Here's How Much Snowflake Spent on Research and Development Last Quarter

Snowflake's (NYSE: SNOW) flagship product is the Data Cloud, which helps organizations break down data silos to extract more value from the information they harvest from their operations. Since data is the key to developing the most powerful artificial intelligence (AI) models, Snowflake is in the perfect position to build products for that industry.

The company launched its Cortex AI platform in 2023, which allows businesses to combine their data with ready-made large language models (like Meta Platforms' Llama 3) to create AI software applications. Plus, Cortex comes with pre-built AI tools like Document AI, which allows developers to quickly extract valuable data from unstructured sources like contracts and invoices.

Snowflake loses money each quarter because it invests heavily in growth initiatives like research and development, which is its largest cost. While many tech companies have tried to manage their expenses over the last couple of years, that hasn't been so easy for Snowflake because of its focus on rolling out new AI products and services.

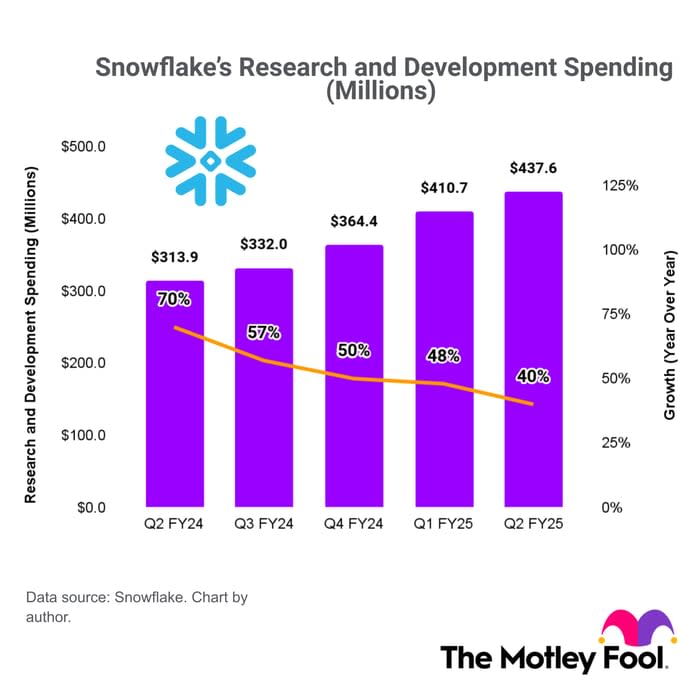

During the recent fiscal 2025 second quarter (ended July 31), Snowflake spent a record $437.6 million on research and development, which was a 40% increase from the year-ago period:

While that growth rate is decelerating, it's still much faster than the company's revenue growth, which came in at 30% in Q2 -- and that figure has also been decelerating over the last couple of years. An increase in operating costs overall led to a $316.9 million net loss for Snowflake during the quarter, which was a 40% jump from the year-ago period.

That trend is unlikely to reverse anytime soon because the company continues to hire more employees every quarter, with its headcount hitting a record high of 7,630 in Q2.

Investors will have to get used to persistent losses if Snowflake is to take a leadership position in the AI industry. However, they are clearly losing patience because the stock is down 39% this year already, and it's now down 71% from its all-time high. One investor that is no longer a shareholder is Berkshire Hathaway, which recently sold its shares.

Should you invest $1,000 in Snowflake right now?

Before you buy stock in Snowflake, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $769,685!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms and Snowflake. The Motley Fool has a disclosure policy.