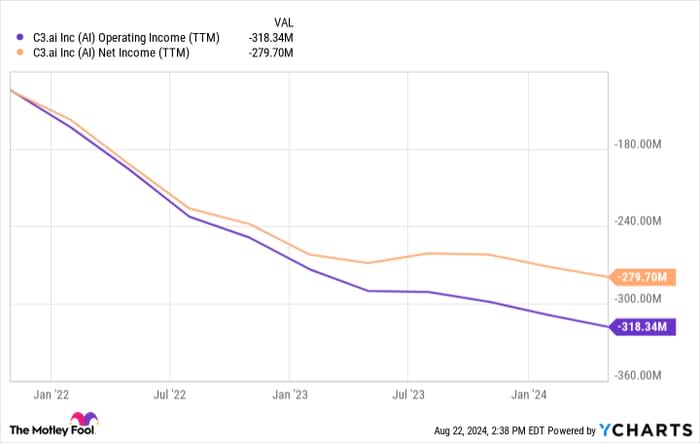

The company's gross profit was essentially flat year over year, while operating losses and net losses were actually slightly higher.

AI Operating Income (TTM) data by YCharts

This financial picture implies that C3.ai is paying a hefty price for its growth. It is not sustainable to fund unprofitable growth in the long run. For this reason, C3.ai could very well be looking at a liquidity crunch at some point, which could be detrimental for the business.

The bottom line

Navigating growth stocks can be tough. In particular, software-as-a-service (SaaS) businesses can be a beacon for attention -- but that doesn't always translate into a prudent investment choice.

To me, investing in C3.ai simply carries outsize risk compared to Palantir. Palantir generates more revenue in one quarter than C3.ai does in an entire year. Furthermore, Palantir is consistently growing its business in a profitable way whereas C3.ai continues to hemorrhage cash.

Despite its rich price tag, investing in Palantir could be justified right now. The long-term outlook for AI remains bullish, and given Palantir's unique position between the private and public sectors, the company's prospects look bright. Alternatively, C3.ai has yet to prove that it can disrupt its peers and encroach on their market position.

For these reasons, I see Palantir as the superior investment choice over C3.ai and think long-term investors will be rewarded handsomely if they can exercise some patience.

A good approach to investing in a stock like Palantir is to use dollar-cost averaging. This strategy will allow you to invest in Palantir at various price points over time, which helps mitigate risk. Investors who are looking for some exposure to emerging AI opportunities may want to consider a position in Palantir right now.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Palantir Technologies. The Motley Fool has positions in and recommends Accenture Plc, Alphabet, Amazon, Microsoft, and Palantir Technologies. The Motley Fool recommends Booz Allen Hamilton and C3.ai and recommends the following options: long January 2025 $290 calls on Accenture Plc, long January 2026 $395 calls on Microsoft, short January 2025 $310 calls on Accenture Plc, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.