The first question to ask when a markets expert speaks

A version of this post was published on Tker.co. Subscribe here.

Liz Ann Sonders, chief investment strategist at Charles Schwab, compiled an outstanding list of quotes from history’s investing legends. (I recommend reading her post from start to finish.)

One quote that stuck out to me came from Edwin Lefevre, author of “Reminiscences of a Stock Operator”:

Speculators buy the trend; investors are in for the long haul; 'they are a different breed of cats.' One reason that people lose money today is that they have lost sight of this distinction; they profess to have the long term in mind and yet cannot resist following where the hot money has led.

Some people try to make money trading the stock market over short-term periods. Some aim to build wealth by investing in the stock market over long, multi-year timeframes. Many do some combination of both.

All of these people seek out information and insights that might help them get an edge and improve their returns.

Unfortunately, trading tips and investment advice come with a lot of the same jargon that make it easy to confuse the two if you’re not paying careful attention.

When a markets expert starts talking, the first question you should ask is: “What is the timeframe?”

Is it one month? One year? Several years? One day?

Why? Because it’s possible that the same person who’ll tell you stocks will fall in the coming weeks will also tell you they expect prices to be higher in the coming years. In fact, I can almost guarantee you that the Wall Street strategists who expect the S&P 500 to fall this year will also tell you it’ll be much higher in three to five years.

All this relates to Step 4 of TKer’s “5-step guide to processing ambiguous news in the markets and the economy”: “Beware the motivations of those communicating the information.”

The hot shot hedge fund manager on financial TV may present a compelling, eye-catching case for why the stock market could tumble from here. However, reporters don’t always follow up and ask what to expect when you stretch the timeframe, which may be more relevant to long-term investors. This lack of temporal context is common in the news industry, which tends to focus on the recent past and the near future.

This doesn’t mean that investors should completely ignore what the pros are saying about what could happen in the coming weeks or months. While expectations for volatility in the near-term might not affect how you position your long-term investments, they can serve as valuable reminders to keep your “stock market seat belts” fastened.

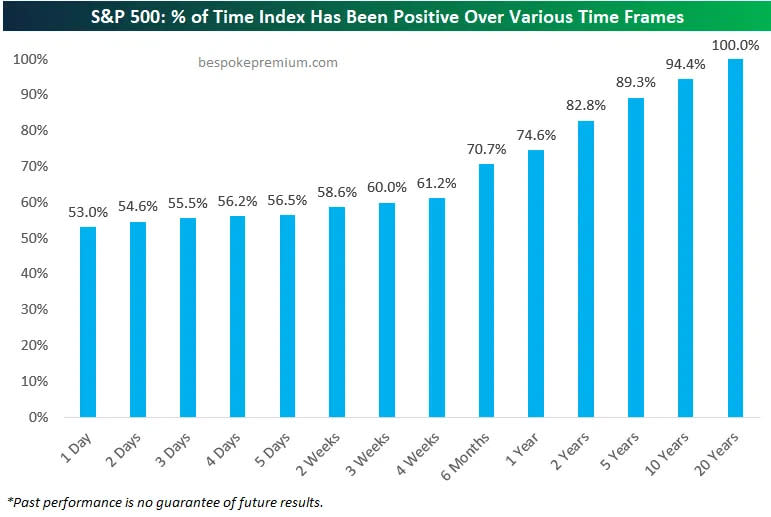

After all, the odds that stocks fall are relatively high when you look at short timeframes.

As my friend Joseph Fahmy says: “The majority of arguments on FinTwit have to do with timeframe. One person could be selling a stock because they think it will go down over the next 2 days and another could be buying because they think it will go up over the next 2 years. Don't assume everyone trades like you.”

FinTwit, the community of people posting about finance on X, sees lots of heated bulls vs. bears debates about markets that come to no resolution. And it’s often the case that one side may be making the case for a short-term trade whereas the other side is making the case for a long-term investment — but the two sides aren’t aware of the disconnect. They’re not necessarily in disagreement; they’re just arguing about different things.

Zooming out 🔭

TKer Stock Market Truth No. 1 says: “The long game is undefeated.“ In other words, the stock market usually goes up over time.

Meanwhile, TKer Stock Market Truth No. 2 says: “You can get smoked in the short-term.” That is to say long-term investors should be prepared to experience a lot of sell-offs on the way up.

When I compiled this list of truths, I deliberately put these two next to each other because I wanted to make clear that bearish market developments can occur within a bullish long-term framework.

All of this is to say that it’s possible to be bullish and bearish simultaneously. The nuance is in the timeframe.

Related from TKer:

Beware alarming business stories that get a lot of news coverage 🗞️

Smart people agree that the best investing wisdom shares a common theme 🧐

Reviewing the macro crosscurrents 🔀

There were a few notable data points and macroeconomic developments from last week to consider:

