Zscaler Stock Sinks on Guidance. Time to Buy the Dip?

Shares of Zscaler (NASDAQ: ZS) sank after the cybersecurity company issued disappointing guidance in conjunction with its fiscal 2024 fourth-quarter results this week. The stock now trades down nearly 27% so far this year.

Disappointing guidance often triggers the market to sell a stock, but was this selloff an overreaction? If it was, is now a good opportunity to buy the stock on the dip?

Disappointing guidance

In its fiscal fourth quarter (ended July 31), Zscaler grew its revenue by 30% year over year to $592.9 million. That was well ahead of its earlier outlook for revenue of between $565 million and $567 million.

Its deferred revenue -- money it has received for services not yet delivered -- increased by 33% to $1.9 billion. Calculated billings, which are the amount invoiced to customers, jumped 27% year over year to $910.8 million. For software-as-a-service (SaaS) companies like Zscaler, these metrics are key indicators of future revenue growth.

The company's adjusted earnings per share (EPS) jumped from $0.64 a year ago to $0.88. Its previous guidance was for adjusted EPS of between $0.69 and $0.70. It generated operating cash flow of $203.6 million and free cash flow of $136.3 million. The company ended the quarter with $2.41 billion in cash and short-term investments on its books, while it has $1.14 billion in debt in the form of convertible notes.

Looking at some other important metrics, the 12-month trailing dollar-based net retention rate was 115%. This metric shows how much established customers are spending with the company compared to a year ago after churn on a trailing 12-month basis. A number over 100% indicates that these customers are, on average, spending more than they did last year. In the past 12 months, Zscaler also added 118 new customers with annual recurring revenues of $1 million or more, bringing the total to 567 customers.

The company said it is seeing solid upsell with newer products such as ZDX, Zero Trust for Branch and Cloud, and AI Analytics. These solutions contributed approximately 22% of its new and upsell business in fiscal 2024, and management is looking for them to contribute mid-20% growth in fiscal 2025. Looking ahead to fiscal 2025, management projects full-year revenue of between $2.6 billion and $2.62 billion, which was just below analysts' consensus estimate of $2.63 billion. It forecast adjusted EPS would land in the $2.81 to $2.87 range, which also was below analysts' estimate of $3.33.

For its fiscal Q1, Zscaler guided for revenue of between $604 million and $606 million with adjusted EPS of between $0.62 and $0.63. Analysts were looking for revenue of $602.8 million and adjusted EPS of $0.73. The company expects its billings growth to accelerate from 13% in the first half of fiscal 2025 to 23% in the back half, thanks to its strong and growing pipeline, contracted billings from prior-year contracts, and sales productivity improvements.

It seems the lower adjusted EPS forecast, meanwhile, stemmed from the fact that its new products will have lower initial gross margins.

Image source: Getty Images

Should investors buy the dip?

Zscaler's management has a history of offering conservative guidance, which it typically beats handily. Its fiscal Q4 results were quite strong, with the company easily surpassing its prior forecasts. Meanwhile, the company continues to do a great job upselling to its established customers. Billings growth and guidance were also solid, although investors typically aren't fans of back-loaded guidance.

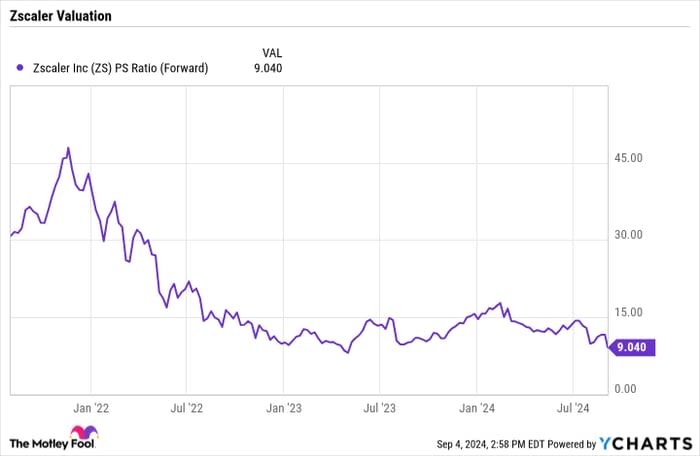

From a valuation standpoint, Zscaler trades at a forward price-to-sales multiple of about 9, based on analysts' estimates. That's a pretty large discount compared to where the stock traded a couple of years ago and not out of line for a company growing its revenue at a 20%-plus rate.

ZS PS Ratio (Forward) data by YCharts.

The price drop in the stock looks like an overreaction. How much Zscaler's customers value its products can be seen in its net revenue retention number, which is impressive for a company of its size. Given this, its lowered valuation, and the growth it is seeing in its emerging products, I'd be a buyer of the stock on this dip.

Cybersecurity remains a priority for companies, and Zscaler is in a position to remain a leader in zero-trust security, which is based on the premise that no individual users or devices should be trusted by default, even if they are already on an organization's network.

Should you invest $1,000 in Zscaler right now?

Before you buy stock in Zscaler, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Zscaler wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Zscaler. The Motley Fool has a disclosure policy.