UPS Faces an Identity Crisis

Carol Tome's first earnings call as UPS (NYSE: UPS) CEO took place in the summer of 2020, and her guiding framework has been clear from the outset. As part of the "better not bigger" approach, UPS would focus on growing earnings by optimizing its existing network and targeting growth opportunities rather than chasing delivery volume growth. Unfortunately, recent events have brought that model into question. So, is UPS investable now? Here's the lowdown.

Better not bigger

Tome's approach made perfect sense; by coincidence, it dovetailed perfectly with the pandemic. The long-term trend of increasing e-commerce deliveries created an excellent volume growth environment, and with Amazon.com growing its delivery capability, the environment was ripe for the transportation company to focus on growing deliveries in targeted areas. This approach is opposed to building a network to chase volume growth that might not be as profitable.

Better not bigger meant targeting end markets like small and medium-sized businesses (SMBs) and healthcare, and it also meant being willing to forgo less profitable deliveries from Amazon. Indeed, the share of UPS' revenue from Amazon fell from 13.3% in 2020 to around 11.5% in the recently reported quarter. Optimizing the existing network also led to a slowdown in capital spending, which boosted cash flow conversion from earnings.

When the pandemic and surging delivery volumes came along, the need for SMBs to immediately build out e-commerce delivery capability led to a spike in profitability at UPS when the company was becoming more selective.

The first half of the chart below shows all this good news: soaring earnings (in the form of earnings before interest, taxes, depreciation, and amortization, or EBITDA), lower capital expenditures, and strong cash flow growth. But it's not the full picture.

UPS Capital Expenditures (TTM) data by YCharts

What went wrong?

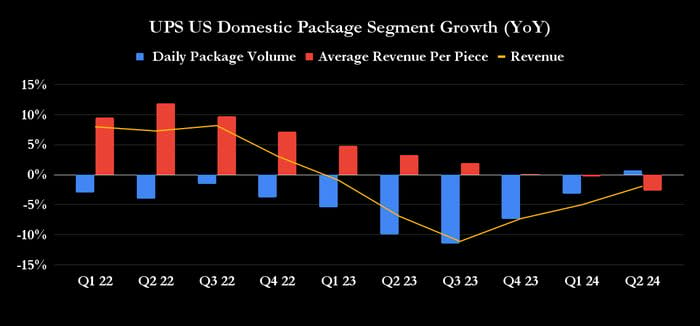

A key part of the assumption about "better not bigger" being best is that growth in the delivery environment will be supportive, and that definitely was the case for the first couple of years. This can be seen in the 2022 data in the chart below for UPS' U.S. domestic package segment. The volume demand environment was strong enough to allow UPS to follow its strategy of allowing for daily package volume to decline as it targeted deliveries with higher average revenue per piece. The result was strong revenue growth through 2022.

Data source: UPS presentations. YoY = year over year.

That said, revenue growth started declining in 2023 as delivery volumes started slowing dramatically, and UPS lost its ability to increase revenue per piece significantly.

Management described the industry situation on UPS' Investor Day earlier in the year. Usually, the industry works with an excess capacity of some 6 million packages a day (for reference, UPS' U.S. average daily package volume was 18.1 million in the recent quarter). However, from 2020 to 2022, the 6 million buffer became a 6 million shortfall, creating ideal conditions for UPS.

Unfortunately, the slowdown in industry volume growth since the start of 2023, alongside rising industry capacity, means the industry now has a 12 million-package capacity surplus.

Unfortunately, that excess capacity is pressuring volume growth and revenue-per-piece growth, and the segment's revenue has declined since the first quarter of 2023.

Image source: Getty Images.

A change of strategy in 2024?

Fast-forward to the latest second-quarter earnings. The disappointing report saw management lower its full-year earnings guidance, significantly reducing full-year adjusted operating margin expectations from 10%-10.6% to just 9.4%.

However, management's full-year revenue guidance of $93 billion is within the original revenue guidance range of $92 billion to $94.5 billion. The reason comes down to an unexpected explosion in lower-margin volume growth from "new e-commerce entrants into the United States," according to Tome.

That sounds more like bigger, not better than "better not bigger."

Bernstein analyst David Vernon took up the issue on the earnings call, causing Tome to respond that UPS wasn't "chasing volume;" it's merely that new customer demand was more than anticipated; "better not bigger has not gone away."

What it means to investors

However you look at it, the industry's excess capacity is challenging UPS' near-term prospects and leading to more lower-margin deliveries in its revenue mix. Management hasn't ditched the approach (now updated as "better and bolder"), but it's unlikely to see the full benefit of it while industry overcapacity exists in the U.S.

As such, there's near-term risk around UPS earnings in 2024 but plenty of longer-term opportunity when industry volumes improve, creating a better pricing environment that allows UPS to be more selective over its deliveries. UPS will regain its identity, but it could take a few quarters to muddle through a challenging market environment before it does so.

Should you invest $1,000 in United Parcel Service right now?

Before you buy stock in United Parcel Service, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and United Parcel Service wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.