Junior Achievement simulation; empowers 8th graders with finances

MILWAUKEE - Gucciano Dastoli is not a parent. He’s not a data warehousing specialist either. But he’s boasting about some big numbers because of his "job."

"My gross monthly income is $5,768. My credit score is 760," Dastoli said.

Like dozens of his classmates, he’s pretending to be all these things as part of a social and economic lesson at Junior Achievement of Wisconsin’s Finance Park. "If I do a little bit of saving I’ll be able to get where I want to be," he said.

"It really takes you through the life cycle of what it takes to be an adult and to learn how to manage your own money," said Junior Achievement of Wisconsin President Julie Granger.

Every year, 15,000 students visit from throughout the metro-Milwaukee area. The kids are generally years away from having to implement these skills in their real lives.

"I think this is really a sweet spot for kids," said Granger. "They can learn these concepts just before they might put them into action, for example, in that first job."

Granger says the organization’s mission is to prepare and inspire the next generation through entrepreneurship, career readiness and financial literacy.

"They could be an engineer making $100,000 and be single. Or be married and a construction worker with three children making $40,000 a year. It’s in that context they are really walking through all of the bills they need to pay," she said.

The kids move from storefront to storefront, budgeting for things like groceries, utilities and savings.

"They have the opportunity to maybe fail here before having to do that out in the real world," said Junior Achievement employee Tyree Roberts.

Roberts helps navigate the students through each space. By the time kids get to Finance Park, they’ve already completed a 13-week personal finance course in the classroom. Roberts says the exercise also helps students develop empathy.

"The biggest eye-opener is finding out how expensive things are," Roberts said. "They’re researching and budgeting, and that budget may not be enough for shopping groceries and child care."

"The whole idea behind setting a budget is to be honest and candid with yourself, right?" asks volunteer Bob Landwehr.

15 volunteers are needed every day to make Finance Park come alive. Students learn one-on-one from professionals, like Landwehr, who is a retired GE HealthCare HR manager.

"When you talk to people my age and other people and say, ‘I’m going to go teach financial literacy – wow. Why didn’t I have that class?’ They can rattle off two or three other classes they don’t think they got a lot of value out of. ‘Boy, if I had a class in financial literacy, that would have been super helpful,’" said Landwehr.

Landwehr helps students think about the future and the reality of things like child care costs.

"I’ve got a nephew, and I think he’s paying about $3,000 a month [in child care] for his three kids," he said.

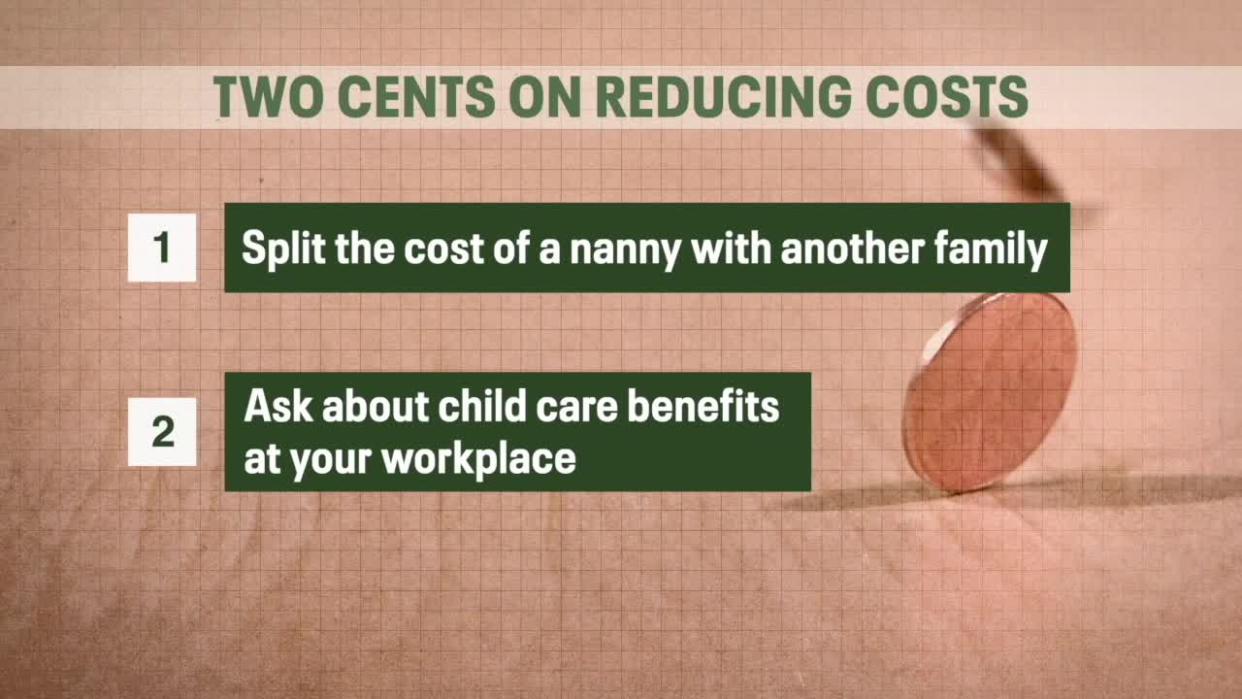

With fewer options since before the pandemic and the cost of child care rising faster than inflation, U.S. Bank offers some tips for all of us:

Split the cost of a nanny with another family. Try looking into a babysitting co-op.

Ask about child care benefits at your work. There are tax breaks and flexible spending accounts that can help.

That’s just one of many scenarios at Finance Park.

"For example, they’ll visit UWM, and they have to think about, depending on the career I want, do I need that college degree? And what does that tuition look like?" said Granger. "They visit the bank. They understand how important it is to save for the future."

It all helps reinforce life-skills that will soon be put to the test for all these eighth graders.

"Budgeting is important and saving is important," said Dastoli. "Not just blowing your money on stupid stuff."