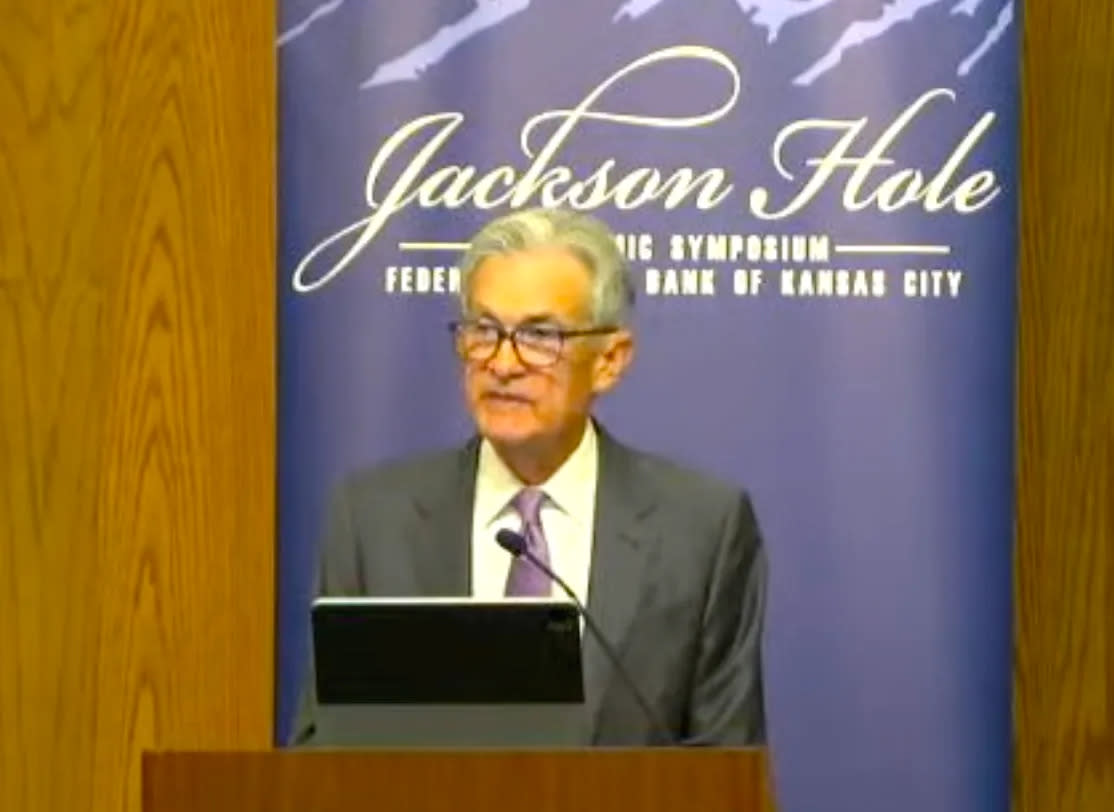

🏛️ “The time has come”: “The upside risks to inflation have diminished,” Fed Chair Jerome Powell said on Friday. “And the downside risks to employment have increased.”

Speaking at the Kansas City Fed’s economic symposium in Jackson Hole, Powell acknowledged how the unemployment rate had risen to 4.3% in July, saying: “We do not seek or welcome further cooling in labor market conditions.“

“The time has come for policy to adjust,” he added. “The direction of travel is clear.“

Fed watchers see this language as a signal that the central bank’s first rate cut could come as soon as its September 17-18 Federal Open Market Committee meeting.

For more on what this means and how we got here, read: Fed Chair Powell: 'The time has come' ⏰

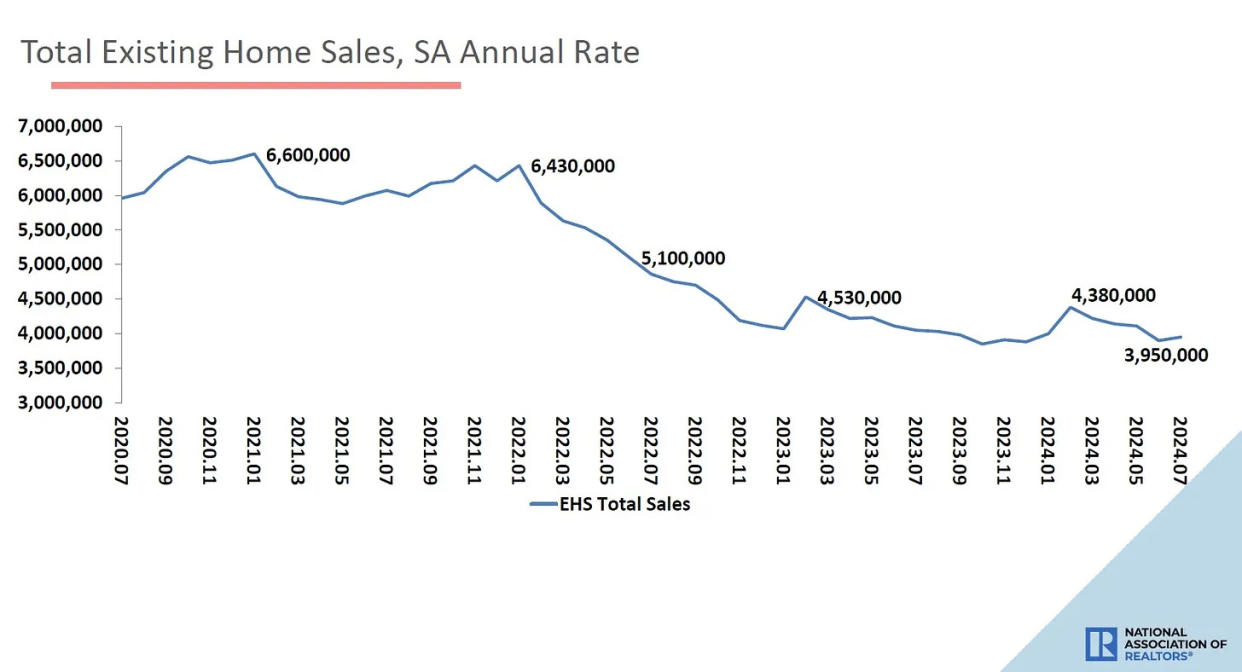

🏚 Home sales rose. Sales of previously owned homes increased by 1.3% in July to an annualized rate of 3.95 million units. From NAR chief economist Lawrence Yun: "Despite the modest gain, home sales are still sluggish. But consumers are definitely seeing more choices, and affordability is improving due to lower interest rates."

