Is Taiwan Semiconductor Manufacturing (TSMC) a Buy on the Dip?

After a strong start to the year, shares of Taiwan Semiconductor Manufacturing (NYSE: TSM), or TSMC for short, have cooled off recently following some geopolitical worries. The stock is still up over 50% year to date, but down about 17% from its recent highs. The question for investors is whether TSMC is a buy following the pullback in the stock.

Riding the AI semiconductor wave

TSMC is a semiconductor contract manufacturer, which means that it owns a number of foundries, or semiconductor manufacturing facilities, where it produces chips for semiconductor companies. Many companies that design semiconductors use what it is commonly called a fabless model, where they contract out the production of their chips to a third party such as TSMC.

Building out foundries is a capital-intensive endeavor, and utilization levels must be high for the plants to run profitability. As such, for many semiconductor companies it is easier to outsource production and not have to spend the cash and keep up with production technology advancements, instead focusing on their core competencies of designing chips.

TSMC has become the largest semiconductor manufacturer in the world by revenue and counts Apple and Nvidia among its largest customers. According to Statista, TSMC has an over 60% market share in the global semiconductor foundry market. It is also estimated that it produces 90% of the world's most advanced chips.

Given TSMC's dominant position in the chip manufacturing space, the company has been riding the wave of demand for artificial intelligence (AI)-related chips, such as the graphics processing units (GPUs) designed by Nvidia that are used to help build out the infrastructure needed to run AI applications. Demand for AI chips from Nvidia has been outstripping supply, and TSMC has been working to increase capacity. Meanwhile, other companies have also been designing their own AI chips to try to compete with Nvidia, which is business that benefits TSMC as well.

This strength could be seen in TSMC's second-quarter results, with its revenue rising over 40% year over year and over 13% sequentially. .

In addition to building a number of new manufacturing facilities to help meet future demand, TSMC is also in the process of moving some of its manufacturing to 2-nanometer production technology. Reducing the size of chips helps increase speed and lower power consumption while giving TSMC the ability to fit more chips onto a wafer, helping reduce costs and increase capacity.

It has been rumored that Apple has been looking to secure all of TSMC's 2-nanometer capacity, although the company has indicated that all customers have engaged it on the technology. While the initial ramp can be negative to gross margins, the company expects to reach the corporate average more quickly than it did with 3-nanometer technology.

The company has also hinted at increasing prices given the value it provides and how well its customers such as Nvidia have been doing. In light of the current capacity constraints and its dominant market share, the company finds itself in a good position to get some better pricing.

Image source: Getty Images.

Is TSMC a buy?

TSMC is riding some powerful waves given the demand of AI chips, and the company looks well-positioned as it migrates to 2-nanometer technology and continues to build out capacity. If AI technology is indeed in its early innings, the company has a long runway of growth in front of it.

Now there are also some potential risks that come with an investment in TSMC. The first is that chip manufacturing is a very high fixed-cost business, so if the company builds additional foundries and future demand does not materialize, it can be a big drain on profitability if these facilities have low utilization levels.

Meanwhile, the U.S. has been considering tougher trade restrictions for chips to China. This is largely for more advanced chips, and not all semiconductors. In the second quarter, about 16% of TSMC's revenue came from China.

Meanwhile, there have long been invasion fears associated with where the company is headquartered, and comments from former President and current presidential candidate Donald Trump about Taiwan stealing the U.S. chip industry and having to pay a higher price tag for its defense rattled the stock. Given the island's importance in the chip manufacturing industry, though, it would be in the U.S. and its allies' best interests to defend Taiwan in any attack to avoid a global chip catastrophe.

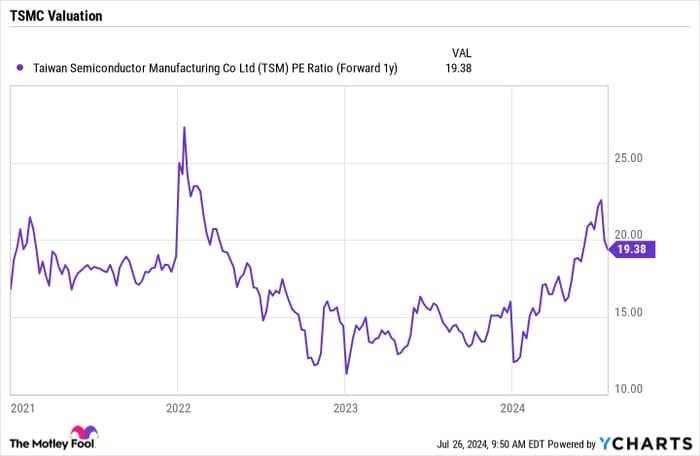

TSM P/E Ratio (Forward 1y) data by YCharts

From a valuation standpoint, TSMC trades at forward price-to-earnings (P/E) ratio of under 20 based on 2025 analyst estimates. While there are risks, I think that this is a very attractive valuation given the opportunities in front of the company. As such, I think the recent pullback is a nice opportunity to buy the stock, as its long-term prospects look bright.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $683,777!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.