Will Nvidia Be Worth More Than Apple by 2025?

It's been nearly impossible to escape coverage on Nvidia (NASDAQ: NVDA) over the last year, as its stock has been on a historic bull run, soaring 762% since the start of 2023. The chipmaker's rise dwarfed the growth of many of the most prominent tech companies, including Apple (NASDAQ: AAPL), which saw its stock increase by 80% in the same period.

The disparity between the companies' stock growth is significant, considering Apple is the world's most valuable company with a market cap of $3.5 trillion. Nvidia's rally has seen it become the first chipmaker to achieve a market cap above $3 trillion, putting it third on the list of most valuable companies (after Microsoft, which is in second).

Nvidia's swift rise saw it temporarily overtake Apple in market cap earlier this year, but it didn't last. However, the chipmaker's consistent ability to outpace Apple in growth suggests it's a matter of when, not if, Nvidia will one day be worth more than Apple. Meanwhile, the company's dominance in the chip market and lead over its competitors indicates that day might not be very far away.

So, will Nvidia be worth more than Apple by 2025? Let's assess.

Nvidia is in a far better financial position than its rivals

Nvidia's recent rally was primarily driven by its dominance in artificial intelligence (AI). The company's graphics processing units (GPUs) are the preferred hardware for developers worldwide, with Nvidia now responsible for an estimated 70% to 95% of the AI chip market.

The company's success in the industry has seen its earnings skyrocket over the last year, even while rivals like Advanced Micro Devices and Intel launched competing products.

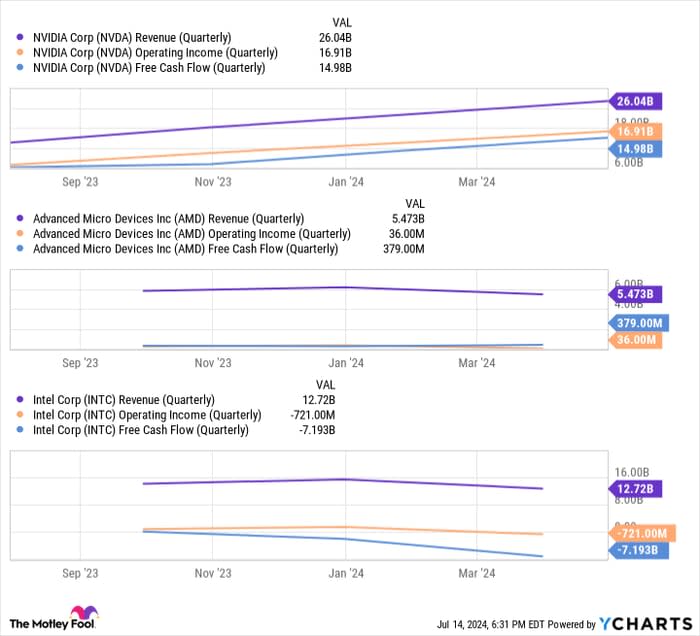

Data by YCharts

Nvidia has taken a massive financial leap Nvidia over its competitors in the last 12 months, with far more revenue, operating income, and free cash flow. The figures suggest Nvidia is far better equipped than AMD and Intel to continue reinvesting in its technology and stay ahead in AI.

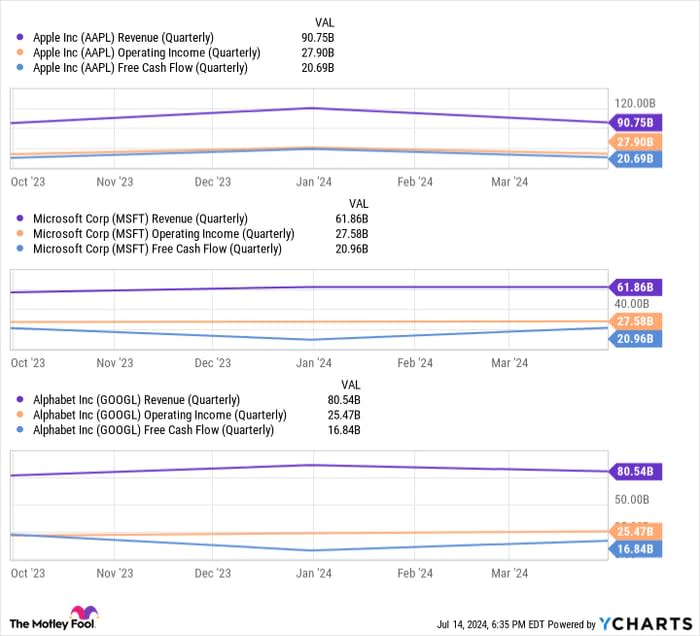

Comparatively, Apple's AI competitors are in similar financial positions to the iPhone maker. Microsoft and Alphabet are investing heavily in the generative technology, even pulling ahead of Apple since the start of 2023, and have the financial resources to do so. As a result, Apple will likely continue to face fiercer competition in AI than Nvidia, which could mean slower earnings and stock growth as it develops in the sector.

Data by YCharts

Additionally, Nvidia's more established position in AI means it's already enjoying major gains from selling its hardware to the industry. At the same time, it remains to be seen if Apple will, in fact, attract consumers to the soon-to-be-launched AI features in its iPhones, Macs, and iPads.

Market trends suggest it'll be challenging for rivals to overcome Nvidia

Past chip trends indicate it will be an uphill battle for Nvidia's competitors to chip away at its leading market share in AI. For instance, Nvidia's share of the discrete desktop GPU market has grown from 65% in 2014 to 88% this year. The company's position has risen despite AMD's investment in the sector, with AMD's share falling from 35% to 12% in the same period.

A similar example has occurred with central processing units (CPUs). Since 2017, AMD's CPU market share has risen from 18% to 33%. While Intel's position in the industry has declined since then, it has held onto its majority market share, which was 64% as of the first quarter of 2024.

Historical trends in the chip market show that once a company takes a dominant position, it can be nearly impossible for a competitor to steal the top spot. As a result, Nvidia will likely retain its dominance in AI GPUs for years, especially as it continues widening the financial gap to its peers.

Meanwhile, in the first six weeks of 2024, Apple's iPhone sales tumbled 24% in China, while domestic rival Huawei's smartphone sales soared 64%. Apple has responded to the market shift by introducing heavy discounts on its iPhones. However, the situation suggests Apple's dominance in some regions could be more fickle than previously thought.

Nvidia's business has exploded since the start of 2023 and has shown no signs of slowing. Apple has delivered solid stock growth more recently, hitting a new high in its share price this year. However, Nvidia's lead in AI and more extensive financial resources than its competitors indicate it could surpass Apple in 2025.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $774,281!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Apple, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.