For more on housing, read: The U.S. housing market has gone cold 🥶

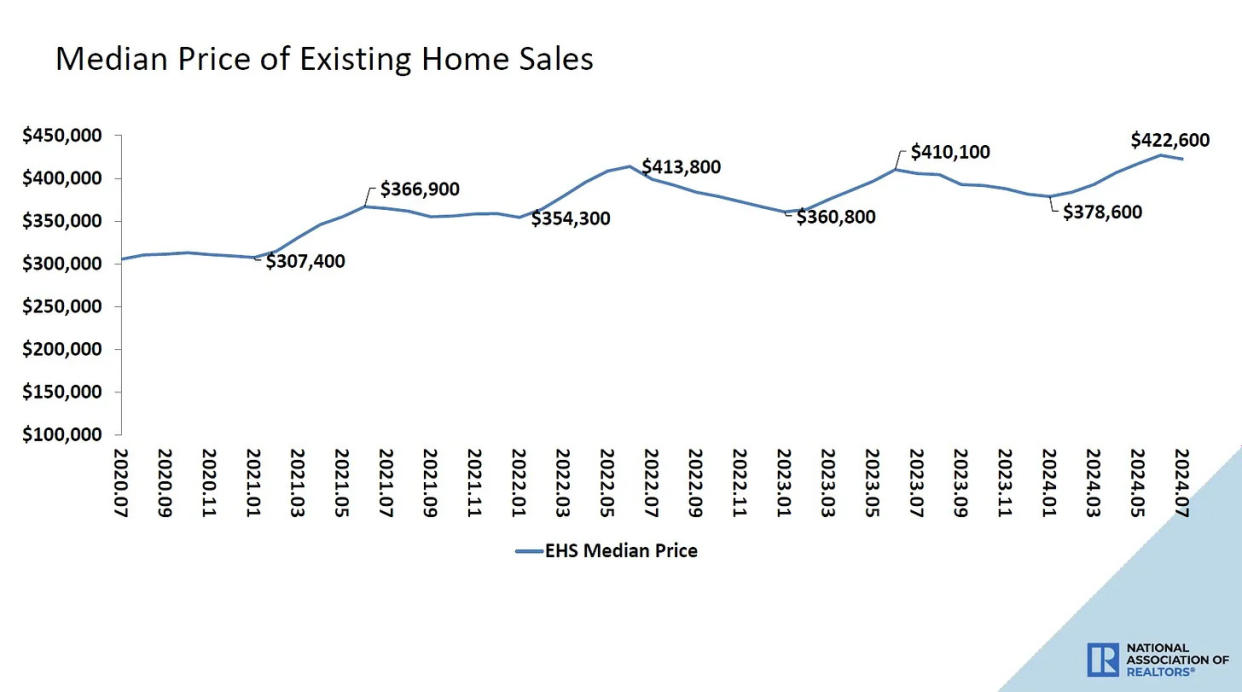

💸 Home prices cooled. Prices for previously owned homes declined from last month’s record levels, but they remain elevated. From the NAR: “The median existing-home price for all housing types in July was $422,600, up 4.2% from one year ago ($405,600). All four U.S. regions posted price increases.”

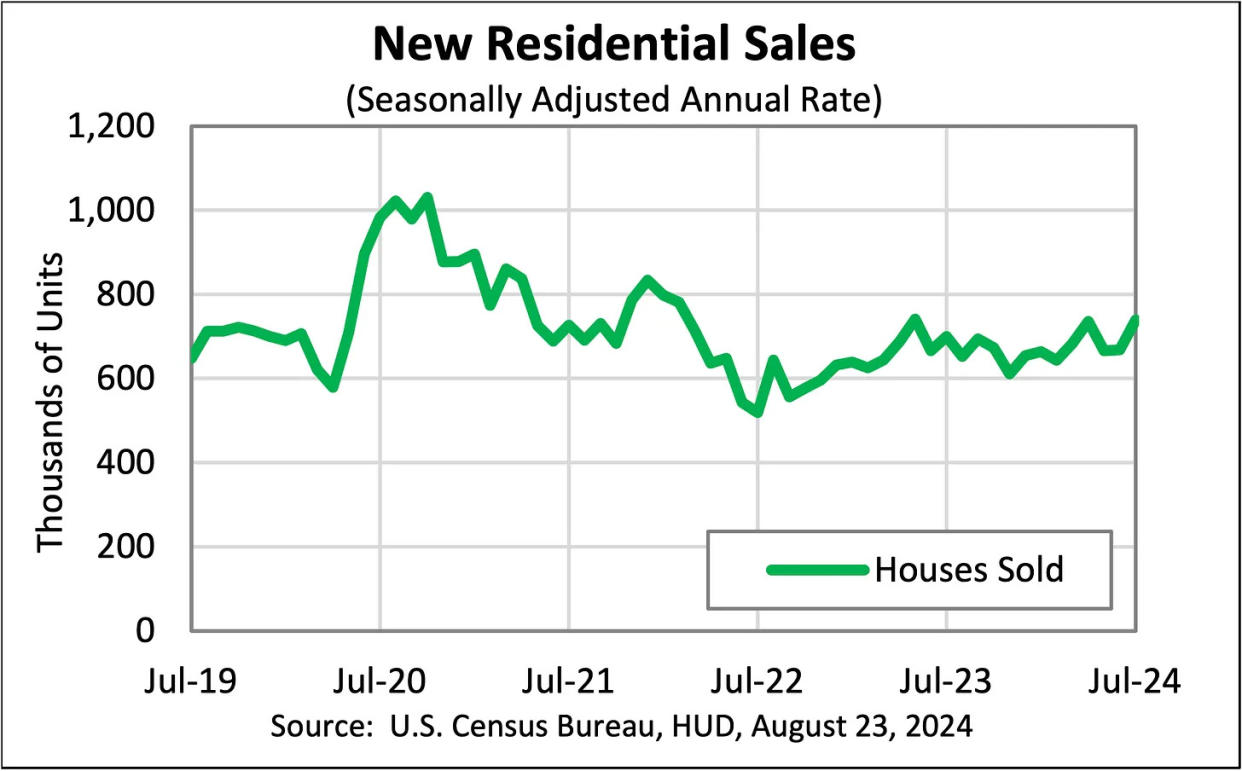

🏘️ New home sales rise. Sales of newly built homes jumped 10.6% in July to an annualized rate of 739,000 units.

