Here's Why Taiwan Semiconductor Is a Screaming Buy After Its Recent Pullback

Sometimes the market misprices a stock and investors need to take advantage of it before the market corrects itself. Taiwan Semiconductor (NYSE: TSM) falls under this category right now, as it's down around 12% from its all-time high despite reporting incredible results.

Before investors rush in to take advantage of the mispricing, it's wise to understand how it got that way in the first place. After knowing why TSMC experienced the drop, it'll be obvious why the 12% discount is a buying opportunity.

Taiwan Semiconductor's results exceeded expectations

Taiwan Semiconductor, or TSMC, is the leading contract semiconductor manufacturing facility. Essentially, it has the technology and resources to produce the world's smallest and most powerful chips. Its clients, including Apple and Nvidia, design their chips and then give those designs to TSMC to manufacture. This places TSMC in an excellent position, as it's just a fabricator that sometimes produces chips for two competing companies.

Because of TSMC's superior technology compared to other chip manufacturers, it's the go-to partner for nearly every company with cutting-edge technology. This was apparent in its second-quarter results, as it reported a blowout quarter.

Heading into the quarter, management expected between $19.6 billion and $20.4 billion based on a U.S. exchange rate of $1 to 32.3 New Taiwan (NT) dollars. While the exchange rate projection turned out to be true, TSMC blew the top end off expectations, delivering $20.8 billion in revenue. This resulted in a 33% growth (in U.S. dollars) over last year's results. In NT dollars, the results were even better, as revenue rose 40%.

Management noted in its conference call that it observed strong artificial intelligence (AI) and smartphone demand compared to last quarter. That's a great sign for investors, as the smartphone market has been weak and made up about a third of Q2 revenue.

TSMC also maintained its strong profit margin, turning 37% of every dollar of revenue into profits.

So why are TSMC shares off their high if it's doing so well?

The stock drop is tied to the U.S. presidential election

A couple of days before TSMC reported these fantastic results, former U.S. president and current Republican nominee Donald Trump commented that Taiwan should pay the U.S. for defense and that it took "about 100 percent of [U.S.] chip business".This spooked some investors and caused shares to slide about 8% the following day.

The stock still hasn't recovered from those losses, which is the investor's prime buying opportunity.

While Trump may be right that Taiwan supplies a huge chunk of semiconductors to the U.S., TSMC management quickly pointed out that they are working on moving some of that capability back to U.S. soil with its plant in Arizona.

Regardless, this isn't a great reason to panic. TSMC is a vital company for every American, as so many devices rely on TSMC-produced chips.

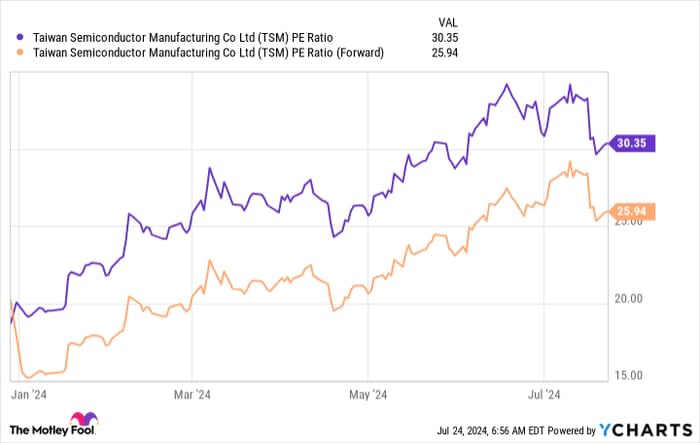

With the pullback, TSMC trades for about 26 times forward earnings.

TSM PE Ratio data by YCharts. PE = price-to-earnings.

While this isn't as cheap as you could have gotten it at the start of the year, TSMC is a vital company for nearly every technological device. As AI proliferation occurs and more chips are needed to power smartphones, data centers, or cars, Taiwan Semi will be a primary benefactor.

The stock carries a significant geopolitical risk. Still, the benefits of owning it far outweigh the risks, which is why this pullback is a premier buying opportunity for long-term investors.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $692,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

Keithen Drury has positions in Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.