Microsoft and Nvidia are now the world’s most valuable companies. How Intel—once the top chipmaker—blew its shot to be one of them

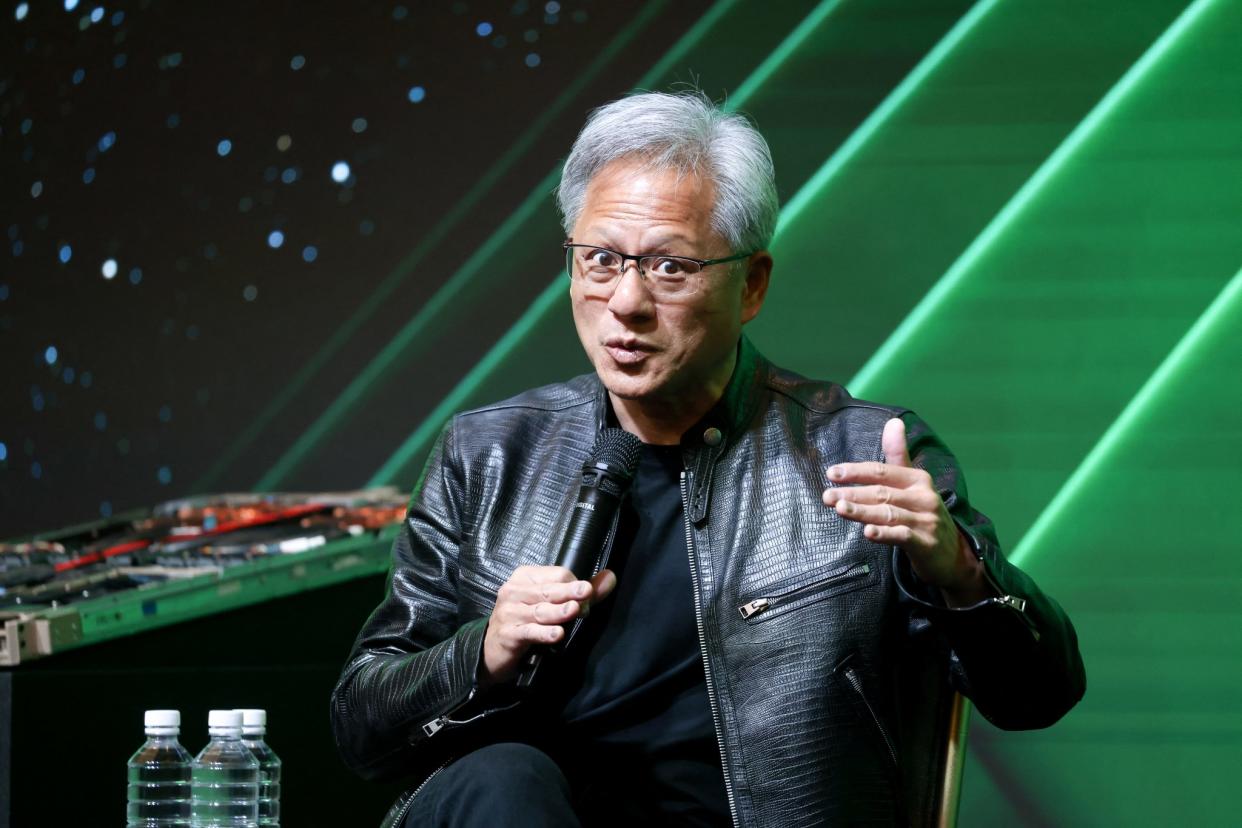

In the annals of business success stories few saw coming, Nvidia’s incredible rise to surpass Microsoft and become the world’s most valuable company is one for the books. This past week Nvidia, cofounded by Jensen Huang, edged out Microsoft as its market cap soared to $3.42 trillion. Yet it could have been otherwise. As business leaders marvel at Nvidia’s rise, it’s worth remembering that another company—Intel—came tantalizingly close to being where Nvidia is now.

Instead, Intel is waging a heroic effort to regain its place as the world’s preeminent maker of leading edge chips. The story of how it lost that position is part of a recent Fortune case study.

As detailed in the piece, a key moment occurred in the mid-2000s, when Paul Otellini, then CEO of Intel, said a word to Steve Jobs he almost never heard: No.

It was 2006, and Intel, the global king of computer chips, was bringing in record revenue and profits by dominating the kinds of chips in hottest demand—for personal computers and data centers. Now Jobs wanted Intel to make a different type of chip for a product that didn’t even exist, which would be called the iPhone.

Otellini knew chips for phones and tablets were the next big thing, but Intel had to devote substantial capital and its best minds to the fabulously profitable business it already possessed. Besides, “no one knew what the iPhone would do,” he told The Atlantic seven years later, just before he stepped down as CEO. “There was a chip that they were interested in, that they wanted to pay a certain price for and not a nickel more, and that price was below our forecasted cost. I couldn’t see it.”

Otellini, who died in 2017, was a highly successful CEO by many measures. But if that decision had gone the other way, Intel might have become a chip titan of the post-PC era. Instead, it gave up on phone chips in 2016 after losing billions trying to become a significant player. As he left the company, Otellini seemed to grasp the magnitude of his decision: “The world would have been a lot different if we’d done it.”

Meantime, some 800 miles north, in Seattle, Microsoft was struggling to find its role in a tech world dominated by the internet, mobile devices, social media, and search. Investors were not impressed by its efforts. No one could have foreseen that years later, a few key decisions would set the company up as an AI powerhouse and send its stock soaring.

There was a time not so long ago that Microsoft and Intel were both atop the tech world. They were neither competitors nor significant customers of each other, but what New York University’s Adam Brandenburger and Yale’s Barry Nalebuff deemed “complementors.” Microsoft built its hugely profitable Windows operating system over the years to work on computers that used Intel’s chips, and Intel designed new chips to run Windows (hence “Wintel”). The system fueled the leading tech product of the 1990s, the personal computer. Microsoft’s Bill Gates became a celebrity wonk billionaire, and Intel CEO Andy Grove was Time’s 1997 Man of the Year.

Snubbing Steve Jobs wasn’t the only cause of Intel’s decline, but it was a significant one. Intel also tried and failed to develop a GPU (graphics processing unit), which turned out to be the type of chip used in AI development and that Nvidia designs. What if Intel had succeeded? It was the world’s sixth most valuable company in 2000 and the largest maker of semiconductors; today it’s No. 69 by value and No. 2 in semiconductors by revenue, far behind No. 1 TSMC (and in some years also behind Samsung).

A Fortune 500 CEO makes thousands of decisions in a career, a few of which will turn out to be momentous. What’s easy to explain in hindsight—that Microsoft would be at the forefront of AI, that Google would become a behemoth, that Blockbuster would fade into obscurity—is never preordained. Often the fateful decisions are identifiable only in retrospect. Nothing more vividly illustrates this than the parallel stories of Microsoft and Intel, and the failures at the latter that cleared the way for the moonshot rise of Nvidia. The case study of what went right and wrong at these giant corporations offers a master class in business strategy not just for today’s front-runners at the likes of Nvidia, Google, Open AI, Amazon, and elsewhere—but also for any Fortune 500 leader hoping to survive and thrive in the coming decade.

You can read the full case study here.

This story was originally featured on Fortune.com