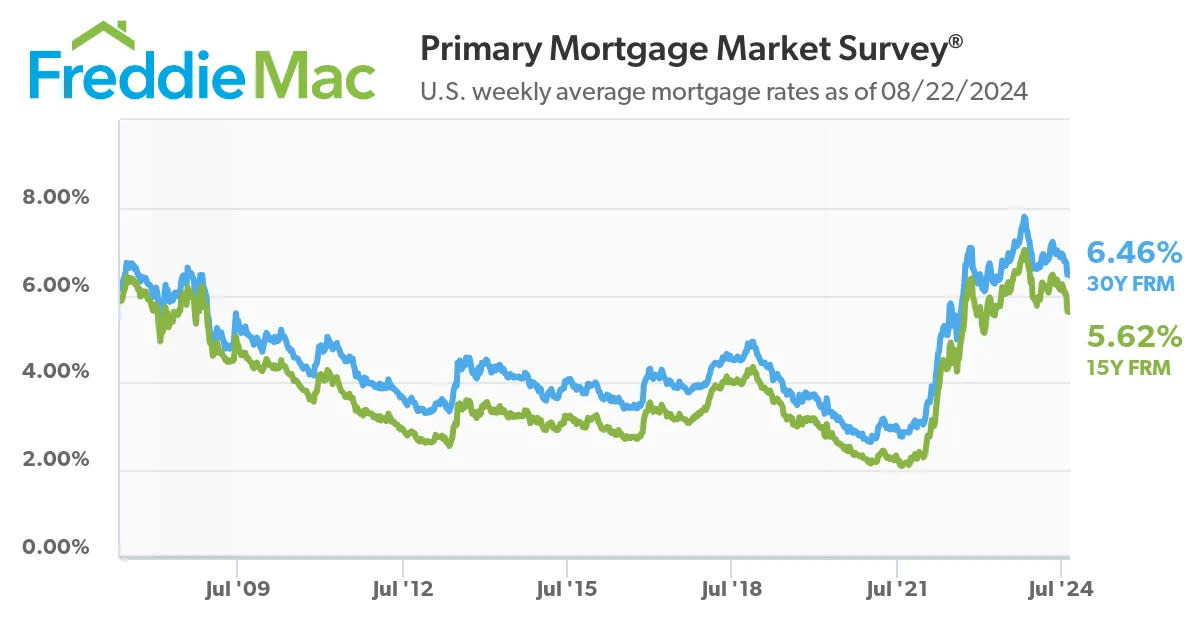

🏠 Mortgage rates tick lower. According to Freddie Mac, the average 30-year fixed-rate mortgage declined to 6.46%, down from 6.49% last week. From Freddie Mac: “Although mortgage rates have stayed relatively flat over the past couple of weeks, softer incoming economic data suggest rates will gently slope downward through the end of the year. Earlier this month, rates plunged and are now lingering just under 6.5%, which has not been enough to motivate potential homebuyers. Rates likely will need to decline another percentage point to generate buyer demand.”

There are 146 million housing units in the U.S., of which 86 million are owner-occupied and 39% of which are mortgage-free. Of those carrying mortgage debt, almost all have fixed-rate mortgages, and most of those mortgages have rates that were locked in before rates surged from 2021 lows. All of this is to say: Most homeowners are not particularly sensitive to movements in home prices or mortgage rates.

For more on mortgages and home prices, read:Why home prices and rents are creating all sorts of confusion about inflation 😖

