Is It Too Late to Buy Iovance Biotherapeutics Stock?

Earlier this year, share prices of Iovance Biotherapeutics (NASDAQ: IOVA) were soaring after one of its therapies obtained approval from regulators. Iovance stock would go on to reach share price highs of more than $18. Today, however, the stock trades at less than half that price. And in just three months, it has fallen by more than 40% as the hype surrounding the business appears to have evaporated.

Is it too late to invest in Iovance, or could the best be yet to come for this promising healthcare company?

The stock peaked after it obtained accelerated approval for Amtagvi

On Feb. 16, the Food and Drug Administration (FDA) granted accelerated approval for Iovance's cell therapy treatment, Amtagvi (lifileucel), to treat advanced melanoma. It marked the first time regulators approved a one-time individualized T-cell therapy for treating a solid tumor cancer. The following day, the stock would jump by more than 31% and within two weeks reach its 52-week high of $18.33.

It's not uncommon for a biotech stock to soar on such a positive development, as it gives investors hope for the company's long-term prospects for generating revenue and potentially turning a profit down the road. But that can still be a long and bumpy road ahead. Analysts estimate that Amtagvi may generate $846 million in sales by 2029.

An ongoing need for cash could limit Iovance's upside

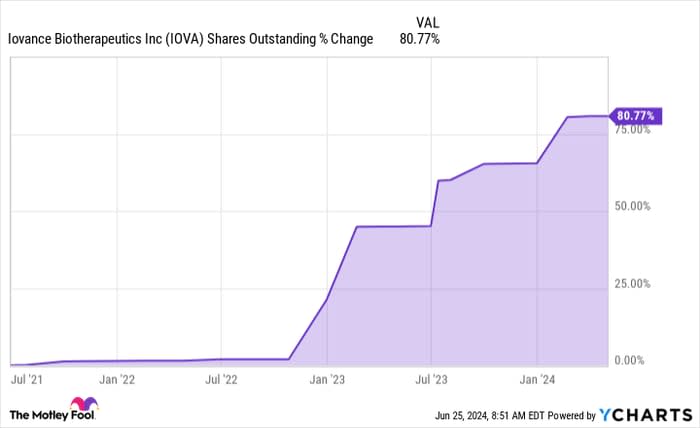

Amtagvi will give Iovance's financials a much-needed boost but with the company incurring nearly $450 million in losses over its past four quarters, it's likely going to continually need to raise cash in order to fund its day-to-day operations. And the risk for investors is that those offerings will negatively weigh down the stock price. Over the past few years, Iovance's share count has risen significantly.

IOVA Shares Outstanding data by YCharts

Iovance's stock does have more potential catalysts out there

When the company reported its first-quarter earnings on May 9, Iovance said that the initial demand for Amtagvi was strong, with over 100 patients already enrolling for the therapy. The company also plans to expand the therapy into new markets this year, including the U.K., Canada, and the European Union. Next year, it's eyeing expansion into Australia and other countries. As the company starts accumulating revenue and if it can start to shrink its losses, that could attract some potential growth investors to buy the stock. Iovance also has other trials ongoing, which include lifileucel involving other cancers in its pipeline. Favorable developments involving those trials could serve as catalysts in once again driving up its share price.

Ultimately, what's likely to keep the stock price elevated and rallying is Iovance becoming a sustainable and safe investment for the long haul. With deep losses and the company burning through more than $384 million in cash from its day-to-day operating activities in the past 12 months, it's nowhere near such a stage today.

It may not be too late to invest in Iovance, but it's arguably too early for most investors

Iovance has begun to generate revenue. But with quarterly losses still totaling more than $100 million, investors should brace for the likelihood of frequent supplemental stock offerings. While the stock is a better and safer buy than it was a year ago and I would argue that it's not necessarily too late to invest in the business, I think it might actually be too early to do so.

With the company still in the early stages of its growth story, it could soar much higher as Amtagvi starts generating more revenue and if the company obtains additional product approvals. But given the state of its financials, it's still too risky of a stock to be investing in just yet.

Right now, with Iovance burning through so much cash and its losses still piling up, things may get a lot worse before they get better for investors, which is why the safest option may be to just wait on the sidelines for now.

Should you invest $1,000 in Iovance Biotherapeutics right now?

Before you buy stock in Iovance Biotherapeutics, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Iovance Biotherapeutics wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $759,759!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Iovance Biotherapeutics. The Motley Fool has a disclosure policy.