Nvidia Drags Semiconductor Stocks Lower Today

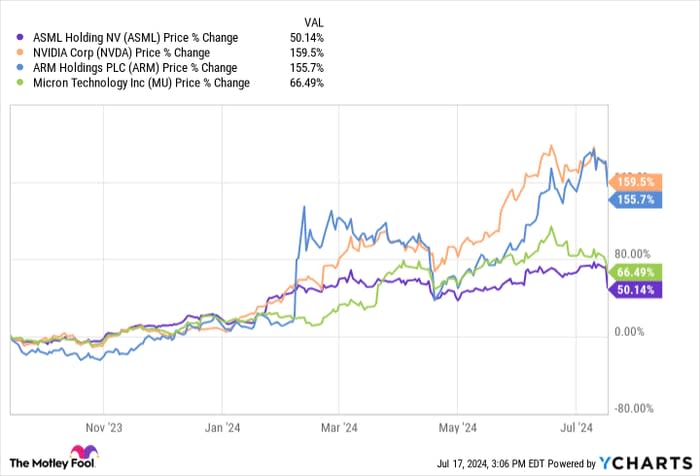

Shares of semiconductor stocks fell sharply on Wednesday after the first major industry results came out from ASML (NASDAQ: ASML). Management is optimistic about the future of artificial intelligence (AI), which has pushed chip stocks higher this year, but still expects revenue to be flat for the year.

Nvidia (NASDAQ: NVDA) shares responded by falling as much as 7.6% in trading on Wednesday, Arm Holding (NASDAQ: ARM) fell 9.6%, and Micron Technology (NASDAQ: MU) was off 6.2%. The stocks were down 6.7%, 9.2%, and 6.1% respectively at 3 p.m. ET.

ASML wasn't bullish enough

When stocks go up rapidly, expectations of the underlying companies go up as well. ASML is no exception and while second-quarter results were better than expected, investors were disappointed management didn't raise full-year revenue guidance from previously provided "similar to 2023."

Nvidia, Arm, and Micron aren't competitors to ASML, but they are downstream in the supply chain and they ultimately drive demand for the company's equipment. Expectations have risen for these chip stocks and ASML is the first company to indicate they may not see the explosive growth investors are expecting.

There's a delicate balance between stocks pricing in growth and running so high that even a small guidance miss can crush stocks. Given the run in AI-related stocks, the market is going to pounce on any sign of weakness.

China and Taiwan are concerns again

The Biden administration said it may ratchet up restrictions on companies working with China, including ASML and Nvidia. There are already restrictions on the equipment that can be sold into China, but limiting how workers can maintain equipment could curb demand even further.

As much as the U.S. has tried to disrupt China's advanced semiconductor manufacturing, many companies still rely on China for a large amount of revenue. If companies like Nvidia, Arm, and Micron are targeted, they could see a drop in demand just as they're ramping up AI demand worldwide.

China could ultimately be forced to create its own semiconductor tooling, which it's already doing, and AI chips, which would be competition to these companies.

Taiwan, which is where most of the world's advanced chips are made, gets roped into this conflict because of its proximity to China and the country's claim on Taiwan itself. It's a tenuous position for chip companies and given the high valuation of these stocks it makes sense investors are taking a "risk off" approach today.

Rubber meets the road in AI

The tensions with China continue to ebb and flow and shouldn't surprise any semiconductor investors. I don't think the latest news presents any more risk than what investors knew about the industry a day or two ago.

What's going to be more impactful is the demand for semiconductor equipment and chips as the AI boom matures. Investors are expecting Nvidia's revenue to more than double this year and double again in 2025. Arm is expected to grow 25% this fiscal year and Micron is expected to grow 62% in fiscal 2024 and another 52% in fiscal 2025.

Those are high bars to clear and any indication they'll fall short will hurt the stocks. It's not clear if ASML's caution is a sign the industry isn't growing as quickly as hoped, but we'll find out as earnings are released over the next month.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $774,281!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML and Nvidia. The Motley Fool has a disclosure policy.