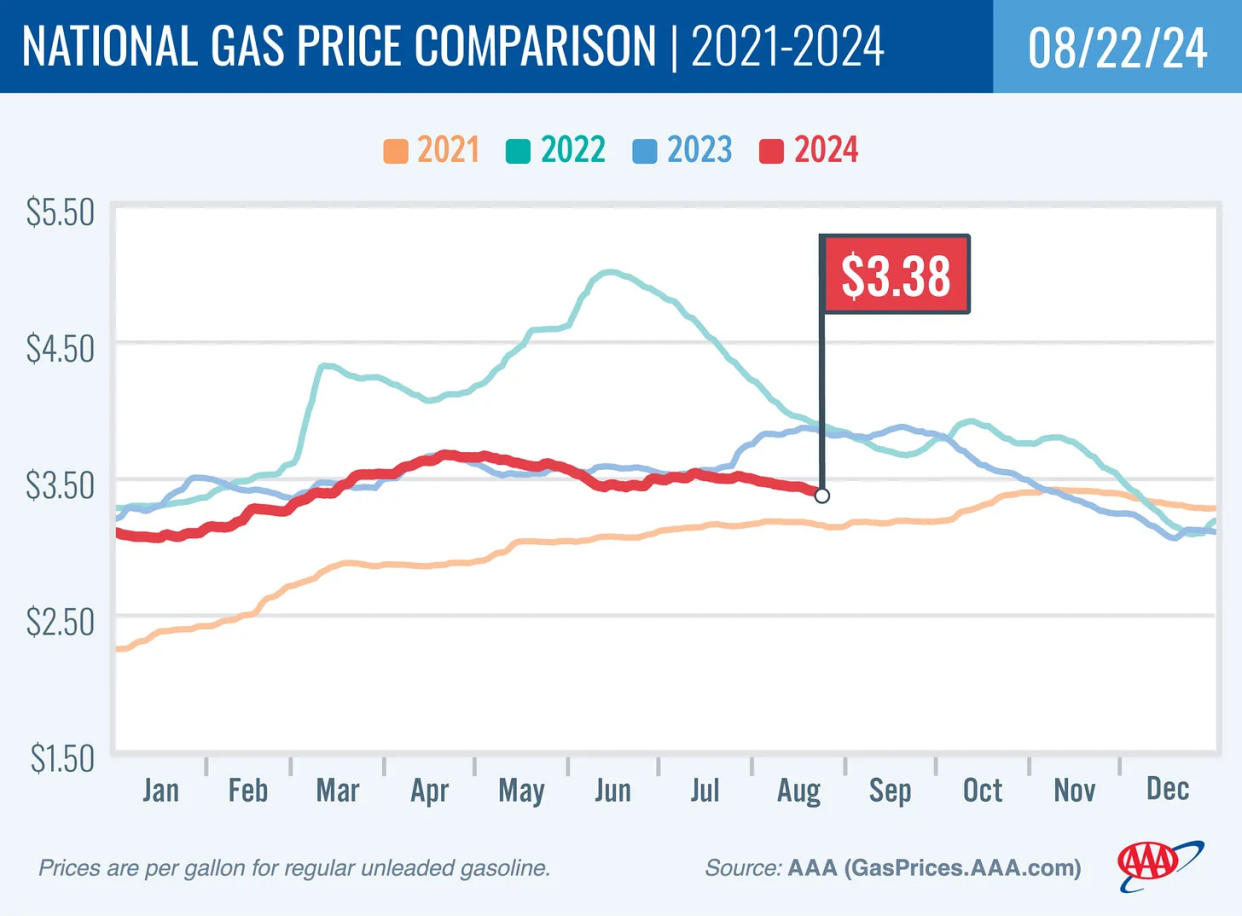

⛽️ Gas prices fall. From AAA: “Reaching a price point last seen on March 6, the national average for a gallon of gas fell six cents to $3.38 since last week. According to new data from the Energy Information Administration (EIA), gas demand crept higher last week from 9.04 million b/d to 9.19. Meanwhile, total domestic gasoline stocks fell from 222.2 to 220.6 million barrels, but gasoline production increased, averaging 9.8 million daily. Mild gasoline demand, steady supply, and low oil costs may cause pump prices to slide further.”

For more on energy prices, read:Higher oil prices meant something different in the past 🛢️

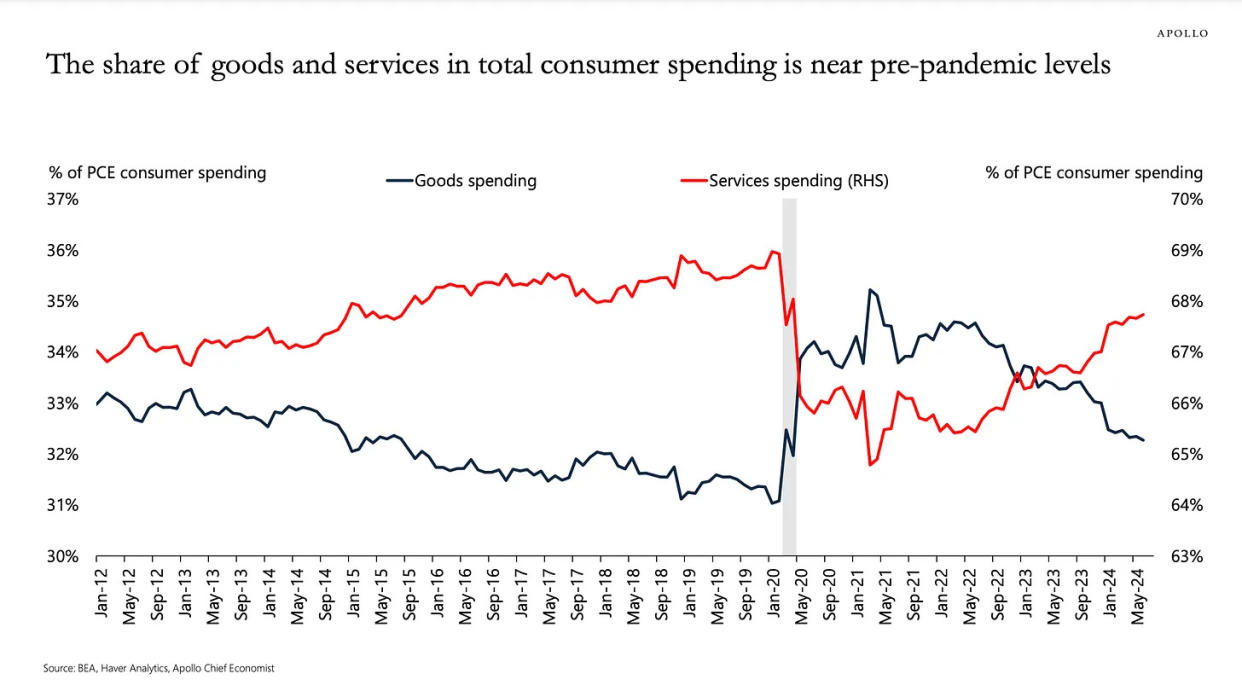

🛍️ Spending behavior is normalizing. From Apollo’s Torsten Slok: “During the pandemic, households increased spending on goods because they were shopping online, and services spending was lowered because they couldn’t go to restaurants and travel. The chart below shows that consumers have significantly increased spending on services over the past two years, and the current share at 68% is now close to pre-pandemic levels. The bottom line is that we are getting to the end of the catch-up effect for companies in the consumer services industry.“

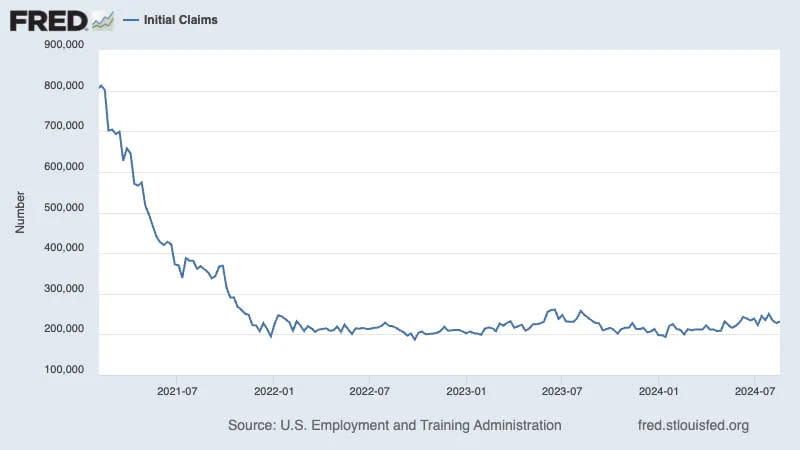

💼 Unemployment claims ticked higher. Initial claims for unemployment benefits rose to 232,000 during the week ending August 17, up from 228,000 the week prior. While this metric continues to be at levels historically associated with economic growth, recent prints have been trending higher.

