Why Intel Stock Is Sinking Today

Intel (NASDAQ: INTC) stock is slipping again Wednesday. The chip company's share price was down 2.4% as of 2:40 p.m. ET, according to data from S&P Global Market Intelligence. Meanwhile, Nvidia stock was down 2.8%.

While there isn't any business-specific news pushing Intel stock lower today, the company's share price is dipping in conjunction with moves for Nvidia. The artificial intelligence (AI) leader is scheduled to report second-quarter results after the market closes today, and investors are feeling jittery ahead of the release.

What will Nvidia's Q2 report mean for Intel stock?

Nvidia stock has been hugely influential in shaping valuations for semiconductor stocks and the market at large this year. The company's results will be used as a barometer to gauge overall demand in the AI space and could cause significant movement for Intel's valuation.

Expectations are high heading into Nvidia's Q2 report. The average analyst estimate is calling for Nvidia to post sales of $28.7 billion -- suggesting growth of 112.4% year over year. The midpoint Wall Street target also calls for non-GAAP (adjusted) earnings per share of $0.65 -- up 141% over the split-adjusted earnings of $0.27 per share it posted in last year's quarter.

Even if Nvidia winds up delivering Q2 sales and earnings results that beat Wall Street's expectations, Intel and other AI stocks could face valuation volatility. If forward guidance falls short of expectations or the company announces a bigger-than-expected delay for its next-gen Blackwell processors, semiconductor stocks could be hit with an uptick in bearish sentiment.

Is Intel stock a buy?

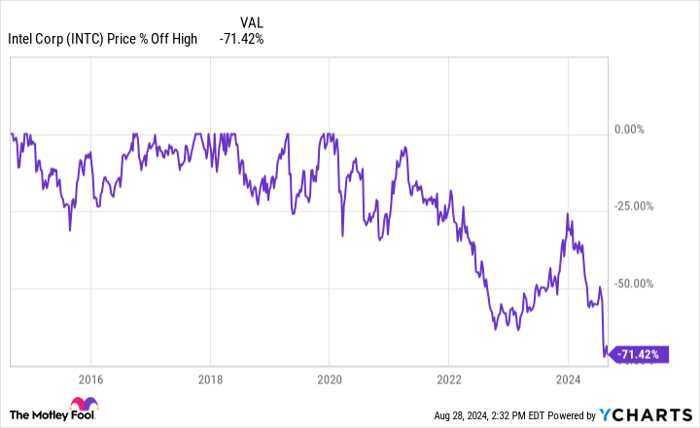

With today's sell-off, Intel stock is once again trading just a hair above the 10-year low that it hit earlier this month. The company's share price has now fallen 61% year to date, and it's off 71% from its 10-year high.

For risk-tolerant investors who see promise in the company's pushes to compete with Nvidia and other AI leaders and dramatically expand its chip fabrication business, the big pullback on Intel stock could be a worthwhile buying opportunity. But investors should approach Intel stock with the understanding that the company is still in the early stages of complicated restructuring and turnaround initiatives, and dramatic pullbacks for its share price reflect uncertainty about whether the business can succeed with its comeback plans.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $786,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.