Nvidia, Microsoft, or Apple: Which $3 Trillion-Dollar Stock Is the Better Artificial Intelligence (AI) Play?

While the current buzzword for the hottest tech stocks might be the "Magnificent Seven," that could soon turn into the Terrific Three.

Nvidia (NASDAQ: NVDA), Microsoft (NASDAQ: MSFT), and Apple (NASDAQ: AAPL) have put a considerable amount of daylight between themselves and the remainder of the Magnificent Seven, which includes Alphabet, Amazon, Meta Platforms, and Tesla.

Nvidia, Microsoft, and Apple all have market caps in the range of $3 trillion, and all are among the leaders in the AI revolution in different ways.

Nvidia is the leading chipmaker, building the AI infrastructure that is powering new large language models and applications like ChatGPT. More than any other company, Nvidia has defined the current AI era, and its stock has been the biggest gainer based on market cap.

Microsoft has established itself as a leader in AI applications thanks to its partnership with OpenAI. Microsoft has invested an estimated $13 billion in the ChatGPT maker, and it has forged a close partnership with OpenAI, which has allowed it to deploy ChatGPT across a wide range of products, including Azure, its Office suite, GitHub, and Bing, and the AI-based Copilot, as well as other AI tools already driving meaningful growth for Microsoft.

Finally, Apple has been somewhat late to the AI party, but the iPhone maker can't be ignored when it comes to a new technology like AI. That's because Apple has an installed base of active devices of 2.2 billion, meaning that it controls the connectivity to AI for billions of users. Apple is also releasing Apple Intelligence, a suite of AI tools like a writing assistant, which is expected to be available to consumers shortly.

Image source: Getty Images.

How Microsoft, Nvidia, and Apple stack up against each other

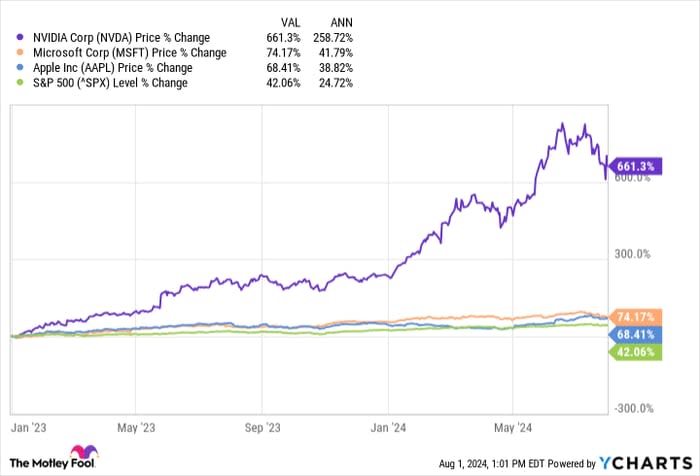

As the descriptions show, all three of these companies have their own strengths in AI, and all three stocks have outperformed the S&P 500 in the AI era. However, Nvidia has been the clear winner during that time, as the chart below shows.

Nvidia is also the most expensive stock of the three based on its trailing price-to-earnings ratio, which is currently 65, compared to Microsoft at 37 and Apple at 33.

However, Nvidia is also the fastest-growing of the three stocks and is expected to grow revenue by 98% this year, compared to Microsoft at 16% and Apple at 8%.

Because of that, Nvidia' forward P/E is much lower, at just 40, bringing it more in line with that of Microsoft and Apple.

Which is the best AI play?

Of the three stocks, Nvidia's future is the most closely tied to AI. Its revenue more than tripled over its last four quarters as it's become the de facto supplier of GPUs and other components needed for AI infrastructure.

Nvidia's also moving fast to release new products and stay on the cutting edge of AI and ahead of the competition. The company just announced a suite of services and computing platforms to help build the next generation of humanoid robots.

Additionally, the company recently launched its new Blackwell platform, which can process trillion-parameter large language models at as much as 25 times less cost and energy than Nvidia's previous Hopper architecture.

Nvidia has executed nearly perfectly since the beginning of the generative AI era, and the company looks like a good bet to continue to dominate the market for AI hardware.

While Microsoft and Apple both have their own strengths in AI, they don't have the same level of exposure to AI that Nvidia does, and they haven't demonstrated the same ability to develop new AI technology.

If you're bullish on AI, Nvidia looks like the best stock of the three to own today.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $657,306!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Jeremy Bowman has positions in Amazon and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.