Is Tellurian the Best Energy Stock for You?

In the energy sector, Tellurian (NYSEMKT: TELL) has an interesting story to tell, but investors need to recognize that it still has a long way to go. That may be perfectly fine with some on Wall Street -- likely those with a more aggressive investment approach -- but it could also be a reason for some investors to simply pass. Here's what you need to know before you buy shares in this in this Houston, Texas-based energy company.

Tellurian has big plans

Tellurian doesn't really have a business today. What it has is the approvals it needs to build a liquefied natural gas (LNG) facility, known as Driftwood, in Louisiana. When completed, it will be capable of exporting up to 27.6 million tons per annum (mtpa) of LNG. The logic behind building that capacity is supported by the expectation that LNG demand will greatly outpace supply in a world that is increasingly using natural gas for power over dirtier-burning coal. By 2040 the supply deficit is expected to be as large as 170 mtpa.

Image source: Getty Images.

So far, this sounds like a pretty good story, with Tellurian building new LNG export capacity into a high demand environment. Recently, Tellurian has been taking steps to improve its financial position as well, including bringing in new leadership, selling non-core assets, and paying down debt. It is also working with a potential customer on a contract for a portion of Driftwood's capacity. So things seem to be looking up for Tellurian.

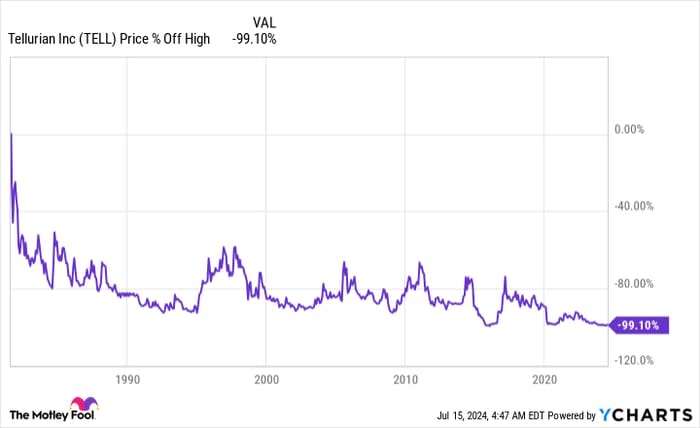

That's good news given that the stock price has declined more than 90% from its peak levels, largely because of ongoing losses related to the construction effort and upheaval in the leadership ranks. This is where things start to get more interesting, however, because there could be a huge opportunity here if LNG demand materializes as expected. Indeed, this would mean that, when completed, Driftwood could become an important export hub for the global LNG market.

But there are also huge risks to consider -- and the huge price drop suggests investors are looking at the company with a glass half empty attitude today. That's why Tellurian will be an acquired taste best considered by more aggressive investors.

Tellurian is nowhere near ready for prime time

The first big issue is that Driftwood, despite having the permits needed, isn't expected to be up and running until at least 2028. As of March 2024, the project was only 30% complete, and the company had already spent $1 billion on its construction! Think about that for a second. There's another 70% of the construction process to go over the next four years, and it will clearly require billions in additional spending to get Driftwood up and running.

There are huge execution risks involved in a massive capital investment project like this one. And, given the costs, there are also funding issues to consider. If anything goes wrong, Tellurian could quickly find itself in a troubled state.

Add on top of that the constantly changing dynamics of the energy sector, and it is hard to predict what will really happen here, even if the construction process goes as well as planned. After all, LNG is a commodity, and high LNG prices could lead to more subdued demand than anticipated.

That's notable because Driftwood has yet to sign a single customer for its capacity. Yes, Tellurian is in discussions with clients, but until one company takes the plunge, all potential customers are likely to be cautious here, particularly given that the capital investment still required is large and will likely result in ongoing losses at Tellurian for at least several more years.

Tellurian is not for the faint of heart

When you break it all down, Tellurian is only appropriate for the most aggressive energy investors. The story is pretty good, but there's a lot that needs to get done before that story can come to fruition. More conservative investors will probably be better off sticking with diversified energy giants like Chevron or Enterprise Products Partners, which both have strong financial positions and long histories of rewarding investors with growing dividends/distributions.

Should you invest $1,000 in Tellurian right now?

Before you buy stock in Tellurian, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tellurian wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $722,626!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.