One Red Flag for Nvidia Stock That Could Send It Tumbling

When digging through financial statements, it's important to look at the trends for metrics rather than just a single quarter of results. This can lead to a better picture of a company's performance, and I've pinpointed one for Nvidia (NASDAQ: NVDA) that investors should watch.

The trend of this metric is concerning and could cause weakness in the stock.

Unprecedented demand for Nvidia's GPUs has raised profit levels

Nvidia's graphics processing units (GPUs) have become an important piece of computing hardware. Their ability to process multiple calculations in parallel separates them from more conventional computing methods. This also makes them perfect for processes that require intense calculations, like training artificial intelligence (AI) models or running an engineering simulation.

AI has been the primary driver for Nvidia's surge in GPU demand. With major players in AI loading up on its GPUs, the company has been able to charge practically whatever it wants, since its GPUs are seen as second to none.

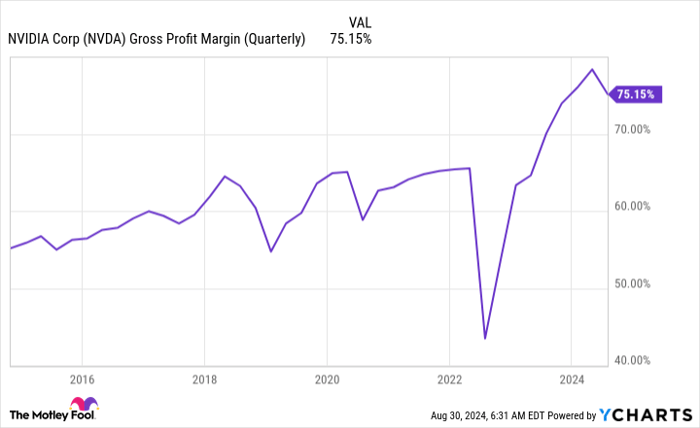

This has shown up in its gross profit margin, a figure that conveys how much money is left after the cost of manufacturing the product is accounted for.

Historically, Nvidia's gross profit margin hovered in the high 50% to low 60% range. But thanks to this new wave in demand and the company's market position, it has spiked to around 75%.

NVDA gross profit margin (quarterly); data by YCharts.

But the second quarter saw a slight decline in gross margin from the first quarter, falling to 75.1% from 78.4%. This fall is expected to continue in the third quarter, with management's projections guiding for 74.4% gross margins.

This isn't a huge decline, but the trend is noteworthy. Usually, when a company's gross margins fall, it means it has to decrease prices to drive more demand. Obviously, Nvidia doesn't need any more demand. But what the decline could mean is that alternative solutions are gaining steam, and the company is having to tweak its prices slightly.

This could be a drop in the bucket and have no real meaning over the long term. But if worthy competition does arise and Nvidia's profit margins fall back to historical levels, the stock could be in trouble.

What if Nvidia's margins fell to historical levels?

If Nvidia's margins reverted back to historical levels, it wouldn't be good for the stock.

Let's assume the gross profit margin falls back to normal levels (60%) and its current operating expense level is maintained. That would give Nvidia net income of $12.2 billion (if the second quarter's tax rate is used). That would be a 27% decline from today's levels.

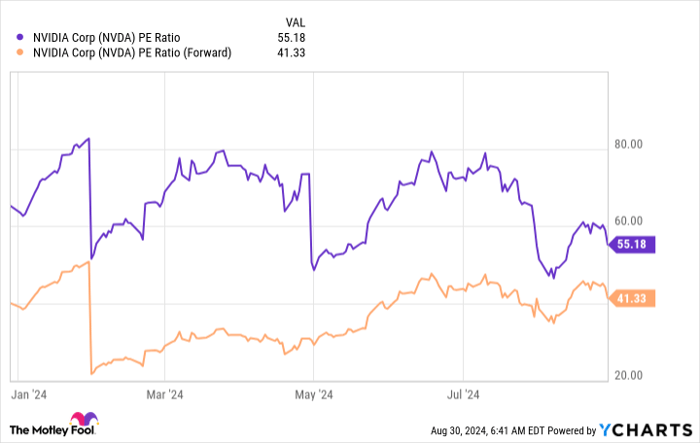

The expectations that are built into Nvidia's stock are extraordinary: It trades for 55 times trailing earnings and 41 times forward earnings.

NVDA PE ratio; data by YCharts.

If you reduce the denominator of the price-to-earnings ratio (P/E) by 27%, these figures would rise to 75.6 times trailing earnings and 56.5 times forward earnings.

That's even more expensive, and the stock might not command that premium with growth rates starting to slow down due to year-over-year comparisons becoming more difficult.

So, I wouldn't be surprised if the stock price declined by a similar amount. That's only if I could snap my fingers and see Nvidia's margins instantly decline. In reality, a decline like this would take some time to play out.

I'm not saying that Nvidia's margins will fall back to previous levels. However, investors should consider that the new margin levels are vital to the investment thesis.

If the gross margin continues to compress and then starts to fall, then the stock will likely follow suit. However, unless Nvidia's competitors (or its current customers) launch a product that can rival its GPUs, its elevated gross margins could be permanent.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $650,810!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.