‘You people are broke!’: Missouri couple has ‘monster’ debt of $240K but can’t let go of the ‘family car’ to improve finances. Dave Ramsey is furious

As of mid-2024, the average debt per household in America is $104,215 — including mortgages — according to data from Experian and the New York Federal Reserve Bank. John from St. Louis, Missouri is carrying more than double that amount excluding his mortgage.

On a recent episode of The Ramsey Show, John told the co-hosts his total consumer debt balance was $240,500, spread across various credit cards, two auto loans, a HELOC, a student loan and a 401(k) loan.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

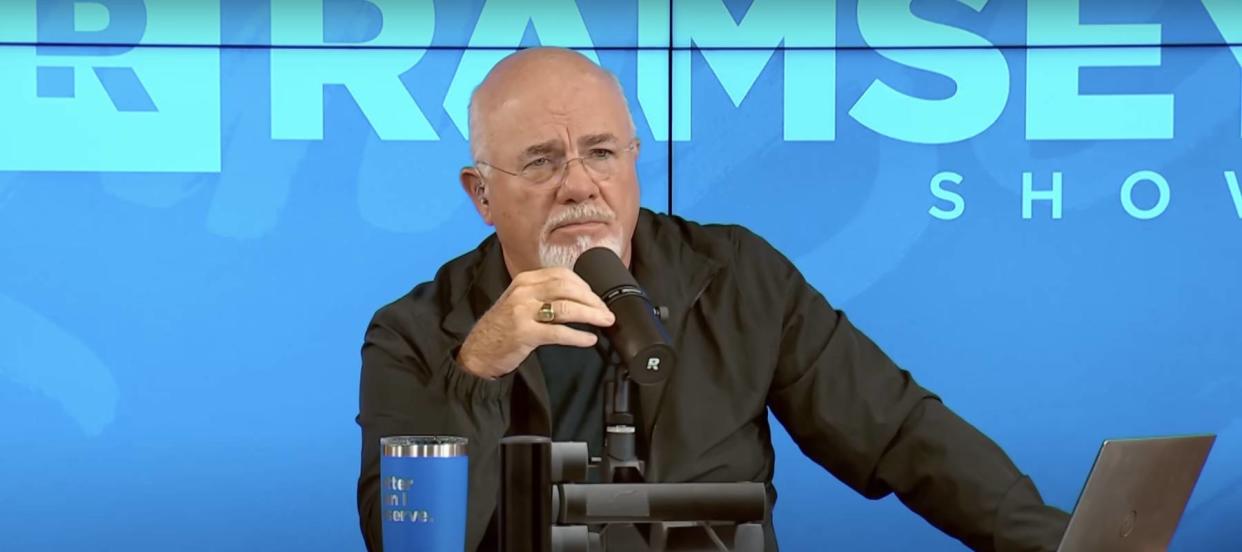

“You’ve never met a debt you didn’t like,” Dave Ramsey said. “You people are broke!”

To tackle this “monster” debt burden, Ramsey told John to make big lifestyle changes. However, his reluctance highlights why so many American families struggle to get out of debt even when they know it’s a problem.

Reluctant to get rid of the family car

The couple’s debt binge has been enabled by a relatively robust income of $151,600 before taxes.

A solid income doesn’t guarantee financial stability. Nearly 48% of Americans earning more than $100,000 said they were living paycheck-to-paycheck, according to a recent PYMNTS report. In fact, more than a third of Americans (36%) earning more than $200,000 said the same.

Record-high debt coupled with elevated interest rates could be driving this trend. John’s struggles are primarily related to servicing his “monster” debt burden.

John’s car has an outstanding auto loan balance of $28,700 while his wife owes $21,000 on her vehicle. Together, this accounts for roughly a fifth of the family’s total debt burden, which is why co-host Jade Warshaw recommends selling at least one of the cars to reduce it.

However, John was reluctant to let go of the family car.

“I don’t really care if it’s the family car, you people are broke!” Ramsey said, exasperated. “You're starving to death making $150,000 a year. You don't get to say it's the family car. You get to say everything's on the table, we're selling so much stuff the kids think they're next.”

America’s stubborn car culture is reflected in auto loan data. At $1.63 trillion, auto loans outstanding at the end of the second quarter of 2024 accounted for the largest source of non-housing debt on households’ balance sheets. Nearly one in four Americans who purchased a new car in Q2 2024 were in debt on the loan on their trade-in vehicle by an average of $6,255, according to Edmunds.

Even if John overcomes the mental barrier and trades in his car, the rest of the family’s debt burden is likely to be just as difficult to tackle.

Read more: Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here's how you can save yourself as much as $820 annually in minutes (it's 100% free)

Cold turkey

Dave Ramsey compared John’s debt addiction to alcohol abuse. To overcome it, Ramsey said the family needs to go “cold turkey,” referring to the abrupt cessation technique some addicts use.

“No use of plastic is going to be OK in your house,” Ramsey said. “You guys have to go cold turkey. You don't walk around with a flask in your back pocket if you're trying to quit drinking.”

This addiction is so common that a group launched the Fellowship of Debtors Anonymous, inspired by Alcoholics Anonymous, in 1968. Today, the group organizes over 500 meetings across 15 countries worldwide.

Ramsey and Warshaw said cold turkey techniques helped both of them climb out of immense debt earlier in their career.

What to read next

Unlock access to 4,700+ hand-picked, single-family homes across America — and the juicy rental cash they can generate. Here's how to start with as little as $10

82% of Americans are missing out on a savings account that pays over 10 times the national average

Rich young Americans have lost confidence in the stock market — and are betting on these assets instead. Get in now for strong long-term tailwinds

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.