With Spending on Pets on the Rise, Is It Time to Buy Chewy Stock?

For the second time this year, investors were applauding strong quarterly earnings results from Chewy (NYSE: CHWY), sending the online pet products retailer's shares higher.

Elsewhere, the stock gained added attention when it was learned that Keith Gill, aka Roaring Kitty on the Wallstreetbets message boards of Reddit, had made an investment. Gill helped spur the meme-stock craze a few years ago.

Let's take a closer look at Chewy's recent results and see if the uptick in investor enthusiasm this year is warranted.

Pet owners are spending more on their pets

For its fiscal second quarter that ended in July, Chewy saw its sales rise 3% year over year to $2.86 billion. Autoship sales climbed nearly 6% to $2.24 billion and were 78% of its total revenue.

Net sales per active customer (NSPAC), meanwhile, jumped over 6% year over year to $565. This was the second straight quarter of strong NSPAC growth, showing that pet owners are now spending more on their pets. The company also saw mobile orders climb 15% after it revamped its app.

Gross margin improved 120 basis points to 29.5%. Meanwhile, the company said it was seeing selling, general, and administrative expenses (SG&A) leverage, as 40% of its order volume is now benefiting from automation.

The gross-margin improvement led to strong increases in profitability metrics, with adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) surging 64% year overyear to $144.8 million. Adjusted earnings per share (EPS) soared 60% to $0.24. Chewy generated $91 million in free cash flow in the quarter. It ended the period with $695 million in cash and marketable securities and no debt.

During the quarter, the company bought back $500 million worth of shares from its largest shareholder, BC Partners.

The company opened two vet clinics in the quarter, bringing the total to six. It said the clinics are serving as a strong customer-acquisition funnel, as well as helping lead to more pharmacy-related sales.

Looking ahead, company management forecast revenue growth to start accelerating. For Q3, it projected sales between $2.84 billion and $2.86 billion, representing 3% to 4% growth. It maintained its full-year guidance for sales to rise by 4% to 6%, or $11.6 billion to $11.8 billion. This indicates that management expects revenue to continue to accelerate in Q4, although it will be helped by an extra week in the period.

Chewy also increased its full-year adjusted EBITDA margin guidance to a range of 4.5% to 4.7%, up from a prior view of 4.1% to 4.3% and an original outlook of 3.8%.

Image source: Getty Images.

Is now a good time to buy Chewy stock?

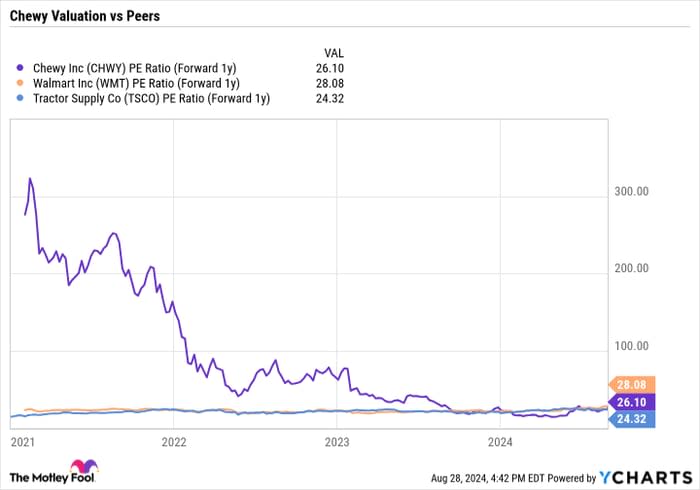

Chewy stock currently trades at a forward price-to-earnings (P/E) ratio of around 26 based on next year's analyst estimates, which on the surface does not appear cheap for an e-commerce company expected to grow its sales between 4% to 6% this year.

However, there are a few things to consider. The first is that much of the company's revenue comes from autoship customers and is highly recurring in nature. These types of businesses that cater to basic necessities trade at premium valuations given their resilient nature, and Chewy's valuation is in line with retailers such as Walmart and Tractor Supply.

CHWY PE Ratio (Forward 1y) data by YCharts.

However, unlike those retailers, Chewy is seeing an inflection in its earnings growth, with profitability metrics growing exponentially higher than its sales.

Third, revenue growth is expected to accelerate moving forward. There are clear signs that people are spending more on their pets, which is reflected in the strong sales-per-active-customer growth it has seen each of the first two quarters this year. Its full-year guidance indicates the expectation of very solid sales growth through the rest of this year.

In the long term, the company has a great opportunity to cross-sell its 20 million customers to its pet pharmacy business. This is a higher-margin business, and growth in this area would continue to improve gross margins and profitability.

Given that, I think investors can still look to buy Chewy stock for the long term.

Should you invest $1,000 in Chewy right now?

Before you buy stock in Chewy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chewy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Geoffrey Seiler has positions in Chewy. The Motley Fool has positions in and recommends Chewy and Walmart. The Motley Fool recommends Tractor Supply. The Motley Fool has a disclosure policy.