Inflation returns to target, but experts warn June rate cut ‘off the table’

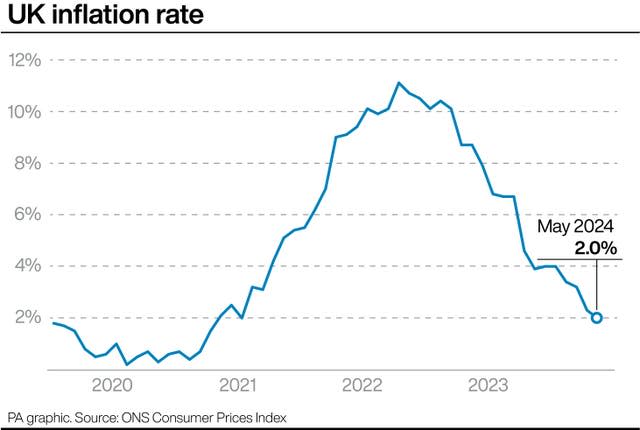

The Prime Minister has hailed inflation falling back to target as “great news” as official figures showed a return to 2% for the first time in almost three years.

The Office for National Statistics (ONS) said Consumer Prices Index (CPI) inflation fell to 2% in May, down from 2.3% in April.

Rishi Sunak insisted the milestone shows the economy has “turned the corner”, ending nearly three years of above-target inflation.

But experts said that, despite the symbolic importance of inflation returning to target, the Bank of England is still set to hold fire on any interest rate cuts until after the General Election on July 4

Mr Sunak said: “Great news this morning that inflation is back to normal at 2%. That’s lower than Germany, France and America.

“When I became Prime Minister, inflation was at 11%. But we took bold action. We stuck to a clear plan, and that’s why the economy has now turned a corner.”

CPI was last recorded at 2% in July 2021, before shooting up amid the cost-of-living crisis, at one stage reaching a 40-year high of 11.1% in October 2022.

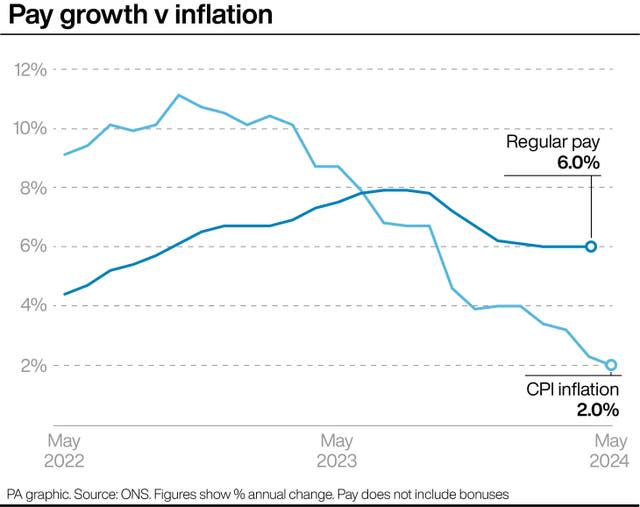

The latest fall means that prices are still rising across the country, but at a much slower rate than in recent years when households and businesses were being squeezed during the cost crunch.

The data comes at a crucial time, less than three weeks before polling day and as the political parties home in on economic pledges in their manifestos.

It will also be watched closely ahead of the Bank’s next interest rate decision on Thursday.

Economists dashed household hopes of a cut this month, with some warning that a reduction may not come until the autumn because prices are still rising at a fast pace in the services sector.

Chancellor Jeremy Hunt said he hopes the Bank will now cut interest rates so mortgage costs can come down.

“A year-and-a-half ago, the Bank of England predicted the longest recession in 100 years,” he told broadcasters.

“Instead, we have had a soft landing, with inflation that was higher than nearly any other major economy now lower than nearly all our major competitors.

“Now we have inflation down, taxes starting to come down and, hopefully soon, mortgages coming down as well.”

The main parties seized on the figures to make political points, with Mr Sunak warning that inflation could rise again if Labour wins the General Election.

He said: “Let’s not put all that progress at risk with Labour.

“All they would do is spend a load of money, push up inflation and cost every working family £2,000 in higher taxes.”

Labour has rejected the Tory claim that it is planning £2,000 of tax rises.

Shadow chancellor Rachel Reeves said: “After 14 years of economic chaos under the Conservatives, working people are worse off.

“Prices have risen in the shops, mortgage bills are higher and taxes are at a 70-year high.”

Liberal Democrat Treasury spokeswoman Sarah Olney said: “The hard truth is that millions of people won’t be feeling any better off today.”

Experts said that, despite the milestone for inflation, there is still work to do in bringing down prices throughout the economy.

The Bank is keeping a watchful eye on inflation in the services sector, which fell from 5.9% to 5.7% in May, but this was above forecasts as it remains stubbornly high.

It is one of the factors that has been partly responsible for staying the Bank’s hand in bringing rates down from their 16-year high of 5.25%.

Suren Thiru, economics director at Institute of Chartered Accountants in England and Wales (ICAEW), said: “Despite this landmark fall in inflation, concerns over both underlying price pressures and changing policy in the run-up to a General Election means a June interest rate cut is almost certainly off the table.”

Robert Wood, at Pantheon Macroeconomics, said higher services inflation could mean a rate cut is now pushed back until September.

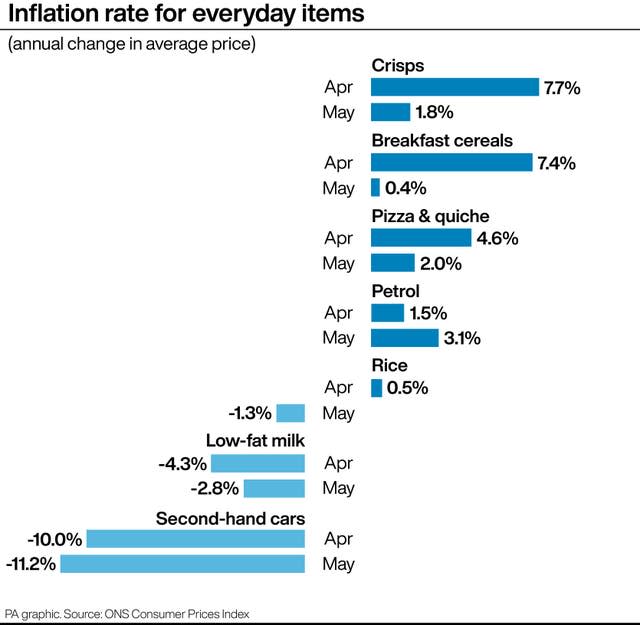

The ONS said food inflation fell back to 1.6% – the lowest since October 2021 – which was the biggest factor in pulling the overall level of CPI inflation lower.

At one stage food inflation reached nearly 20% – at 19.6% – in March last year, but has been steadily easing back since then.

However, last month saw prices rise at the petrol pumps, while air fares also lifted, according to the ONS.

The average price of petrol rose by 0.7p per litre between April and May to stand at 148.8p per litre.

The latest data also showed the CPI measure of inflation including housing costs (CPIH) fell to 2.8% in May from 3% in April, while the Retail Prices Index (RPI) fell back to 3% from 3.3%.