For more on the labor market, read:The labor market is cooling 💼

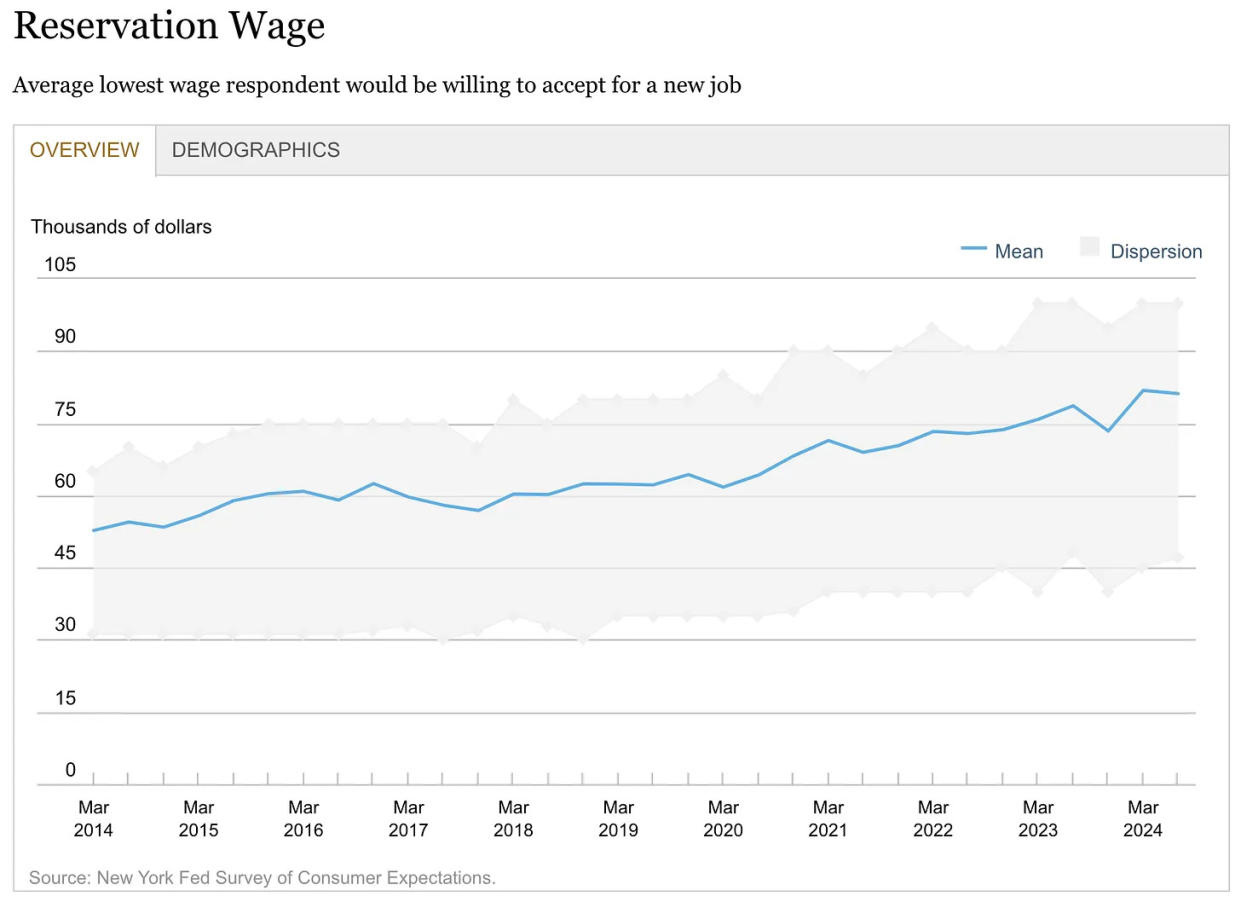

💵 People want more money to change jobs. From the New York Fed’s July SCE Labor Market Survey: “The average reservation wage—the lowest wage respondents would be willing to accept for a new job—increased to $81,147 from $78,645 in July 2023, though it is down slightly from a series high of $81,822 in March 2024.“

For more on why wages matter right now, read:Revisiting the key chart to watch amid the Fed's war on inflation 📈

