Prediction: Ford Shifting Gears With EVs and Turning to Hybrids Will Benefit Investors in the Long Run

Ford (NYSE: F) recently announced that it is scrapping plans for a three-row electric SUV and instead will look to introduce the vehicle as a hybrid. The move is part of a broader strategy shift that will see the automaker shift more resources toward hybrids and away from electric vehicles (EVs).

My prediction is that this will turn out to be a very good move for Ford going forward, despite the cost of the change of plans.

Changing plans

In addition to deciding not to go forward with its three-row electric SUV, the company announced a number of other planned changes. It will push back the successor of the F-150 Lightning to 2027, while it will begin production of a new electric van aimed at tradespeople and commercial users in 2026. It also plans to start production of a medium-sized electric pickup in 2026. Meanwhile, it will move battery production from Poland to Michigan to take advantage of tax credits.

Ford will take a $400 million non-cash writedown on the three-row electric SUV. Meanwhile, it said its actions could lead to an additional $1.5 billion in expenses and capital expenditures (capex).

The company also said that its capex dedicated to pure EVs will be reduced from a planned mix of 40% to 30% moving forward. It cited the increasing demand for hybrids around this decision, so it will presumably dedicate more resources to hybrids moving forward. Ford added that it will not produce any new EV models unless it thinks they can be EBIT (earnings before interest and taxes) positive within the first 12 months after launch.

Image source: Getty Images.

Waning EV growth and shift toward hybrids

Ford's announcement comes at a time when EV sales growth has been slowing and competition in the space is increasing. According to Kelley Blue Book, EV sales in the U.S. rose 11% in the second quarter. While that was a record, it marked a big slowdown from the over 50% growth EV sales saw last year in the U.S.

At the same time, more companies have introduced EV models into the market. However, this has led to some very heavy discounting for some makes and models. For example, the new Kia EV9 sold at an average discount of $18,000 below MSRP (manufacturer's suggested retail price) in June. To put that in context, lead-generation platform TrueCar lists the average offer to customers for the popular hybrid and hybrid plug-in versions of the 2025 Kia Sportage above MSRP.

People have started to shy away from EVs for a few reasons. One is that there is a concern about the longevity and cost of battery replacements. While most EV batteries are expected to last for over a decade and generally have solid warranties, the cost to replace them can be astronomical.

For example, the cost of replacing a Chevrolet Bolt's battery is estimated at between $17,000 and $19,000, including labor, while a Tesla Model 3 battery is estimated to cost between $15,000 and $18,000. This has led to some EVs seeing huge depreciation, and worries among consumers of having to spend more on a battery replacement than a car may be worth.

At the same time, access to charging can be an issue for many potential EV car buyers. People who live in condos or apartments might not be able to charge their vehicles at their homes, while outside charging is generally not convenient or quick. Many people also still worry about taking long trips and EVs running out of power.

Hybrids take many of these worries away. Non-plug-in hybrids don't need to be charged, instead getting their charge from regenerative breaking. They also take gasoline, so there is no worry of running out of power on long trips. Meanwhile, hybrids have smaller batteries that cost less to replace.

Against this backdrop, hybrid sales growth has taken off, with hybrid sales up 41% and plug-in hybrid sales soaring 49%.

Why Ford stock is now more attractive

In my opinion, Ford is making the right move by shifting more toward hybrid vehicles. EVs will still play a role for the company, but it will be in segments where it has very strong positions, like pick-up trucks.

However, hybrids are where consumer interest is currently. I don't think that is going to change soon, as they help save on fuel but relieve many of the worries and obstacles to ownership that people may have regarding EVs. As such, revamping its strategy should benefit the company in the long run.

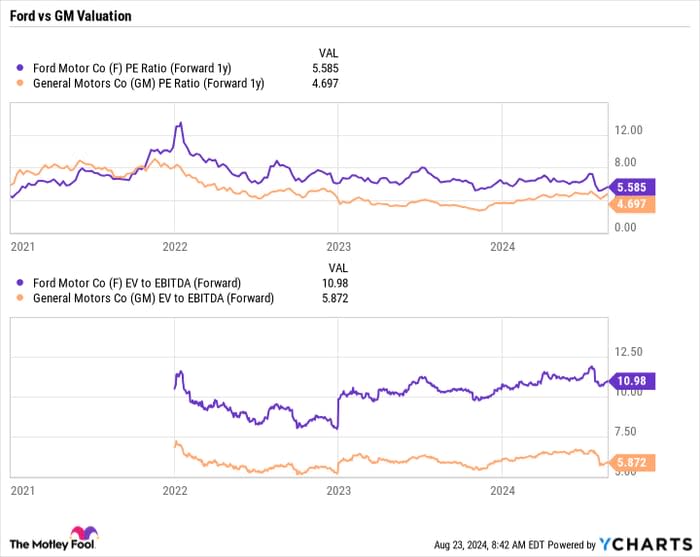

Ford currently trades at a forward price-to-earnings (P/E) ratio of just over 5.7 and an enterprise value-to-EBITDA multiple of 11 times base, which is a premium to rival General Motors (NYSE: GM). However, that is likely due to GM's large exposure to the Chinese market.

F PE Ratio (Forward 1y) data by YCharts.

Overall, I think Ford moving away from EVs, where the company has been piling up losses, and moving toward hybrids is a great strategic move. It shows increased focus, as the company needed to show investors that it is moving away from money-losing ventures.

The company still has its work cut out for it, and we'll have to see how the economy holds up, but for now, it is a better long-term buy than before this move.

Should you invest $1,000 in Ford Motor Company right now?

Before you buy stock in Ford Motor Company, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ford Motor Company wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $786,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.