Nvidia's Stock Split Happened 2 Weeks Ago. Is It Too Late to Buy?

The artificial intelligence steam train that is Nvidia (NASDAQ: NVDA) finally overtook Apple and Microsoft to become the most valuable company on the planet by market capitalization. This comes on the heels of the company's 10-for-1 stock split earlier this month. Investors saw the number of their shares multiplied by 10, while the share price became a tenth of where it was before.

A split like this is somewhat cosmetic in that it doesn't change the value of people's investments directly. But there's often an indirect effect. In Nvidia's case, more people who don't have access to fractional trades can now afford shares who couldn't before when they were trading around $1,200. The lower stock price also makes options trading more accessible.

This brings new money into the market and can bump up the price, which did indeed happen.

The stock is up about 12% since the split, giving Nvidia enough steam to take the No. 1 spot. So, if it's already the most valuable company in the world, is it too late to get in? Let's consider.

Nvidia can't seem to stop making money

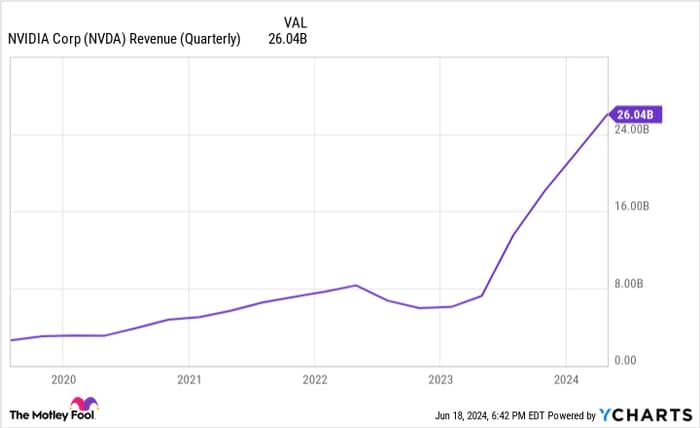

The company delivered incredible revenue growth quarter after quarter for years with only a slight decline during the market downturn in 2022. The growth in quarterly revenue has an inflection point in 2023 -- that's when the company's AI business really took off.

NVDA revenue (quarterly) data by YCharts.

This growth looks to continue for the foreseeable future. The company expects $28 billion in revenue this quarter, almost a $2 billion bump from last quarter.

To say CEO Jensen Huang is optimistic would be an understatement. "The next industrial revolution has begun ... AI will bring significant productivity gains to nearly every industry," Huang said.

Now, take this with a pretty massive grain of salt. CEOs, especially tech CEOs, are prone to making some pretty big claims that they can't always back up. But Huang's ability to captain Nvidia to where it is today speaks to his vision.

A word of caution: The competition is heating up

You don't get to be the most valuable company in the world without others gunning for your position. Several companies are spending liberally to try to catch up with the AI pioneer.

Advanced Micro Devices is probably the single company with the best shot of replicating Nvidia's chip power at scale. It spent $1.5 billion last quarter on research and development. And although it released some pretty impressive technology, it hasn't yet matched Nvidia.

And here's the kicker: For every dollar AMD spent last quarter on R&D trying to catch up, Nvidia spent two shoring up its pole position.

OK, but don't forget about valuation

But while Nvidia can defend itself against AMD and continue delivering the growth that it has, there is a ton of hype around it. That could mean it's overvalued. If you look at the company's price-to-earnings (P/E) ratio, that might look to be the case.

Nvidia has a P/E of 79.4. That's pretty high. What about the two companies it just surpassed? Microsoft and Apple have a P/E of 38.7 and 33.3, respectively.

While that might give you reason to pause, it's not really the most accurate picture. The earnings considered in the P/E ratio are for the trailing 12 months. Nvidia is still in high-growth mode; Apple and Microsoft are growing but are in a more stable position.

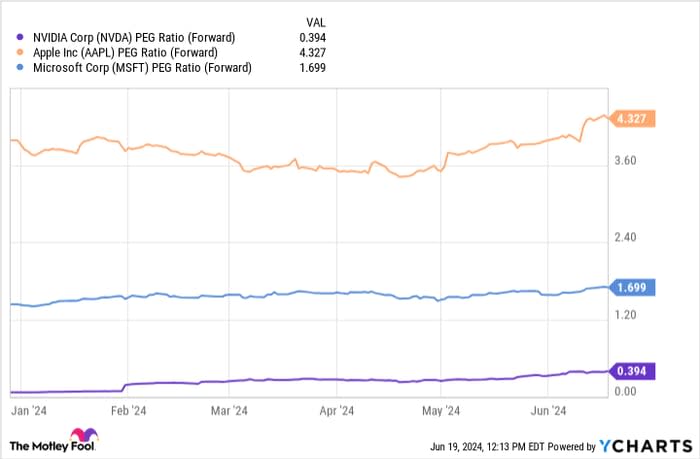

A different metric, the forward price/earnings-to-growth (PEG) ratio, is a better choice here. This is its current price compared to its (expected) growth rate over the next year. Here, Nvidia looks much more reasonably priced -- better even than Apple and Microsoft. Take a look at this chart showing the different ratios.

NVDA PEG Ratio (Forward) data by YCharts

Nvidia might be trading at a premium today, but I still believe it's justified given reasonable expectations of the company's growth. But keep an eye on whether the company delivers on the promised growth.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $801,365!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.