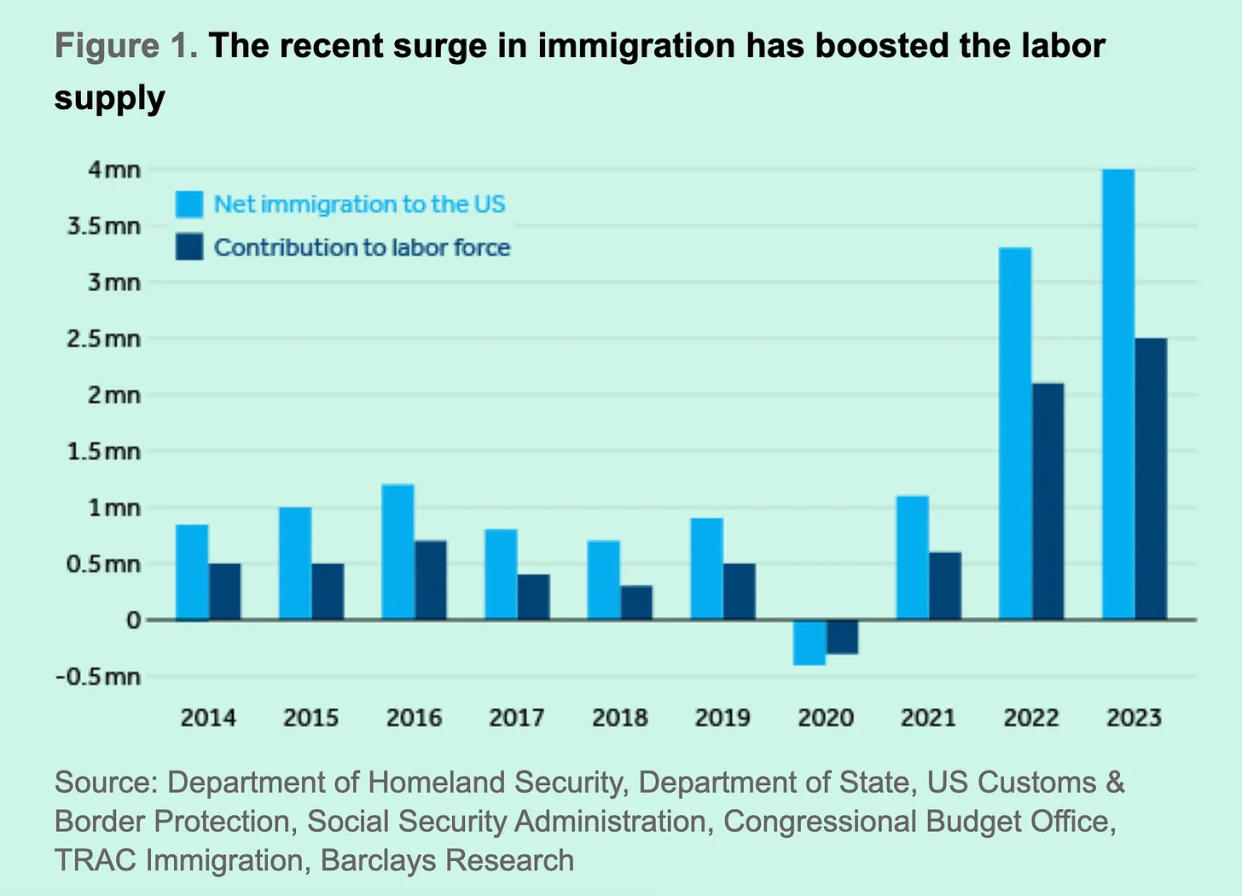

🌎 Immigration has helped boost growth. From Barclays: “Almost half a million people immigrated into the US in December, a record that was just the latest in a series of elevated inflows stretching back to spring 2022. While the surge has caused a public backlash and prompted political measures to curtail it, immigration has helped boost economic growth. It has helped relieve post-pandemic labor shortages and has been one of the factors behind the strength of the US economy. … Immigrants likely contributed nearly a third of economic growth. We estimate that new immigrants accounted for three quarters of the increase in private payroll employment over the past year. Their contribution of additional hours worked to output growth more than offset a drag from US-born workers.“

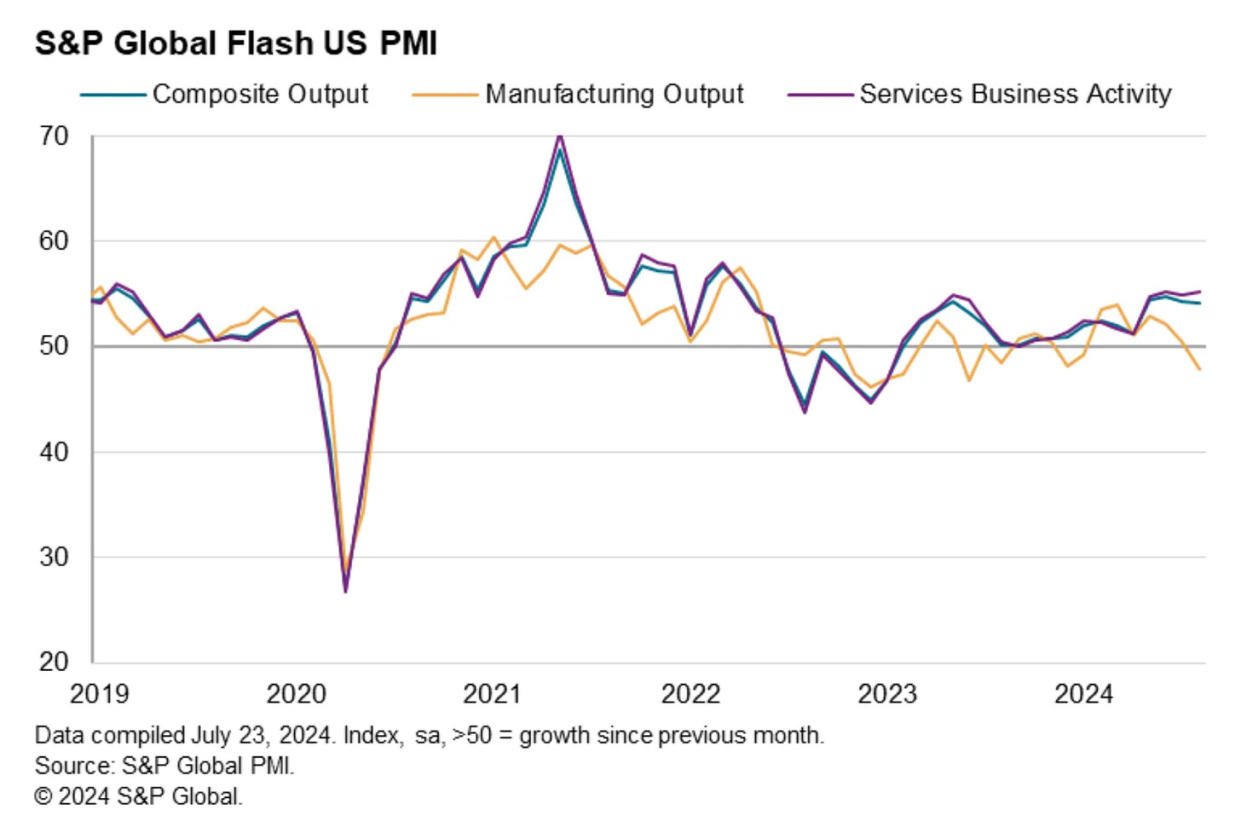

🐢 Survey signals growth, but cooling growth. From S&P Global’s August Flash U.S. PMI: “The solid growth picture in August points to robust GDP growth in excess of 2% annualized in the third quarter, which should help allay near-term recession fears. Similarly, the fall in selling price inflation to a level close to the pre-pandemic average signals a ‘normalization’ of inflation and adds to the case for lower interest rates.”

