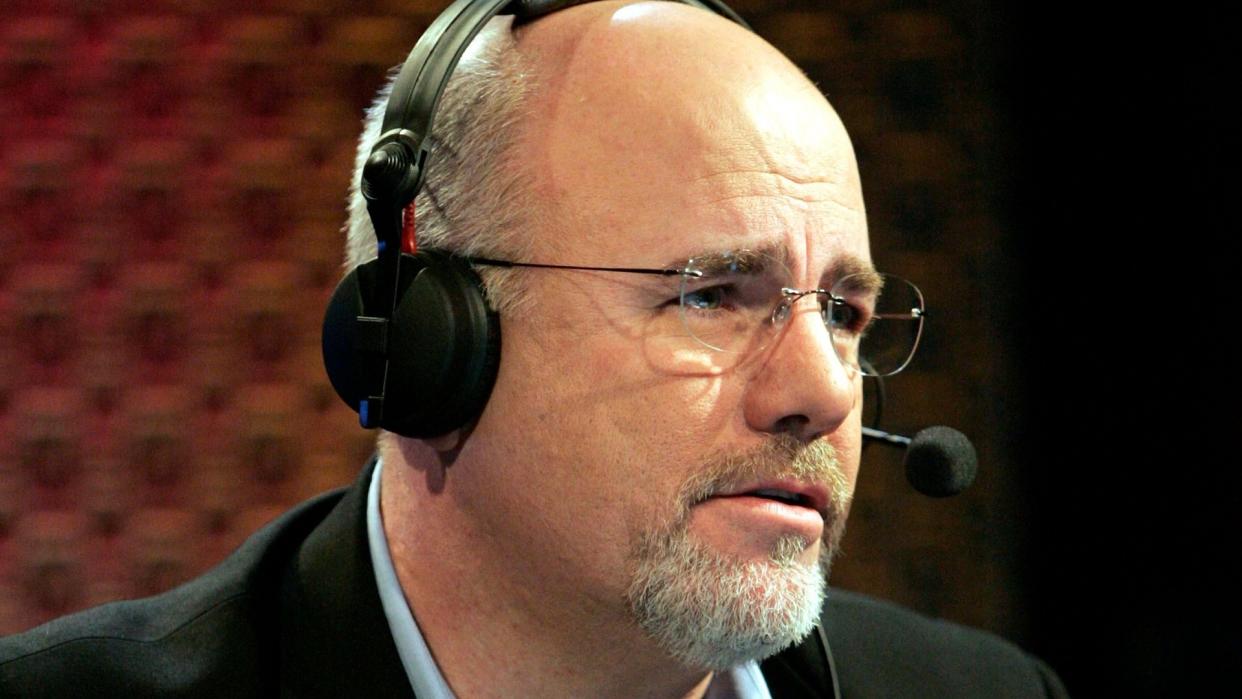

Dave Ramsey: 3 Ways Retirees Can Become Debt-Free (Even on a Fixed Income)

Living on a fixed income is already challenging, but getting out of debt with limited funds can seem impossible. According to a recent report from the Nationwide Retirement Institute, almost a third of retirees think they will be less financially secure than their parents or grandparents in retirement.

Be Aware: I’m Planning My Retirement — 5 Expenses I Wish I Had Cut Sooner

Find Out: 9 Easy Ways To Build Wealth That Will Last Through Retirement

However, there is a way out of debt. According to Dave Ramsey, here are three things to do to be debt-free on a fixed income.

Create a Budget

Figure out how much you owe in debt, then make a monthly budget. Once you know where you stand, you can start making progress.

“When you set up your budget, you’ll see how you’ve been spending your money,” according to a recent Ramsey Solutions article. “Then you can start making the changes you need to get some confidence — and pay off your debt.”

Making a budget might seem overwhelming, but Debt.org explained it doesn’t have to be complicated.

“Fortunately, the main challenge in creating a budget is simple: You make a list of all your expenses and then compare it to your income. Think of it as a snapshot of your financial situation.”

Explore More: Cutting Expenses for Retirement? Here’s the No. 1 Thing To Get Rid Of First

Read Next: 7 Things You’ll Regret Downsizing in Retirement

Have an Emergency Fund

Before paying off debt, Ramsey Solutions advised putting money aside for emergencies.

“We call this Baby Step 1 — meaning it comes first, before you even start paying off your debt. Go ahead and save up a cool $1,000 as fast as you can. We know, on a fixed income, it’s going to take a little bit longer, and that’s a-okay.”

Learn More: How Much Money Do Americans Have in Their Bank Accounts in 2024?

Start Paying Off Debt With the Snowball Method

Once you have a budget and emergency savings in place, it’s time to focus on eliminating debt by paying off your smallest debts first. Pay as much as possible on the lowest bill, and pay the minimum amount on the others. This is Baby Step 2 in Dave Ramsey’s money management plan.

“When you knock out the smallest debt first, you get motivation,” Ramsey Solutions explained. “When you pile that payment onto the next debt, you get momentum. Motivation plus momentum equals victory.”

The Bottom Line

You can get out of debt on a fixed income with discipline and hard work.

“Don’t buy into the lie that you have no choice but to rely on debt as your life raft in the rocky waters of life,” Ramsey Solutions asserted. “Nope! You can become debt-free. Will it be easy? No, it sure won’t. But anything that’s worth doing is hardly ever easy.”

More From GOBankingRates

7 Reasons A Financial Advisor Could Boost Your Savings in 2024

4 Best International Cities to Buy a House in the Next 5 Years, According to Real Estate Experts

17 Walmart Items Retirees Should Stock Up on Before Winter Hits

This article originally appeared on GOBankingRates.com: Dave Ramsey: 3 Ways Retirees Can Become Debt-Free (Even on a Fixed Income)