Warren Buffett Holds $175 Billion of His Portfolio in 2 Stocks That Could Rise 13% and 29% According to a Pair of Wall Street Analysts

Warren Buffett took control of Berkshire Hathaway in 1965, and the gains since then have been legendary. Shares of the holding company have delivered a 4,110,936% return since he took the helm, and buying common stocks available to everyday investors was a big part of his strategy.

If you want your portfolio to deliver Berkshire Hathaway-sized returns, keeping tabs on Buffett's trading activity is a good place to start. Thanks to rules that require professional money managers to disclose their trading activity every three months, following the legendary investor isn't hard to do.

Image source: The Motley Fool.

Berkshire's latest disclosures revealed Apple (NASDAQ: AAPL) holdings valued at about $135.4 billion and around $24.5 billion worth of Coca-Cola (NYSE: KO) stock. These are the first and fourth largest holdings in Berkshire Hathaway's portfolio, and the Wall Street analysts who follow these businesses think their best days are still ahead of us.

The case for Apple

Berkshire Hathaway started accumulating Apple shares in early 2016, and since then the stock has delivered a 680% gain, or a 754% total return if you include dividends.

Buffett trimmed back Berkshire's exposure to Apple this year, but it's still the holding company's largest investment by a mile. Wedbush analyst Dan Ives is bullish for Apple and wasn't swayed by Berkshire's sale of some shares. In May, Ives raised his price target on the stock to $275, which implies a gain of about 29% from recent prices.

Ives is more than a little excited about Apple's moves to implement generative artificial intelligence (AI) services. Sales of the latest iteration of the iPhone have been a little disappointing, but a suite of new features could give previously hesitant customers a reason to upgrade their older devices.

To improve security, many of the new Apple Intelligence features will run locally. That means only the company's latest devices are powerful enough to participate.

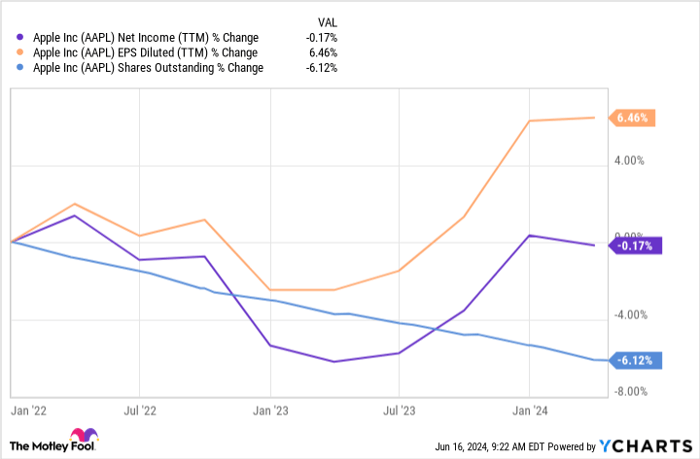

Before you buy Apple, you should know that growth driven by new AI features is already baked into the stock's price. Shares have been trading at 32.3 times forward-looking earnings expectations. This is a valuation appropriate for businesses with a rapidly growing bottom line, but net income hasn't risen since the end of 2021.

AAPL Net Income (TTM) data by YCharts

Apple has been able to report rising earnings per share because it can use profits to repurchase shares. That hardly justifies a market valuation appropriate for a fast-growing business. If investors lose confidence that Apple Intelligence can drive growth, this stock's earnings multiple could get cut in half.

I find it hard to imagine average consumers will be any more interested in new Apple Intelligence features than they were in titanium cases or extra camera lenses. With that in mind, it's probably best to wait and see if Apple Intelligence can improve Apple's bottom line instead of assuming from the start that it will be more important to the business than green bubble shaming.

The case for Coca-Cola

It's been about 12 years since Berkshire Hathaway made a big Coca-Cola purchase. It's easy to see why Buffett still holds it. Since 2012, shares of the beverage giant have delivered a 138% total return.

Coca-Cola's returns haven't been as great as Apple's, but there's a lot less risk involved. After all, its flagship brand has been the world's most recognized beverage for decades, and it doesn't need fancy new AI applications to stay that way.

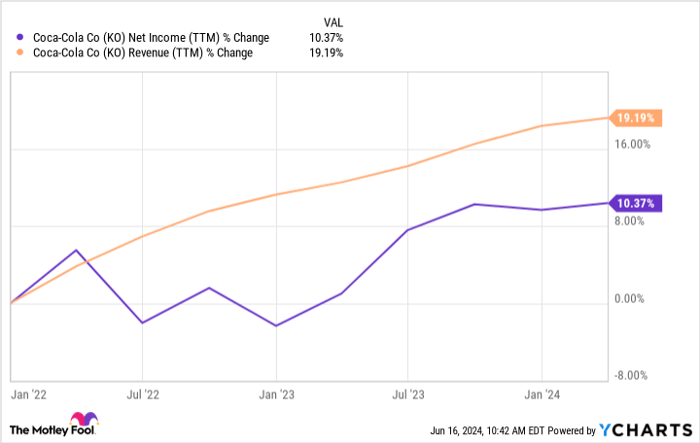

Coca-Cola's stock price hasn't kept pace with Apple's, but its business has outgrown the device maker in recent years. Net income at Coca-Cola has risen 10.4% since the end of 2021, and sales are up by 19.2% over the same time frame.

KO Net Income (TTM) data by YCharts

Argus analyst Taylor Conrad recently raised his firm's price target for Coca-Cola to $72 and kept a buy rating on the stock. He's expecting profit margin expansion thanks to a recently slimmed-down brand folder and the franchising of bottling operations.

At recent prices, you can buy Coca-Cola shares for 22.2 times forward-looking earnings expectations, which makes it look like a beacon of safety compared to Apple stock. Coca-Cola also offers a 3.1% dividend yield, and you can keep those payments even if the bottom falls out from under the stock market.

Without any AI features to market, Coca-Cola might not seem as exciting as Apple. For most investors, though, it's a better stock to buy now.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $802,591!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Cory Renauer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool has a disclosure policy.