How To Invest in Index Funds

In 1976, the Vanguard Group launched the First Index Investment Trust, which is now the Vanguard 500 Index Fund.

The firm’s goal was to “democratize the institutional strategy of indexing… The index strategy, previously available only to pension funds and other institutional investors, brought low costs and broad diversification to individual investors.”

Nearly 50 years later, index funds are at the core of countless portfolios, from novices just starting out to major insurers and other institutions — and with good reason. They offer an inexpensive, efficient, simple way to reduce risk and grow wealth, even for the greenest investors.

Takeaways

Index funds are efficient, low-cost, easy-to-understand investments

Index funds are a particularly good option for beginning investors or those who don’t understand or have the time to research individual stocks

Index funds can still be risky

Index funds approximate the return of the index, nothing more and nothing less

What Are Index Funds?

An index fund is an investment that tracks an index. As you can’t directly buy an index like the S&P 500, you’ll need to buy an index fund if you want to track its performance. Index funds are known as “passively managed” investments, as no manager actively buys and sells securities. Rather, the managers simply add or remove stocks or other securities based on any changes in the underlying index. For example, an S&P 500 index fund manager won’t buy or sell any stocks in the portfolio until they are added to or removed from the index itself.

Are Index Funds a Good Way To Invest?

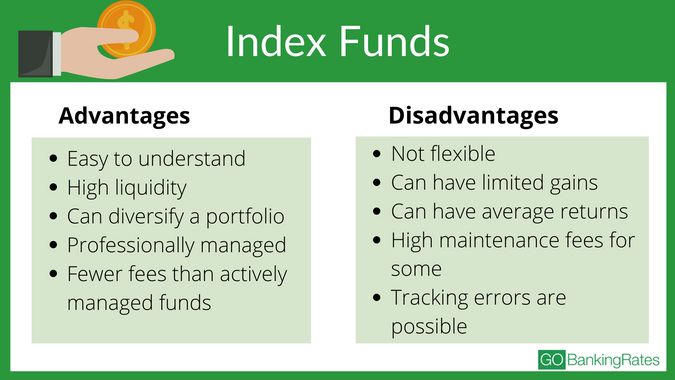

Index funds are a good way to invest because they’re simple and inexpensive. They can also be diversified, as the purchase of a single share can buy you ownership in hundreds or even thousands of publicly traded companies. Most index funds come in the form of exchange-traded funds, or ETFs. These securities can be bought or sold any time the stock market is open. Other index funds may be traditional mutual funds, which are bought and sold directly from the fund management company once per day, after the market closes. In either format, index funds are typically quite inexpensive, and less costly than actively managed funds. Perhaps even more importantly, they have also historically outperformed actively managed mutual funds.

That’s not to say they are without risk — no investment is. But over the long term, index funds are a good way to grow your wealth because they track large swaths of the market, and the market trends up over time. Also, since index funds don’t change their holdings as frequently as actively managed funds, they result in fewer taxable gains.

They can make excellent additions to 401(k)s, IRAs, Roth IRAs, individual brokerage accounts or any other investment vehicle.

How Do Index Funds Compare With Other Options?

Due to their lower internal expenses, passively managed index funds have an edge over pricey actively managed ones. You also know exactly what you’re getting at all times, which is the return of the easily trackable index. With an actively managed fund, you might not know exactly what your fund managed is buying and selling until the fund releases its quarterly report. On the downside, when you buy an index fund, you are by definition getting an “average” return. There is no chance for outperforming that market, as you may be able to with individual stock selection or actively managed mutual funds.

How Do Index Funds Track Market Performance?

Index funds generally buy all the securities in an index to track its market performance, although there are different ways they can accomplish this. Some funds buy a representative sample — say, 495 of the 500 stocks in the S&P 500 — to achieve essentially the same results. Other index funds use futures or other instruments to track the return of an underlying index.

Are Index Funds Cost-Effective?

