S&P 500 Sell-Off: Is It Really Safe to Invest in the Stock Market Right Now?

After enjoying record-breaking highs most of the year, the S&P 500 (SNPINDEX: ^GSPC) has taken a fairly significant tumble in recent days. The index is currently down by nearly 9% since its peak in mid-July, inching dangerously close to correction territory -- which is considered a fall of at least 10% from an index's high.

Many investors have been worried about a downturn for months now, and this recent dip has caused many to panic.

Image source: Getty Images.

To be clear, nobody can say for sure whether we really are on the verge of a more significant market slump. But if you're concerned about investing right now, you're not alone. So is it really safe to invest in the market during volatile times like these? Or should you hold off until the market stabilizes? The answer is simpler than it might seem.

How much does market volatility really matter?

Market turbulence is daunting, even for seasoned investors. It's tough watching your portfolio drop in value, no matter how long you've been investing. But the good news is that volatility doesn't matter as much as you might think -- even if a more severe downturn is looming.

The key to maximizing your wealth in the stock market involves keeping a long-term outlook. While your investments may drop in value when stock prices dip, you don't technically lose any money unless you sell. If you simply hold your stocks until the market recovers, your portfolio should bounce back, and you'll likely be right back where you started without losing a dime.

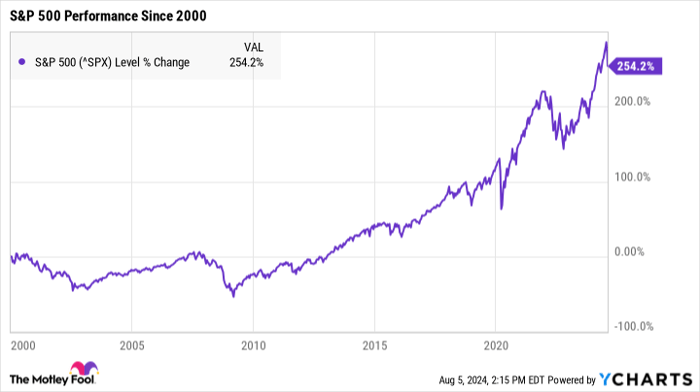

Historically speaking, there's a very good chance that will happen, as the market has an incredible track record of rebounding after downturns. In fact, there has never been a crash, bear market, or correction that the market has not survived.

Right now, the current S&P 500 tumble may feel severe. But when you consider the index's performance historically, it's faced far worse and come out the other side stronger than ever.

Also, research suggests that when it comes to the S&P 500's historical returns, there's never been a bad time to buy as long as you're a long-term investor. Analysts at Crestmont Research examined the index's rolling 20-year total returns and found that every single one of those periods ended in positive gains.

This means that if you'd invested in the S&P 500 (through an S&P 500 index fund or ETF, for example) and held that investment for 20 years, you'd have earned positive returns no matter when you'd invested.

The silver lining for investors

There may not be much to love about market downturns, but the silver lining is that they can be fantastic investing opportunities. It can be incredibly expensive to buy when the market is surging, but now that prices are beginning to drop, it's a prime time to snag high-quality stocks at a discount.

Again, the market could have further to fall. But as long as you hold your investments for the long haul, you're far less likely to lose money. By "buying the dip" and riding out the storm, you can pay less for your stocks while still reaping the rewards once the market inevitably rebounds.

It's critical, however, to ensure you're investing in strong stocks. Weak companies may struggle to rebound from economic turbulence, which could be costly if they don't survive. Healthy companies, though, are far more likely to have what it takes to weather the storm. By loading up on these stocks when their prices are lower, you can set yourself up for substantial gains down the road.

Market volatility can be alarming, but the right strategy will protect your portfolio as much as possible. By staying calm, keeping your money in the market, and taking this opportunity to invest in quality stocks, you can not only survive this slump, but thrive.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $615,516!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

Katie Brockman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.