Keep in mind that during times of perceived stress, soft data tends to be more exaggerated than actual hard data.

For more on this, read:What businesses do > what businesses say 🙊

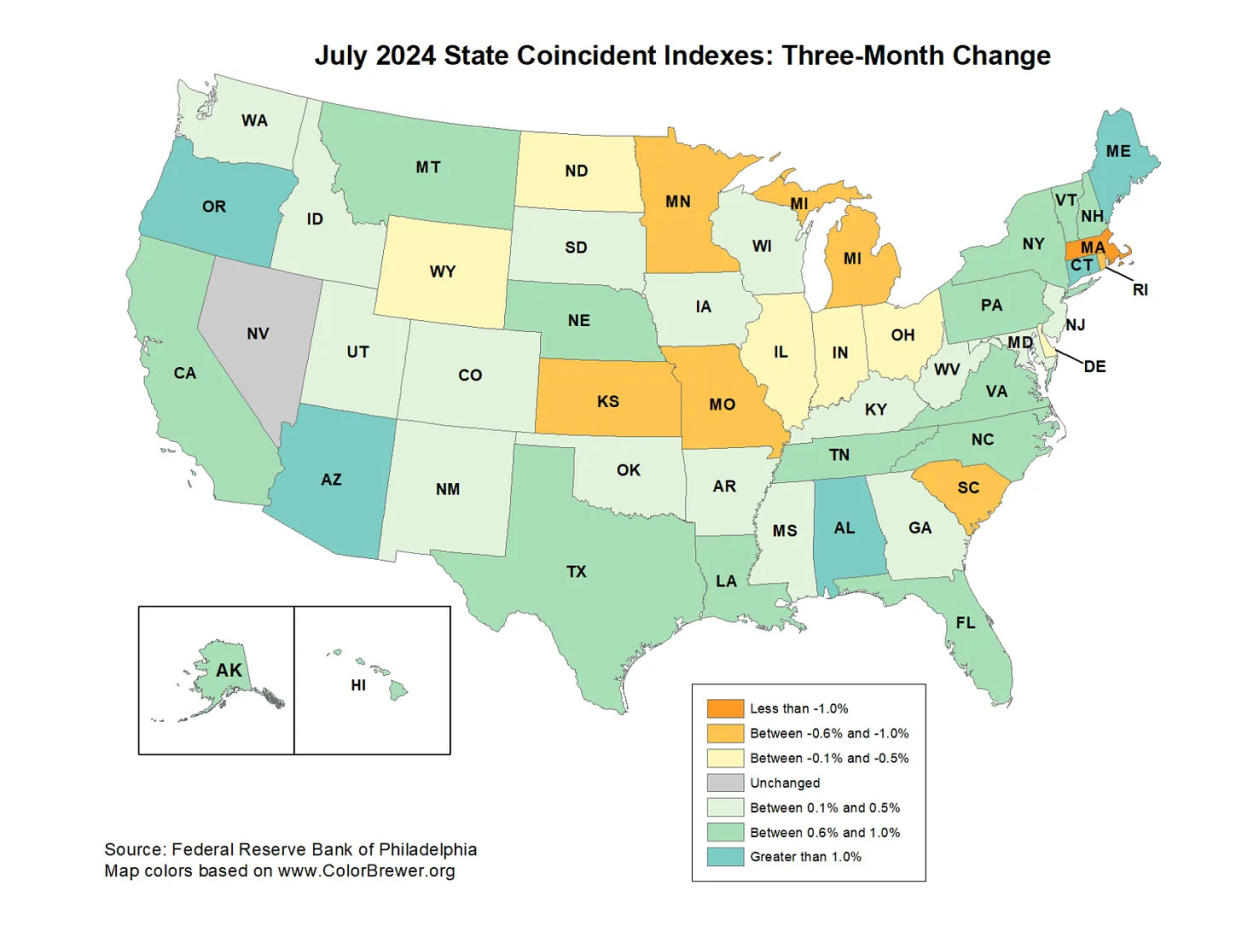

🇺🇸 Most U.S. states are still growing. From the Philly Fed’s July State Coincident Indexes report: "Over the past three months, the indexes increased in 36 states, decreased in 13 states, and remained stable in one, for a three-month diffusion index of 46. Additionally, in the past month, the indexes increased in 26 states, decreased in 17 states, and remained stable in seven, for a one-month diffusion index of 18.”

For more on economic growth, read:Economic growth: Slowdown, recession, or something else? 🇺🇸

Putting it all together 🤔

We continue to get evidence that we are experiencing a bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

This comes as the Federal Reserve continues to employ very tight monetary policy in its ongoing effort to get inflation under control. Though, with inflation rates having come down significantly from their 2022 highs, the Fed has taken a less hawkish tone in recent months, even signaling that rate cuts could come later this year.

It would take a number of rate cuts before we’d characterize monetary policy as being loose, which means we should be prepared for relatively tight financial conditions (e.g., higher interest rates, tighter lending standards, and lower stock valuations) to linger. All this means monetary policy will be relatively unfriendly to markets for the time being, and the risk the economy slips into a recession will be relatively elevated.

At the same time, we also know that stocks are discounting mechanisms — meaning that prices will have bottomed before the Fed signals a major dovish turn in monetary policy.

Also, it’s important to remember that while recession risks may be elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs, and those with jobs are getting raises.

Similarly, business finances are healthy as many corporations locked in low interest rates on their debt in recent years. Even as the threat of higher debt servicing costs looms, elevated profit margins give corporations room to absorb higher costs.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have recently had some bumpy years, the long-run outlook for stocks remains positive.

For more on how the macro story is evolving, check out the the previous TKer macro crosscurrents »

A version of this post was published on Tker.co. Subscribe here.