One of the best features of index funds is that they are extremely cost-effective. For example, the average actively managed equity mutual fund has an expense ratio of 0.42%. But the average equity index fund charges just 0.15% per year. While this may not seem like much, it means actively managed funds charge nearly three times as much as passively managed index funds.

What Are the Top 5 Index Funds?

The five biggest index funds according to assets under management are:

SPDR S&P 500 ETF Trust (SPY)

Vanguard S&P 500 ETF (VOO)

iShares Core S&P 500 ETF (IVV)

Vanguard Total Stock Market ETF (VTI)

Invesco QQQ Trust (QQQ)

Bigger Isn’t Always Better

As you can see, some of the biggest and most popular index funds track benchmark indices like the S&P 500 and Nasdaq, and those kinds of funds have excellent track records because they include some of the largest and most stable companies in the world.

But there’s a whole universe of index funds to choose from depending on your investing style, interests and goals.

Here are just a few of the many diverse choices available to index fund investors:

iShares Core U.S. Aggregate Bond ETF (AGG): A tax-efficient and low-cost fund that offers exposure to U.S. investment-grade bonds.

iShares Russell 2000 ETF (IWM): This fund mirrors the Russell 2000, an index that tracks the 2,000 smallest publicly traded companies in the United States.

Vanguard Mid-Cap Growth ETF (VOT): This fund mirrors the performance of the mid-cap stock market, which includes companies that are bigger than small-cap businesses but smaller than the large-cap giants.

Vanguard Balanced Index Fund Admiral Shares: This index fund provides an easy, low-cost way to gain exposure to both equity and fixed investments. It invests roughly 60% in stocks and 40% in bonds.

How To Invest in Index Funds

Index funds are extremely easy to buy, particularly when they come in the form of an ETF. These types of index funds can be bought or sold on the open market, just like individual stocks. Any time the market is open, you can either instruct your broker to buy or sell shares or do it yourself online.

If you prefer to buy the traditional mutual fund version of an index, you’ll have to have an account at a brokerage firm that offers access to that specific fund. While most online brokers offer a wide range of index funds from multiple companies, you may have to shop around a bit to find the exact fund you want, particularly if it’s a smaller fund or tracks a more obscure index. You can also buy mutual fund shares directly from the issuing firm.

Risks and Limitations

Just because index funds may hold hundreds of different securities doesn’t mean they don’t carry risk as well. An S&P 500 index fund may hold 500 securities, for example, but it will still be just as volatile as the overall stock market — in fact, exactly as volatile. Some specialized index funds that track much narrower indexes, like the 30-strong NYSE Semiconductor Index, and can be particularly volatile.

As mentioned above, one of the big limitations of index funds is that you resigning yourself as an investor to an average return. While you won’t underperform the index, you also won’t outperform it.

Tax Considerations

When you sell an index fund at a profit, you’ll still owe the same capital gains tax that you would on an individual stock. However, if you hold a fund long-term, you won’t generally have as many taxable distributions as an actively managed fund. This is simply because there will be fewer transactions conducted within the fund.

FAQ

Here are some of the questions most commonly asked about index funds.

Is it a good idea to invest in index funds?

Index funds can be a great idea, particularly for beginning investors. The combination of low costs, ease of trading, tracking capability and at least some level of instant diversification make them something investors should at least consider. No less than billionaire Warren Buffett, the famed "Oracle of Omaha," has frequently said that "In my view, for most people, the best thing to do is own the S&P 500 index fund."

What are the cons to investing in index funds??

Theoretically, actively managed funds should outperform passive index funds -- and many do, every year. While it's not always the same actively managed funds that outperform, many have strong long-term track records. If not for their expenses, passive index funds might often lag behind the performance of good managers, because they guarantee an average return.

Andrew Lisa contributed to the reporting of this article.

Information is accurate as of July 11, 2024.

This article originally appeared on GOBankingRates.com: How To Invest in Index Funds