Down 50% From Its High, Is Lululemon Stock a Good Buy Right Now?

Lululemon Athletica (NASDAQ: LULU) is a recognizable and iconic name in the fashion industry. Known for its high-quality activewear, consumers are often willing to pay a premium for its products. But Lululemon isn't immune to challenging macroeconomic conditions, and investors have been dumping the stock as its growth rate has slowed significantly in 2024. But now, with the stock down 50% from its high, is it too cheap to pass up?

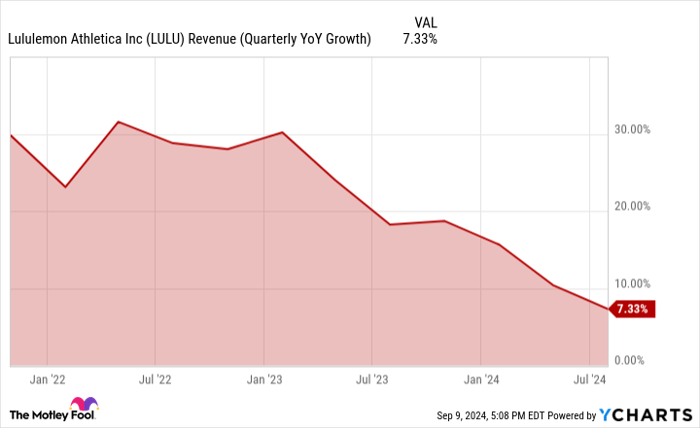

Lululemon's sales numbers underwhelm in Q2

On Aug. 29, Lululemon reported its second-quarter earnings numbers, for the period ending July 28. The company grew its revenue by 7% to $2.4 billion for the period, but was slightly short of analyst expectations. The company, however, delivered a solid beat on the bottom line, with earnings per share of $3.15 coming in far better than the $2.93 that Wall Street was looking for.

What's troubling, however, is that the company is seeing softness in its core markets in the Americas, where comparable sales were down 3% year over year. CEO Calvin McDonald said that not having new and enticing styles for women resulted in weak demand in its U.S. business. Sales growth in China was strong with revenue rising by an impressive 34%. But with the Chinese economy showing signs of slowing down, Lululemon may not be able to count on such high numbers for long.

And the problem of slowing growth is by no means an isolated problem for Lululemon.

LULU Revenue (Quarterly YoY Growth) data by YCharts

Reduced guidance and a troubling outlook only add to the bearish case

Not only was the current quarter a bit underwhelming, but Lululemon reduced its guidance for the full fiscal year (which ends in January) as well. Revenue is projected to be around $10.4 billion (previously the forecast called for at least $10.7 billion) while earnings per share will also be lower, at a midpoint of around $14.05 -- down from $14.37.

Those aren't necessarily significant adjustments but the risk for investors is that those numbers could get worse if economic conditions deteriorate; demand for Lululemon's high-priced apparel could slow even further if consumers feel more of a need to reduce spending amid a recession.

Lululemon's stock is trading at a steep discount

Lululemon stock has lost more than half of its value and it's nowhere near its 52-week high of $516.39. What may be attractive to investors is the stock's fairly light valuation; it's trading at less than 20 times earnings. That's far below its five-year average.

LULU PE Ratio data by YCharts

On the flip side, the business is also growing at a much slower pace than in the past. Typically, investors pay a premium for a stock when it's performing well. A discount is arguably warranted in light of Lululemon's recent results and the headwinds facing the business.

Should you buy Lululemon stock today?

For a top apparel stock with a notable brand, Lululemon could be attractive to investors who are willing to take a contrarian position in the company. The last time the stock traded much lower than where it currently is was back in 2020.

The business is still posting strong profits and while it may face some challenges, it's in the same boat as other high-priced apparel companies. There's no reason to suggest that the brand is in trouble and as economic conditions improve, the company could get back to generating stronger sales numbers. For investors willing to be patient and hang on for at least a couple of years, buying the stock right now, while it's at a discount, could set you up for some great returns down the road.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 720% — a market-crushing outperformance compared to 160% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Lululemon Athletica made the list -- but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of September 9, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lululemon Athletica. The Motley Fool has a disclosure policy.